Trending

Weak job growth adds to doubts over NYC office market

Office-using employment growth slowed dramatically in 2015-2016: report

The New York metropolitan area’s office-using job growth slowed dramatically over the past 12 months, adding to concerns over a potential supply glut in the office market.

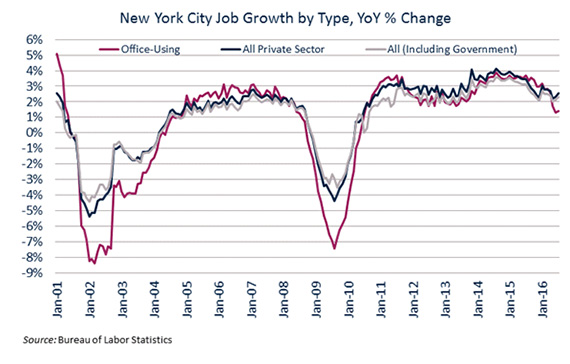

A new report by brokerage Savills Studley [TRDataCustom] found that while job growth overall was strong, most new jobs were added in sectors that don’t primarily use offices, such as healthcare, retail or education. The growth in office-using jobs, meanwhile, was the slowest since 2010, when New York’s economy was still reeling from the 2008 financial crash (see chart). Between July 2015 and July 2016, only 19,000 (1.4 percent growth) such jobs were added, compared to 49,000 and 46,000 in the two prior years (when growth averaged more than 3 percent).

Credit: Savills Studley

The slowdown in job growth comes as developers are adding millions of square feet to New York’s Class-A office supply through developments such as Hudson Yards, Manhattan West, the World Trade Center and One Vanderbilt. Skeptics have long worried that the new supply is exceeding demand.

“It was Confucius who said a builder will build when money is available,” Sam Zell recently said on Bloomberg TV. “And demand, all the other factors, are always secondary.” Referencing Hudson Yards, Zell added: “I don’t see 10 to 12 million square feet of demand.”

The Real Deal recently reported that some Midtown landlords are already struggling with an outflow of office tenants.

Credit: Savills Studley

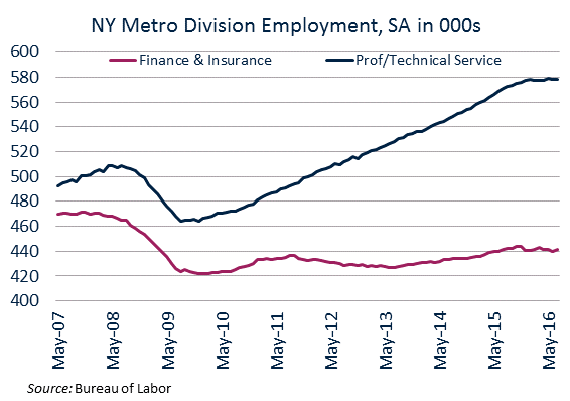

Savills Studley’s chief economist Heidi Learner said actual demand for office space may be even weaker than job numbers suggest because the industries that are adding the most jobs – such as technology – tend to use less space per employee. Meanwhile, employment in finance and insurance still hasn’t recovered from the 2008 crisis and continues to be a drag on the office market (see chart).

Learner pointed to two reasons for slowing job growth: one is disappointing revenues among New York’s public companies — less than a quarter recorded revenue growth of 5 percent or more –– which creates pressure to cut costs. The other is cyclical. Seven years into the recovery, job growth should be expected to slow down.

“Just factually it would be hard to find any real reason why we should see an upswing in rents at this point in the cycle,” she said.