Trending

Failure to pass terrorism insurance act could result in high-stakes defaults: Aon

REBNY confident motion will make it through Congress

Despite the legislative jockeying taking place on Capitol Hill, the Real Estate Board of New York said it is confident Congress will renew the Terrorism Risk Insurance Act. Failure to do so, industry experts warn, could have dire consequences for Manhattan’s most at-risk properties.

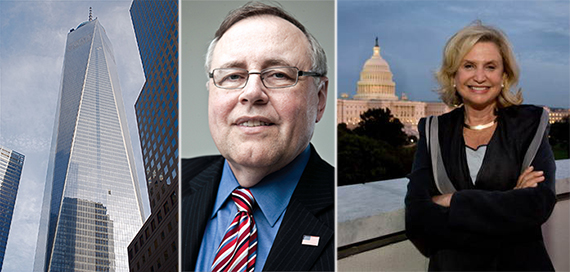

“We believe it’s still very much in play,” REBNY President Steven Spinola said in a statement. “We don’t believe the Congress will adjourn without extending this critical program.”

With the clock ticking on TRIA’s Dec. 31st expiration date, Congress appears to be at an impasse over renewing the legislation that provides a federal back-up to insurance providers in the case of a terrorist attack.

House Republicans attached a rider to the TRIA bill seeking changes to the Dodd-Frank financial reform law – a non-starter with Senate Democrats. This is not the first time TRIA has come up for debate, as the legislation has been renewed twice since it was signed into law after the attacks of 9/11 left insurers facing billions of dollars in claims from property owners. Most insurers raised the premiums dramatically, or in some cases, dropped the coverage altogether.

Experts said failure to keep the financial safety net in place could have serious implications in states where terrorism coverage is mandated as part of workers’ compensation.

“The risk of terrorism doesn’t go away if the TRIA backstop disappears. There’s still an obligation to offer that coverage,” said Aaron Davis, the managing director of the national risk-solutions arm of Aon, one of the world’s largest insurance brokers.

Without the federal government backstop, commercial properties in some of the most at-risk areas, such as downtown and midtown office districts, may have covenants placed on loans that mandate minimum coverages.

“There’s a potential for severely increased costs on the terrorism front, which would have a negative impact on net operating income,” Davis said.

In the worst-case scenario, he added, TRIA’s expiration could cause property owners to default on their loans, a sentiment reiterated by East Side Congresswoman Carolyn Maloney (D).

“Since banks often require ‘all risk’ policies in order to provide financing, the elimination of TRIA could place property owners in default on their loans,” said Maloney, who was the lead Democrat on a scuttled TRIA extension bill from last year.

“That would have a disastrous effect,” she added. “It could stall any new projects, and create substantial financial uncertainty for current policy holders.”