Trending

Report shows positive signs for NYC housing

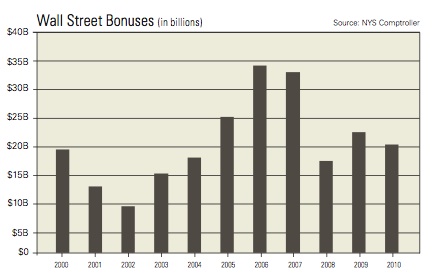

(source: Halstead)There’s reason to be optimistic about the city’s residential real estate market after recent data highlighted a trio of positive indicators. According to a new report compiled by Gregory Heym, Halstead’s chief economist, the city added private-sector jobs in 2010, after posting a net loss in that area the previous year. The gains were led by the education, health and hospitality fields, even as government employment fell by more than 17,000. Meanwhile, Wall Street firms had their second-highest profit total ever in 2010, with $27.6 billion. Although Wall Street cash bonuses fell by around 8 percent, as expected, firms are paying higher salaries and deferring compensation to make up for it. As The Real Deal previously reported, total compensation actually grew in 2010, leading industry experts to believe that the residential real estate market is in store for growth as well. Mortgage rates, which have rising in recent months as a reflection of improving economic conditions, dipped slightly at the end of February, which could be good news for the housing market as some analysts had worried that if mortgage rates rose too quickly, potential homebuyers would stay on the sidelines. TRD