Trending

As feds near settlement with banks, foreclosures plummet citywide

(source: PropertyShark)

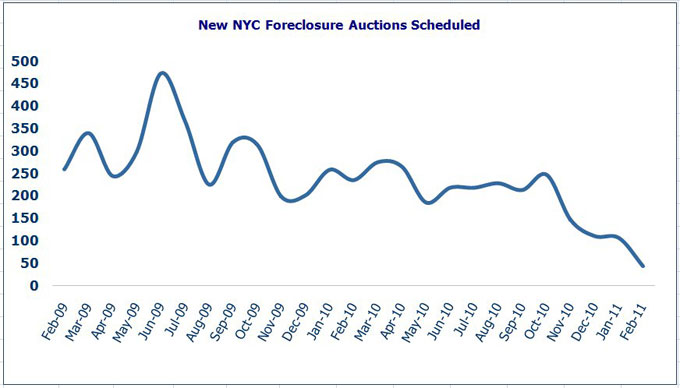

(source: PropertyShark)Scheduled foreclosures on New York City residential properties

plummeted last month as mortgage servicers continued to reel from the

so-called robo-signing scandal that surfaced last year and prompted a

nationwide investigation into their foreclosure practices.

According to new data from PropertyShark.com, just 43 foreclosures

were scheduled for the first time last month citywide, down 59 percent

from the 106 scheduled in January 2011. That’s also 83 percent below

the 247 foreclosures scheduled in the city during October 2010, the

last month before foreclosures began their nosedive as a result of temporary lender-imposed freezes. The freezes came in response to revelations that lenders’ foreclosure paperwork was wrought with errors and that oftentimes, affidavits had been signed with little or no prior review.

Earlier this month, Bloomberg News reported that the coalition of

federal agencies and state attorney generals investigating banks’

foreclosure practices have already proposed a settlement that includes

fines and penalties for the paperwork errors, along with new

regulations on loan modifications.

Meanwhile, Queens and Staten Island, the boroughs that have been

hardest-hit by the foreclosure crisis, each saw 91 percent year-over-year

declines in scheduled foreclosures last month, PropertyShark said. In the Bronx, Brooklyn

and Manhattan, scheduled foreclosures were down 69 percent, 67 percent

and 52 percent, respectively.

Lis pendens, which mark the first step in the foreclosure process,

have also declined since the fall, though not nearly as dramatically.

Citywide, there were 922 lis pendens filed last month, down 6 percent

from the 976 filed in January. In February 2010, there were 1,069 lis pendens recorded, according to PropertyShark.