Trending

Has FiDi’s office market recovered from 9/11? A look at the numbers

Brokerage data shows lower inventory, higher vacancy

UPDATED, Sept. 15, 2:55 p.m.: Fourteen years ago today, the terrorist attacks of Sept. 11 marked one of the deadliest and most traumatic days in U.S. history. A human tragedy above all, they also hit Lower Manhattan’s economy, ushering in an exodus of office tenants that took a decade to reverse.

In recent years, Lower Manhattan’s office market has regained its momentum amid rising rents and the opening of high-profile skyscrapers like One World Trade Center. But a look at the numbers shows the neighborhood still has a ways to go in its recovery.

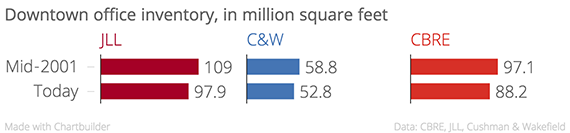

The chart above shows the office supply in Lower Manhattan, as counted by three different brokerages – JLL, CBRE and Cushman & Wakefield. While the three firms track different inventories, they all clearly show that Lower Manhattan has less office space today than it did in the second quarter of 2001.

The chart above shows the office supply in Lower Manhattan, as counted by three different brokerages – JLL, CBRE and Cushman & Wakefield. While the three firms track different inventories, they all clearly show that Lower Manhattan has less office space today than it did in the second quarter of 2001.

The most obvious explanation is the destruction of 9/11, which wiped out more than fifteen million square feet of office space. But the recent boom in office-to-condo conversions also plays a role. For example, Harry Macklowe plans to convert the former Bank of New York headquarters at One Wall Street into condos.

Despite the decrease in supply, today’s availability rate of 12.3 percent (according to CBRE) is almost twice as high as the 6.2 percent recorded on September 1, 2001. And while the average downtown asking rent has risen from $41.80 in 2001 to $56.33 today, that increase is merely nominal. If one accounts for consumer-price inflation (the most common measure for the devaluation of money), rents are almost exactly on the same level today as they were in 2001.

But at least in one sense the market is arguably better off today than it was in 2001. “The market has attracted dramatically more diversified and different composition of tenants,” said John Wheeler, managing director at JLL. Once the almost exclusive domain of financial firms, Downtown has seen an influx of tech and media companies, leaving it less dependent on the fate of a single industry. “It’s still a transformation in progress here in Lower Manhattan,” Wheeler added.

Correction: An earlier version of this post incorrectly referred to the availability rate calculated by CBRE as vacancy rate.