Trending

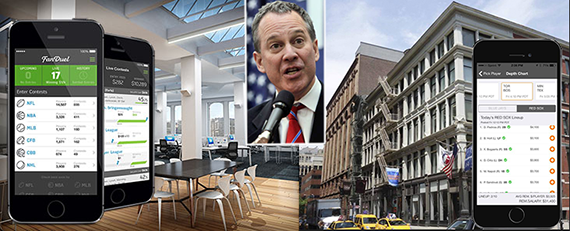

AG’s fight against FanDuel, DraftKings could impact their NYC office spreads

Landlords, brokers back startups despite crackdown

The New York state attorney general’s crackdown on a pair of billion-dollar fantasy sports startups could affect the fate of the sizable office leases they recently signed in New York City.

On Tuesday, Attorney General Eric Schneiderman ordered FanDuel and DraftKings to cease operating in the state, declaring their gaming activities acts of illegal gambling. Although DraftKings is based in Boston, the company signed a five-year lease in June for 23,500 square feet at Alvin Flaster’s 400 Lafayette Street in Noho. Meanwhile, New York-based FanDuel tripled the size of its headquarters by signing for 41,000 square feet at 300 Park Avenue South in September. The asking rents are high-$60s and $80 per square foot, respectively.

Both tenants have since taken possession of their spaces. They also disputed the allegations in statements cited by the New York Times. DraftKings, for example, said it will “vigorously pursue all legal options available.”

While neither firm can currently do business in New York, their landlords are not looking to cut ties or negotiate new lease terms at this time.

“We feel Eric Schneiderman is a political grandstander trying to be the next governor of New York,” Flaster told The Real Deal. “I have full confidence DraftKings and its competitor [FanDuel] will squash this in court. He’s not going to shut down a blooming industry.”

ABS Partners Real Estate’s Jay Caseley, who represented the landlord in the DraftKings lease, said the startup is a “tenant in good standing” despite being benched by the state.

Rockrose Development, owner of 300 Park Avenue South, and brokers on FanDuel’s 10-year lease deal, declined to comment.

After DraftKings secured a lease, the company placed 10,500 square feet on the market for sublease for two years. DraftKings then changed its mind and now occupies the full space.

Donald Adler, counsel at Goldfarb & Fleece LLP who represents several Manhattan commercial landlords, said an office lease typically comes with limited subletting rights, as an option when a situation like this arises. Lease provisions on reducing the size of the space vary for each deal.

A good guy clause commonly allows a commercial tenant to break a lease if it vacates in 90 or 120 days, leaving the space in good condition. Nonpayment of rent and the performing of illegal activity in the space are examples of defaulting.

If the startups challenge the attorney general’s order in court, the fate of the leases could hang for months.

“From the landlord’s perspective, you still have a viable lease and you must keep paying,” Adler said.