Trending

Is the New York Wheel spinning out of control?

Staten Island megaproject dealing with ballooning costs, infighting

TRD Special Report: In September 2014, Rich Marin stood on stage at TEDx St. George and invoked Cornelius Vanderbilt. He spoke of a passion project worthy of the Commodore’s native borough: transforming Staten Island’s sleepy waterfront into “the gateway to America” by building a giant wheel, the world’s largest.

“It’s been said that Staten Island never misses an opportunity to miss an opportunity,” he quipped. “But I like to think that they’ve been smart to wait for just the right opportunity.”

Marin, a tall, beefy man with a professorial air, knew a bit about high-stakes deals. He helped create the derivatives market at Bankers Trust, ran the asset management division at Bear Stearns, and later rescued Lev Leviev’s Africa Israel USA after a disastrous boom-time acquisition spree. The project he spoke of that day in St. George, the New York Wheel, was meant to be his “legacy to the world.”

But this legacy appears at risk. The wheel is now estimated to cost north of $500 million, more than twice the original figure. Critics say its revenue projections are wildly optimistic. And vicious infighting has ripped apart the fabric of the development team. All the while, the public officials and government agencies that threw support behind the project for the past three years have suddenly gone quiet.

“No one is really sure how it got to this point,” said one person with knowledge of the situation.

Origin story

To understand the challenges facing the developers of the 630-foot-tall wheel, it helps to jump back to 2008, when Meir Laufer first visited the London Eye.

Laufer, CEO of Plaza Capital Management, a small Financial District-based developer, began studying every aspect of Britain’s most-visited paid tourist attraction. Why, he asked himself, did his hometown not have something similar?

“I thought: ‘Why not New York, and why not me?’” Laufer told Jewish newspaper Hamodia in 2012. “I knew that one day New York City would have such a wheel. I was utterly convinced that this was going to happen. I got to work right away.”

Laufer pitched the project to his connections, including eventual investor Eric Kaufman, a developer and a former top broker at Colliers International. Some of them scoffed. But once he struck an exclusive construction deal with Starneth, the engineering firm behind the London Eye, he and Kaufman were able to use the agreement to entice deep-pocketed investors.

Starting in 2010, the partners started looking for a suitable site, working with NYC & Company, the city’s official marketing arm, as well as with the city’s Economic Development Corporation. After flirting with the idea of South Street Seaport and Governor’s Island, they secured an eight-acre waterfront parcel on Staten Island’s North Shore.

The partnership grew to include prominent New York businessmen such as Andrew Ratner and Jay Anderson of the Feil Organization, Joseph Nakash, co-founder of jeans giant Jordache Enterprises, and Lloyd Goldman, nephew of the legendary Sol Goldman and founder of BLDG Management.

Laufer and Kaufman served as chairman and CFO, respectively, of the operating entity, New York Wheel LLC. Marin, who had been brought in earlier by Laufer and Kaufman, officially became CEO.

Rich Marin

“One of the puzzles the city had been trying to solve for years was how to take the tourists who ride the Staten Island Ferry every year and convince them to get off the ferry and explore Staten Island,” said Seth Pinsky, the former head of the New York City Economic Development Corporation and now a top executive with RXR Realty. “What we liked about the wheel was that it was a unique attraction that could pull people off the ferry.”

In September 2012, then-Mayor Michael Bloomberg unveiled the plan to the public. “The New York Wheel will be an attraction unlike any other in New York City — even unlike any other on the planet,” he said. “It will offer unparalleled and breathtaking views, and is sure to become one of the premier attractions in New York City.”

Whose wheel is it anyway?

Meir Laufer stands next to then Mayor Michael Bloomberg as the wheel is announced

At the press conference announcing the wheel, a beaming Laufer stood next to Bloomberg, clearly relishing the spotlight and his ascendance to macher status.

But his euphoria didn’t last long. He claims he soon found himself sidelined by the other investors, who by now held the majority equity stake in the project. He alleges he was discriminated against in part due to his Hasidic background, which his partners supposedly said was bad for business.

“Because of his Hasidic garb and ethnic appearance, Laufer was treated differently than other investors and board members,” his lawyer claims in court documents filed in response to a July 2015 lawsuit from fellow investors. “Marin was even so bold as to tell Laufer that, in order to attract investors, the project could not have ‘more than one board member from your ‘community.’”

Laufer further claims he was removed from press releases, excluded from project updates and even barred from speaking publicly about the wheel. Things got so nasty that when he attempted to confront Marin he was told to “suck d**k,” he claims.

[vision_pullquote style=”1″ align=””] “I knew that one day New York City would have such a wheel. I was utterly convinced that this was going to happen.” — Meir Laufer [/vision_pullquote]

As costs began to skyrocket, the partners tussled over their equity positions in the project. As per the wheel’s original operating agreement from 2012, Laufer had a 33 percent ownership stake, court papers show. Wheel Estate LLC, an entity held by Feil, Goldman and Nakash, invested $7 million for a 51 percent stake; Marin, the CEO, had 8 percent; and Kaufman had 4 percent.

But since then, the Wheel Estate investors have allegedly moved to dilute Laufer and Kaufman’s equity positions by making several unnecessary capital calls to the board. Since June 2013, the board has opted to raise an additional $20 million from board members, rather than raising outside capital, the duo claim. Since their wealth didn’t match that of their fellow investors, Laufer and Kaufman haven’t been able to meet contribution demands and so were sidelined, they claim.

In August 2015, Wheel Estate asked a judge to approve reducing Laufer’s stake to just 11.08 percent and Kaufman’s stake to just 1.08 percent. Meanwhile, Feil, Goldman and Nakash want to up their combined stakes to 78.84 percent, saying they had to inject additional equity to cover Laufer and Kaufman’s obligations.

But Laufer and Kaufman claim the capital calls breached the terms of the project’s operating agreement. They insist that at the time, the project was on firm financial footing and wasn’t experiencing any shortfall (which they said was a prerequisite for a capital call).

“Wheel Estate has engaged in an egregious scheme to deprive the originators of the groundbreaking New York Wheel attraction of their rightful ownership interest in the project,” Kaufman’s attorney Marc Kasowitz told The Real Deal. “We are confident that this litigation will finally put an end to Wheel Estate’s abusive pattern of withholding critical financial information and attempting to improperly increase its own financial interest at the expense of the originators.”

Kaufman has also alleged massive financial bungling at the project, saying the wheel had no valid business plan in place, weak management and several unexplained cost overruns.

Marin dismissed the claims as sour grapes, saying the original founders simply didn’t have the funds to keep up with the big boys.

“These two shareholders, who have no money, are sore about getting diluted due to this project costing more than we had originally thought,” he told TRD. “They should be thankful that we did not just throw in the towel but kept moving forward.”

Laufer declined to comment through his attorney, Kenneth Rubinstein.

Breaking down the capital stack

A rendering of the New York Wheel

So, just how much is this wheel going to cost?

When Marin and Laufer responded to a request for expressions of interest (RFEI) from the city in 2011, they estimated a total cost of just $250 million, inclusive of an adjacent terminal building (for $17.5 million) and visitor parking (for $36.8 million), documents obtained by TRD show.

By the time the project was officially approved by the City Council in 2013, and further research had been carried out, the project’s total cost was up to $350 million.

But now, the project is slated to cost a total of $534 million, a 114 percent leap from original projections, despite no significant changes to the initial development plan, documents show.

The developers have already scored about $476 million of that sum, including $80 million of their own equity, $195 million in senior debt secured from JPMorgan Chase subsidiary Highbridge Capital Management last May, $174 million in mezzanine financing through Canam Enterprises, an EB-5 regional center, and $31 million raised from smaller investors through securities firm Houlihan Lokey.

In September, the board announced its intention to raise an additional $30 million through North Capital Private Securities, a Utah-based broker-dealer that would sell New York Wheel shares via its 99Funding online crowdfunding platform and other crowdfunding sites. The wheel, Marin said, will raise this funding by January.

As for a $20 million sponsorship deal the developers hoped to secure with sponsors such as Google, GE and Coca Cola, that plan was nixed after a provisional deal with insurance giant New York Life fell through and another willing suitor couldn’t be found.

[vision_pullquote style=”1″ align=””] “No one is really sure how it got to this point.” [/vision_pullquote]

Marin downplayed the overruns and attributed any escalation in costs to the evolving financing and construction environment in the city and to specific challenges associated with the waterfront site.

“While some of this is due to the passage of time, a lot of this is due to the site conditions requiring more extensive site preparations and foundations,” he said. “We are paying extra to meet the high resiliency needs of the New York Harbor location and quite a bit extra to set a standard of security for this site that makes it a safe site in an increasingly uncertain world.”

He continued: “We have been building this project in a robust New York City building environment where we compete for subcontractor and vendor services with many other large projects underway in New York City. This has undoubtedly contributed to considerable cost escalation, just as it has for many other projects.”

Construction costs have certainly risen at a brisk clip since the project was launched, including expenses for labor, concrete, electrical and insurance, as TRD reported in October 2014. But New York Wheel insiders said too much of the project’s additional burden was due to interest payments on the senior debt from Highbridge, which, unusually, is far costlier than the mezzanine debt arranged by Canam.

The Highbridge debt carries an annual interest rate of 10.25 percent, documents show, while Canam’s mezz debt interest rate is just 2.75 percent. Therefore, for every six months the project is delayed, the development team must fork over nearly $10 million to Highbridge. The documents aren’t clear on the length of the Highbridge loan. A representative from Highbridge did not respond to a request for comment.

[vision_pullquote style=”1″ align=””]“They should be thankful that we did not just throw in the towel but kept moving forward.” – Rich Marin [/vision_pullquote]

Marin said the project would be absorb these financial issues.

“We are about 35 percent complete with the construction, so we have the utmost confidence that everything is and will remain on track, he said. “Fortunately, the robust business model underlying the wheel’s economics can, we believe, support these added costs.”

Representatives for Starneth didn’t respond to multiple requests for comment.

More popular than Lady Liberty

(Video by Alistair Gardiner for TRD)

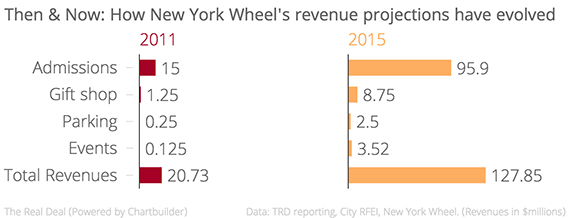

The financial projections distributed to would-be investors in 2015 differ dramatically from what Marin and Laufer first projected in their response to the city’s RFEI in 2011.

In its first year of operation, the wheel was originally slated to earn $15 million from admissions. But now, after jacking up the proposed price of a ride to $35 from $15, the developers are projecting $95.9 million in admissions, more than six times that amount.

And the optimism doesn’t end there. Projected gift shop revenues have jumped to $8.75 million from $1.25 million (a sixfold increase), parking revenues are expected to be $2.5 million, up from $250,000 (a ninefold increase), and event revenues are projected at $3.52 million, 27 times more than the $125,000 originally projected.

Overall, documents distributed to investors last year predict total revenues of $127.85 million for the wheel’s first year in business, more than six times the $20.73 million projection made to the city in 2011.

Those projections rely on the wheel drawing more than 4 million riders in 2017, its first year of business, and 3.5 million riders annually in successive years. Marin said the wheel would be starting at an advantage, given that the Staten Island Ferry carries about 2.5 million tourists annually.

Those projections rely on the wheel drawing more than 4 million riders in 2017, its first year of business, and 3.5 million riders annually in successive years. Marin said the wheel would be starting at an advantage, given that the Staten Island Ferry carries about 2.5 million tourists annually.

“When you’re looking to do 3.5-plus million visitors, having 2-to-2.5 already sort of on the boat is a very good start,” Marin said in a recent promotional video for the wheel.

By comparison, the Empire State Building observatory drew 4.3 million visitors in 2014, according to Empire State Realty Trust, the entity that owns the skyscraper. The Statue of Liberty draws an average of 3.5 million visitors per year, according to the National Park Service, and the Top of the Rock draws an average of 2.5 million visitors per year.

The politicos and government agencies which championed the project for the past three years now have little to say about the wheel.

“We don’t have any comment regarding this except to say we’re very excited about the project and its future impact on New York City tourism,” said a spokesperson for NYC & Company, which once billed the wheel a key fixture of “the new New York.”

Staten Island Borough President James Oddo, a longtime wheel supporter, declined to comment other than to say that the project still had his backing.

Comparing wheels

The proof of the pudding will be in the eating — or, in Ferris wheel terms, in the riding.

As developers of other giant wheels can attest, projections don’t always pan out.

Caesars Entertainment’s High Roller, a 550-foot-tall giant wheel that opened on the Las Vegas Strip in 2014 at a reported cost of $175 million, has reportedly fallen well short of its attendance projections.

While numbers have been climbing, the company said early last year that High Roller was averaging just under 5,000 riders per day (1.83 million annually), compared to projections of between 8,000 (2.92 million) and 11,000 (4.02 million) a day, the latter of which would have yielded annual revenues of up to $60 million.

And what of the London Eye, the inspiration for Laufer’s vision?

Built at a cost of $100 million in 2000, the Eye is estimated to earn $78 million a year, based on 3.6 million visitors and an average ticket price of around $22, according to a report by consulting firm Roland Berger.

But Marin, in the thick of building his legacy, isn’t interested in cautionary tales.

“Dream no small dreams,” he said during his TEDx talk, channeling Victor Hugo, “because they have no power to stir the hearts of men — or women.”