Trending

Wilpon real estate fund has lost more than $300M: report

Sterling Equities chair's $497M fund had only $173M in cash and investments as of June

UPDATED, 10:30 a.m., Feb. 4: Sterling Equities has responded to reports that a Sterling American Property real estate fund has lost more than $300 million. “Contrary to what has been reported, SAP V has already returned over 40% of its investors’ capital and Sterling Equities anticipates that SAP V will be a profitable investment for all of its partners,” a spokesperson said.

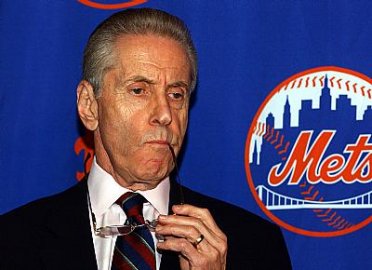

A real estate investment fund run by Sterling Equities chair and New York Mets owner Fred Wilpon had lost more than $300 million through the end of last June, according to a report Wednesday – with the fund, Sterling American Property V, or SAP V, turning $497 million in cash and investments into little more than $173 million.

Wilpon’s Sterling American Property opened SAP V in 2006 as a $609 million discretionary real estate investment fund “with an emphasis on office and multi-family properties with value enhancement opportunities,” per the fund’s website.

But while the fund had called in $497 million as of June 2015, data provided to Gawker Media sports website Deadspin indicates SAP V had a net asset value of just over $150 million and had distributed just under $23 million in returns back to investors as of last June.

SAP V had deployed more than 70 percent of its raised equity through the first quarter of 2010, according to its website – acquiring roughly 4,600 residential units and 2.8 million square feet of office space in the process.

But of the 21 assets the fund has invested in, including two New York City multifamily properties, SAP V lists only three has having been sold – two suburban New Jersey office properties and an office building in San Francisco.

Furthermore, the three divested assets in question were cited in a 2011 Wall Street Journal article as properties that the fund had defaulted on.

The Mets owners reportedly lost $550 million in the Bernie Madoff ponzi scheme and paid out $80 million to settle claims it participated in the scheme. Sterling American Property hasn’t launched a new fund since SAP V in 2006. [Deadspin] – Rey Mashayekhi