Trending

Chestnut buys 200-unit BK multifamily portfolio for $40M

Seller Carmel Partners assembled buildings in 2011 and 2012 for $18M

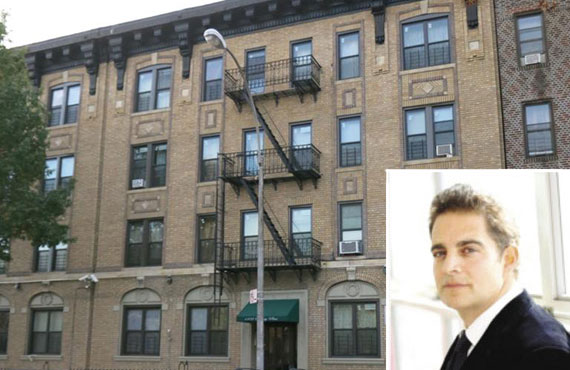

Jonathan Wiener’s Chestnut Holdings picked up a nine-building, 203-unit multifamily portfolio in Brooklyn for $40 million, sources told The Real Deal.

The Bronx-based landlord purchased the properties, which are spread across Crown Heights and East New York, from the San Francisco-based investment firm Carmel Partners [TRData]. Carmel assembled the portfolio, which spans about 160,000 square feet, in 2011 and 2012 for a combined total of $18.25 million, property records show.

All of the 203 apartments are rent-stabilized units, and the portfolio traded a gross rent multiple of around 13 or 14 and a cap rate of 3.9 percent, sources said. In Crown Heights, one building sits at 883 Franklin Avenue at the western near the Brooklyn Botanic Garden, while the remaining properties are clustered along the neighborhood’s eastern end at 1742-1746 Union Street, 1746 President Street and 1402-1406 Sterling Place.

Neither firm responded to requests for comment. Rosewood Realty Group’s Aaron Jungreis, who brokered the deal, couldn’t be reached.

Chestnut, a family firm led by Wiener, owns a large portfolio of multifamily buildings in the Bronx. In April, the company bought a 10-building portfolio in the borough for $46.6 million from San Francisco-based Prana Investments.

In East New York, where the City Council last month passed Mayor Bill de Blasio’s proposed rezoning, three of The Buildings Sit Near The Pennsylvania Avenue 3 train subway stop at 453, 473 and 79 Pennsylvania Avenue. East New York led all city neighborhoods for the number of homes flipped within a one-year period, according to a recent study by the Center for NYC Neighborhoods, which looked at one-to-four-unit buildings. The neighborhood saw 94 flips last year.