Trending

Brookfield, Urban American to spend $16 million to retrofit Harlem buildings

Landlords will upgrade 3,000 units to reduce emissions and save $4M in energy costs a year

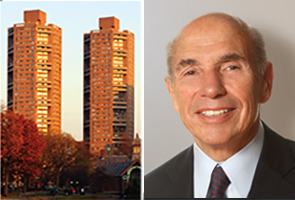

Brookfield Property Partners and Urban American Management are spending $16 million to “green” five apartment buildings across Harlem.

And while the developers hope to reduce energy emissions by as much as 29 percent, the upgrades will also save them about $4 million a year, Crain’s reported.

Plans involve the upgrading of 3,000 rental units where Brookfield [TRDataCustom] and Urban American will replace 6,000 windows, seal cracks and leaks that let heat escape and install a type of mini power plant known as a cogeneration system.

Urban American‘s Joshua Eisenberg said as an owner and operator of multifamily buildings, he felt a “responsibility to reduce the amount of energy” his buildings were producing.

Retrofitting the five buildings with energy-efficient appliances will set the developers back $11 million. And it will cost another $5 million to switch to a cogeneration system — a combined heat and power system — instead of relying on a combination of power grids, natural gas line and boiler.

“Cogeneration is the smallest type of local power station,” said David Davenport, managing principal at Urban Greenfit, an arm of Urban American.

The developers also expect to save $4 million per year on energy costs, in addition to reducing emissions by up to 29 percent.

Urban American has made similar changes at Roosevelt Landings, its 1,003-unit project on Roosevelt Island, where it spent $8 million on cogeneration and retrofits that limit air conditioning and heat use when tenants aren’t home. The firm has saved $2 million thanks to those upgrades since 2014. [Crain’s] — E.B. Solomont