Trending

The 10 juiciest real estate lawsuits of 2016

From a Stuy Town battle to Maitland vs. Sitt, the year in litigation

In the blood sport of New York real estate, litigation is a way to bully, negotiate, and even embarrass — and 2016 didn’t disappoint.

Developers and brokers took to the courts to fight over commissions, poaching, data leaks and even to halt deals they had no part in.

As always, The Real Deal was there to document the carnage. Read on for a closer look at the juiciest cases from the last 12 months.

Stuy Town drama

Bill Ackman and Stuyvesant Town

The biggest deals rarely go down without a fight, and the $5.3 billion sale of Stuyvesant Town-Peter Cooper Village to the Blackstone Group and Ivanhoe Cambridge this year was no exception. In January, Bill Ackman’s Pershing Square Capital Management and Winthrop Realty Trust slapped CWCapital, the special servicer that controlled the property, with a $500 million suit over the deal, alleging they’d been swindled out of a hefty profit on the sale. The suit was labyrinthine: The plaintiffs claimed they’d bought a portion of Stuy Town’s defaulted mezzanine debt in 2010 with a view towards foreclosing on the property, but CWCapital got the courts to block a foreclosure. That was all good until this year, when the plaintiffs alleged CWCapital, who bought the debt from them, had done exactly the same thing it had blocked them from doing. A judge decided in favor of dismissing the suit in October, but Pershing is appealing. Landlord SL Green Realty, which had beef with CW over its One Vanderbilt project in Midtown, also threatened to file a lawsuit that would block the sale, but reportedly received $10 million dollars from CW to walk away.

Naftali vs. protégés

Victor Sigoura and Miki Naftali

Sometimes things go wrong when the kids leave the nest. Developer Miki Naftali and two of his former protégés Victor Sigoura and Drew Popkin traded lawsuits this summer, shortly after Sigoura and Popkin left to start their own company. They accused Naftali of stiffing them on their agreed-upon share of profits from deals, and sought damages of at least $8 million. Naftali quickly shot back with his own $15 million suit, alleging the pair stole confidential financial data and trade secrets when they left the company. Sigoura, Naftali’s former chief investment officer, withdrew his lawsuit in September and apologized. “Circumstances combined with wrong influences got to my head, and as a result I made some bad judgment calls,” he said. Popkin clearly didn’t reach the same conclusion – He and his former boss are still duking it out. Meanwhile, Sigoura and Popkin went their separate ways, with the former running Legion Investment Group while the latter will continue to run Highpoint Property Group.

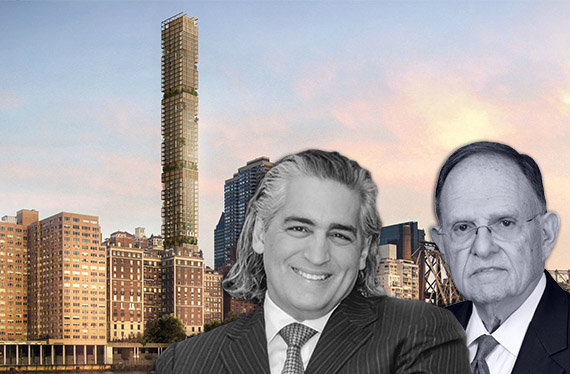

Battle on Billionaires’ Row

Rendering of 111 West 57th Street in Midtown (inset, from left: Kevin Maloney and Michael Stern)

Michael Stern’s JDS Development Group and Kevin Maloney’s Property Markets Group were hit by a lawsuit from partner AmBase Corp. in April over their planned supertall condo tower at 111 West 57th Street. AmBase claimed that JDS and PMG had engaged in an “unlawful scheme to dilute” its equity stake in the project by “artificially driving up development expenses and then issuing unnecessary capital calls to cover the purported costs.” The company, a Florida-based entity, even claimed that JDS and PMG had illicitly obtained financing on favorable terms, thus “limiting their own risk in the condo development “while imposing substantial financial burdens on AmBase.” The capital calls had resulted in AmBase’s interest in the project dropping to 45.3 percent from 60.3 percent. The litigation is still pending.

Schmear campaign at WeWork

From left: WeWork co-founders Miguel McKelvey and Adam Neumann

WeWork took legal action against former employee Joanna Strange in July after she allegedly stole “confidential financial information” and leaked it to Bloomberg. The case appeared to stem from a story the outlet published about WeWork slashing its profit and revenue projections for 2016. The story cited private financial documents. Strange allegedly used a WeWork executive’s username and password to log into the company’s system and take the documents after she was fired. The litigation is still pending. One of the quirkiest details from the leak was that WeWork CEO Adam Neumann canceled a weekly Monday morning $350 salmon and bagel breakfast for the firm’s executives.

Beninati’s Hail Mary

From left: Rendering of 3 Sutton Place, Joseph Beninati and N. Richard Kalikow

Joseph Beninati is this year’s Icarus, and what burned him was 3 Sutton Place.

In February, a Manhattan judge struck down the developer’s for an injunction against his lender Gamma Real Estate to stop a foreclosure auction of his condominium project at 3 Sutton. Beninati’s Bauhouse Group had assembled the site with the help of $147 million in high-interest loans from Gamma, but had fallen into default. In an auction earlier this month, Gamma paid about $86 million for the site plus $12 million to secure additional air rights. In July, Beninati sued Gamma, alleging the lender conspired with Beninati’s attorney, Richard R. Kalikow, who happens to be N. Richard Kalikow’s cousin, to take control of the project, but a judge dismissed those claims.

Elliman and Compass duel it out

Howard Lorber and Leonard Steinberg

In October, Douglas Elliman sued the venture capital-backed unicorn brokerage Compass and its president, Leonard Steinberg, for allegedly waging a scheme to steal Elliman brokers and meddle with their contracts. The brokerage accused Steinberg and his partner Herve Senequier, both ex-Elliman agents, of breaking an agreement not to recruit from Elliman for 18 months, in exchange for retaining their pending contracts, worth about $3 million in commission.

“The recruiting was orchestrated by Steinberg and Senequier but designed to look as though it was coming from others to conceal their involvement in the scheme,” the complaint states.

Elliman had lost over 50 agents to Compass by the time the suit was filed. The suit is ongoing.

Aquino loses faith in Consolo

Joseph Aquino, Faith Hope Consolo and Dottie Herman

In March, Elliman’s Joseph Aquino, right-hand man to self-styled “queen of retail” Faith Hope Consolo, sued Elliman for allegedly improperly deducting over $1 million of his commissions to cover Consuelo’s extravagant personal expenses, including her spa treatments, cashmere sweaters, beauty supplies, and a $100-a-day makeup session. Aquino also alleged that Elliman’s Howard Lorber had threatened to “blackball” him in the industry when he complained. Aquino was fired two days after he filed the suit. In July, Aquino got a new gig heading up the North American operations of the Location Group, a Switzerland-based brokerage, and in October a judge dismissed his suit.

Wendy Maitland takes on Joseph Sitt

From left: Joe Sitt and Wendy Maitland

In May, Wendy Maitland, former president of sales at Town Residential, sued the brokerage and then co-owner Joseph Sitt, days after leaving the company. Maitland accused Sitt, who runs the investment firm Thor Equities, of starving Town of funds, thereby costing the company agents and a new development contract, and hurting the value of the company. At stake was Maitland’s noncompete clause, which Maitland sought to invalidate, and Andrew Heiberger, CEO of Town, fought to keep in force. In September, the two sides settled, and Maitland got to keep her new gig as a new development broker at Brown Harris Stevens.

Chetrit can’t let go

Joseph Chetrit wasn’t too pleased about losing the coveted 14-building Ring portfolio to Extell Development’s Gary Barnett. In 2013, Joseph Tabak’s Princeton Holdings and Chetrit’s Chetrit Group had joined forces to acquire the portfolio, which was split between Michael and Frank Ring, but just as Tabak was closing on Michael Ring’s stake for $112.5 million, he flipped it to Extell. After suing his would-be partner Tabak, he filed a $400 million lawsuit against Barnett and Extell, claiming that Barnett’s interference in the deal was “fraudulent and deceitful.”

Running in circles at the New York Wheel

Meir Laufer and a rendering of the New York Wheel

When Meir Laufer saw the London Eye on a trip in 2008, he decided that New York needed to have its own giant wheel, and that he was the man to make it happen. Thus the idea for the 630-foot-tall New York Wheel, to be built on Staten Island, was born. But things quickly turned ugly. According to a suit he filed in 2015, Laufer got sidelined by big-name investors in the project such as the Feil Organization and BLDG Management’s Lloyd Goldman. His one-third stake in the project got diluted when he couldn’t meet capital calls. After a year of legal tussling, Laufer was back in court in January 2016, fighting his ouster from the Wheel’s board. In March, the court decided in favor of the board. Last month, the investors and Laufer settled the lawsuit.