Trending

Alleged Ponzi scheme mastermind looks to be driving force behind NYC co-working startup Bar Works

An investor who allegedly ran a global multimillion-dollar Ponzi scheme and is being sued by U.K. authorities for misleading investors is a key figure behind the New York co-working startup Bar Works, The Real Deal has learned. The investor, Renwick Haddow, looks to have gone to great lengths to hide his involvement in the company, whose listed co-founder appears to be his Eastern European wife working under an assumed name.

The revelation comes a week after TRD reported Bar Works is raising funds by securitizing its desks and selling them to investors online, in a model that resembles some of Haddow’s past alleged schemes. And it adds to the strange saga of a startup that combines co-working spaces with bars.

In an email, Jonathan Black, who is listed as CEO and co-founder of Bar Works, insisted that Haddow simply acts as a consultant to Bar Works, and said Haddow’s role has diminished considerably over the past six months. He denied that Haddow is an investor or shareholder in the company. But Haddow’s connection to the firm, according to sources, public records and other websites, is deeper than Black suggests. And Black’s own digital footprint raises questions about his identity.

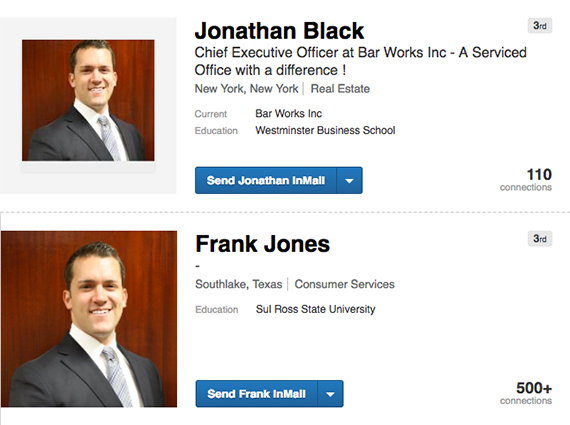

LinkedIn pages for Jonathan Black and Frank Jones

Founded in 2014, Bar Works operates three locations in New York and one in San Francisco, with five more scheduled to open soon, according to its website. The company’s business model of combining a bar and office desks in retail spaces (and its plans to turn Britain’s red phone booths into mini offices) has led to coverage in the New York Times, Fortune, Crain’s, the San Francisco Chronicle and other publications. The articles paint a picture of just another yuppie-focused co-working startup, one of dozens trying to make it in New York.

Haddow, on the other hand, has received decidedly less flattering press. In 2015, the World Policy Journal published a detailed investigative report in which it alleged Haddow, through an umbrella firm called Capital Organization, ran a vast Ponzi scheme involving over 30 different entities that generated more than $180 million in turnover over a period of five years. According to the report, Haddow’s companies created “sucker lists” of British retirees and convinced them to invest in commodities such as palm oil, platinum, diamonds, land and carbon credits, heavily concentrated in Africa. Some investors were guaranteed fixed annual double-digit returns, minimum returns over the duration of the investment, and guaranteed buy-backs. Many of the supposed investments were bogus, the report claims, citing extensive evidence, and some investors lost their life savings to the scheme.

“All the projects were fabricated,” Robert Conroy, a former manager at one of the entities connected to Haddow, told the World Policy Journal. “Between all the companies, about $3 million per month was easily generated in turnover. No monies were actually invested in projects.”

In 2014, the U.K.’s Financial Conduct Authority won a court ruling that Haddow and his co-defendants lacked the authorization to operate “collective investment schemes.” A 2015 appeals court upheld the ruling. The FCA is currently taking Haddow and his co-defendants to court for “misleading statements” made to investors, according to its website. The trial is scheduled for May. Haddow has not been convicted of criminal activity.

The ties that bind

Haddow now spends at least some of his time in New York. On a local meetup group, he described himself as the founder of a crowdfunding platform called “In Crowd Equity.” A phone number for In Crowd Equity listed on its website appears to be out of service. The website states that the company uses a number of advisers that vet investment opportunities, and that the board is “listed on the Information Memorandum for the US Tech Startup Fund.”

In Crowd Equity is the same company that Bar Works, in a press release dated Sept. 8, 2015, says that it is sponsored by. At the time, according to the release, Bar Works was looking to raise about $1.5 million for 20 percent of its equity, pegging itself at a pre-money valuation of $7.5 million.

Haddow’s name doesn’t appear – at least nowhere conspicuous – on Bar Works’ website, press releases and promotional materials. Two Crain’s articles describe the firm’s co-founders as Jonathan Black and Zoe Miller. But one source familiar with the company said that Haddow has co-signed leases on behalf of the firm, is a co-founder and is still actively involved in the firm’s operations. State records show Haddow applied for two New York liquor licenses on behalf of Bar Works as its “principal” in 2016 and for one San Francisco liquor license as a “member” and “officer.” The domain barworks.us was initially registered to the email address renwick@renwickhaddow.com.

Black, in an email, said Haddow is “a consultant with the company and consults on a few areas including licensing.” He denied that Haddow is a principal or investor in the firm. Asked why a consultant would apply for state liquor licenses as a principal of the firm, he wrote Haddow “was simply the only one who had the experience of doing this at the time as you probably appreciate this is a time consuming and complicated process.”

But at the company’s first Brooklyn location, a small warehouse at 242 Metropolitan Avenue, the LLC is registered directly to a Renwick Haddow, state records show. And for some of the other locations, the address listed on the LLCs that control them is the address of Haddow’s Manhattan apartment, property records show.

Reached by phone, Felix Reznick, the managing member at Reznick Law, which is listed as Bar Works’ property attorney, confirmed he has met with Haddow and dealt with him on Bar Works’ leases. He declined to comment except to say that Haddow was a “principal, upstanding guy that pays his bills on time.”

Haddow did not respond to requests for comment. The U.S. Securities and Exchange Commission and the British FCA declined to comment.

As TRD reported last week, Bar Works has been marketing notes tied to rental income from individual co-working desks to investors for as little as $25,000. The program bears similarities to Haddow’s past reported investment schemes: In 2009, an entity tied to Haddow reportedly sold notes tied to income from hotel rooms, according to an article in London-based financial magazine Money Observer. Bar Works is marketing its lease securities through a web of agents with names such as New World Property Investment, EC1 Investments or FJP Investment. And, as with the palm-oil production scheme cited in the World Policy Journal report, investors are promised guaranteed double-digit returns and buy-back options. Black insisted that Haddow’s advisory role did not extend to the investment program.

When TRD visited the Bar Works space on West 39th Street on Thursday afternoon, it was empty save for two customers sharing a table in the corner and an employee manning the bar. The bar’s shelves showed no trace of any liquor bottles. A moveable fan was buzzing loudly. With its pale lighting and gray velvet chairs, the room looked like a cross between a WeWork and an airport waiting area. Taking a page from WeWork’s book, the walls sported posters with motivational quotes. “This is your life,” read one, “and it’s ending one minute at a time.”

International woman of mystery

Renwick Haddow aside, another mysterious figure at Bar Works is Zoe Miller.

A July press release from the company refers to Miller as an “operations executive.” But TRD’s source said Miller is, in fact, Haddow’s Eastern European wife, and has little actual involvement in the firm.

There is some support to back up the claim that Haddow and Miller are a couple. According to “buy buy baby,” an online baby gift registry, Renwick Haddow and Zoia Haddow are expecting a baby in April. A Linkedin page for Zoia Kyselova, a woman listed as having a degree from a university in Ukraine, includes a profile photo that looks strikingly similar to the person identified in the Crain’s articles as Zoe Miller. A Bar Works commercial published on YouTube in June features a cameo by Zoe Miller, speaking in a thick Eastern European accent.

Zoia Haddow appears to be a competitive ballroom dancer, and the 2016 Atlanta Open dance competition lists her as a participant. TRD examined photos of Haddow from the event, and they bear a strong resemblance to the person identified as Zoe Miller in the Crain’s photograph.

Unlike Zoia Haddow and Zoia Kyselova, Zoe Miller appears to have no Instagram, Twitter or Linkedin account, unusual for the young co-founder of a millennial-focused startup.

Asked whether Miller is Haddow’s wife, and whether Zoe Miller and Zoia Haddow are the same person, Black, again over email, dismissed the suggestion as “malicious nonsense.” Black, who did not return multiple phone calls and corresponded only via email, did not make Miller available for comment, nor did he provide any further details about her. When told about the photos from the dancing competition, he wrote: “I have better things to do than comment on one of my staffs marital status and dancing partner.”

Black too, remains an enigma. His LinkedIn page states he graduated from the Westminster Business School in 1993, but the only work experience he has listed on his public profile is Bar Works, beginning in 2015. In his bio, he claims he was the financial controller for a British company called Regent Inns, but TRD could not corroborate this nor find any other evidence online of Black’s ties to other companies. A Wikipedia page for a firm called Regent Inns has little detail, but notes the company went into administration, or insolvency, in 2009.

The photograph Black uses on his LinkedIn profile (see above) is a photograph also used by one Frank Jones, who according to his online footprint appears to be a Texas-based investment adviser. The photograph appears on Jones’ LinkedIn profile, and another photograph of the same individual appears on an honor society newsletter, where he is identified as Jones.

Over the course of reporting this story, Black threatened repeatedly to sue TRD. Two days before the story was published, he copied his legal team on an email to TRD with his remarks. TRD subsequently made multiple attempts to contact the legal team on the email address Black provided. The emails, however, bounced back.

Chava Gourarie, Kyna Doles, James Kleimann, Will Parker and Hiten Samtani contributed reporting.

(If anyone has any further information about Haddow, Bar Works, Miller or Black, please contact kp@therealdeal.com.)