Trending

Here’s what the city thinks each NYC borough is worth

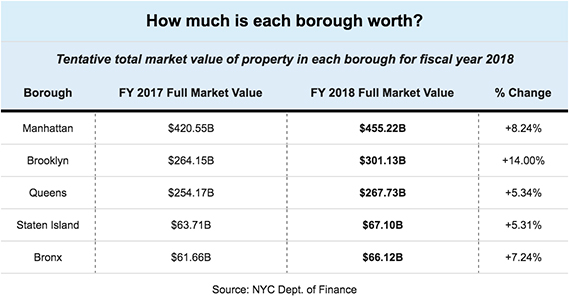

Dept. of Finance estimates show Manhattan property values now total $455.2B

The city’s Department of Finance estimates that all New York’s real estate put together is now worth $1.16 trillion (go figure). But not all boroughs are created equally.

The agency gave The Real Deal a breakdown of how the boroughs changed in market value over the last year as part of their annual property tax assessment. The total value of real estate in Manhattan might seem impossible to compute, but the city pegs it at $455.22 billion for all four combined property classes. That number, for fiscal year 2018, represents an 8.24 percent increase from $420.55 billion the year prior.

Property values blew up most in Brooklyn, rising 14 percent year-over-year to cross the $300 billion mark for the first time, DOF data show. Queens came in third, with its real estate valued at$267.73 billion, up 5.34 percent year-over-year.

The Bronx remains the least valuable borough, but thanks in part to a flurry of large-scale development projects, is now neck-and-neck with Staten Island. Bronx’s real estate is valued at $66.12 billion, compared to Staten Island’s $67.10 billion. And the Bronx’s appreciation in value, at 7.24 percent, was third overall.

City-assessed market value for tax purposes, however, can be a great deal lower than what the property could actually sell for on the open market. If recent sale comps were used instead, that $1.16 trillion number could suddenly look very small.