Trending

What you missed at Milken: Barrack sounds off on WeWork, Schwarzman on evaluating deals … & more

Investment titans on where the opportunities and challenges lie

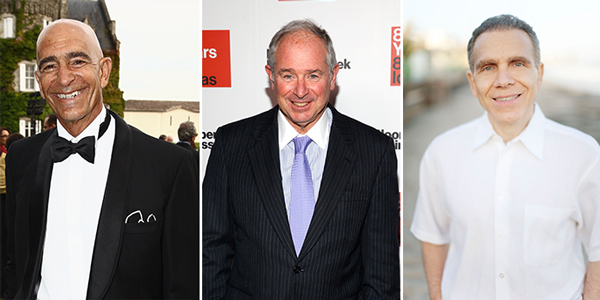

Tom Barrack has seen it all. One of the world’s most successful real estate investors for more than three decades, the head of Colony NorthStar has done multibillion-dollar hotel deals, made a killing off of distressed casinos and even tried his hand at luxury home flipping in Santa Monica.

But WeWork he doesn’t get.

Speaking this week at the Milken Institute global conference in Los Angeles, Barrack said it’s getting trickier to quantify real value in the real estate market given the rise of companies without tangible assets.

“You look at a company like WeWork which owns nothing and the enterprise value is equivalent to Boston Properties, which is probably the best or largest office REIT in the world,” he said. “How do you justify value? Who’s right, who’s wrong?”

Here are the numbers: Following a $300 million investment from Japan’s SoftBank Group earlier this year, the shared-office space firm was valued at over $17 billion. By comparison, Boston Properties, which controls more than 45 million square feet of office properties, including trophies such as the General Motors Building, has a current market capitalization of about $19.38 billion.

Barrack’s not the first big kahuna to question WeWork’s business model. Empire State Realty Trust CEO Anthony Malkin refuses to rent to the company, saying “I’d rather collect rent from somebody I know has a certainty of paying it.”

Other speakers at the Milken conference included the likes of Blackstone Group’s [TRDataCustom] Stephen Schwarzman and Canyon Capital Partners founder Mitchell Julis. Schwarzman described Blackstone’s approach to evaluating real estate bets.

“Every Monday, all of our business lines meet for an hour-and-a-half to two hours,” he said. “We go over every transaction we’re doing everywhere in the world. We have an economist in the room. We have political advisors. You can start seeing trends going around the world. When you do it in multiple asset classes, there’s an enormous advantage.”

Real estate, he said, is a different beast for the rest of Blackstone’s business lines, which include private equity and asset management.

“The cycles for real estate aren’t necessarily correlated one-to-one with cycles for private equity…. but sometimes you can see things. We start to see patterns.”

The company is America’s largest private landlord, and its assets include Stuyvesant Town the Caiola portfolio and 1740 Broadway in New York, as well as 9655 Wilshire in L.A. The company has also been an active real estate lender, backing projects such as Kushner Companies’ Watchtower building in Dumbo.

Julis addressed the current climate of tighter banking regulations, which he said could be a big opportunity for players who can provide short-term loans for real estate developers amid a drought in construction lending.

“The developer will get its ducks in a row and it’ll go to the local bank and it’ll find that the local bank is subject to Dodd Frank, Volcker, Basel and at risk rules,” he said. “They will come to Canyon. The developer has bad timing in that respect. He’s got it all there, but the banks are not there. But they will be there, once it gets developed.”

Julis appeared to be describing the deal his company did at the Lightstone Group’s 365 Bond Street in Gowanus, where it provided a $120 million construction loan in 2014. Lightstone refinanced the loan this week, after completing the first phase of the 700-unit rental complex.

“We’re fitting needs that are out there,” he said. “If it meets the needs of our investors, we’ll design the right security.”