Trending

Ceruzzi, SMI land $200M bridge loan on 520 Fifth site

Developers will later seek construction financing, which could top $500M

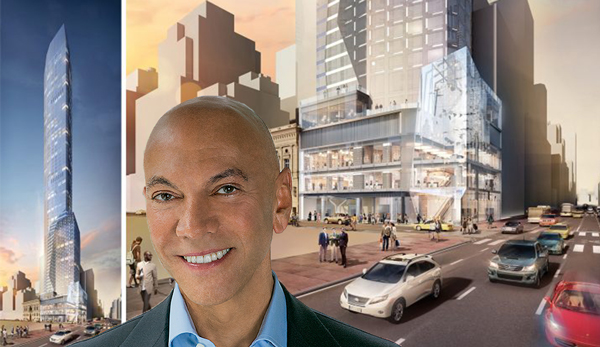

Ceruzzi Holdings and SMI USA secured a $200 million bridge loan from Mack Real Estate Credit Strategies for their development site at 520 Fifth Avenue, where construction costs are expected to exceed $500 million.

The debt replaces a $130 million acquisition loan from JPMorgan Chase and will cover pre-development costs for the mixed-use tower, the Commercial Observer reported.

The loan comes with an 18-month term with a one-year extension, and gives the developers time to decide on a final development plan.

Ceruzzi and SMI bought the site at the corner of 43rd Street for $275 million in 2015 from Thor Equities, which had planned a 71-story tower with a hotel and residential condos above a retail base.

The new owners reportedly planned to move ahead with Thor’s original scheme, but progress slowed and revised plans that surfaced late last year show the developers plan to build 145 condos, 208 hotel rooms and three floors of retail. HFF’s Christopher Peck and David Nackoul brokered the financing.

It’s unclear if those are the current plans. Once pre-development is complete, the owners will be in the market for construction funds.

One possible lender is JPMorgan, which has recently become aggressively active in the condo-construction space. Earlier this year, two brokers filed a lawsuit claiming SMI cut them out of $4 million in commissions on the land sale. [CO] – Rich Bockmann