Trending

Dev site sales prices are finally dropping

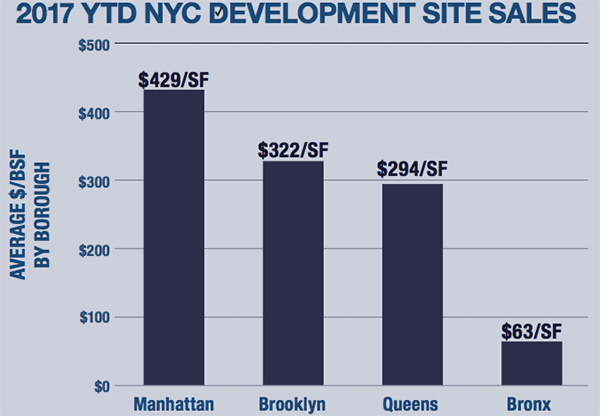

Average price per foot sits 22 percent below 2016 average: report

Sales prices for New York City development sites are down 22 percent through the first half of 2017, according to a new report from Ackman-Ziff Real Estate.

In 2016, transactions averaged $404 per buildable square foot, but that average is down to $314 through June of this year. The Bronx has posted the cheapest closings of any borough, with sales averaging $64 per square foot.

Despite the drop in prices, it’s so far an increasingly lagging market for site trades. Last year saw a reduction of 57 percent in sales volume, according to the report, down to $2.6 billion from $5.2 billion across the five boroughs. And 2017 so far has only been worse.

Ackman-Ziff’s [TRDataCustom] analysis shows that just $370 million in development sales have closed this year through the month of June. (Real Capital Analytics has similar figures — around $350 million.) But Jason Meister, a managing director of investment sales at Ackman-Ziff, hopes that pricing has finally fallen far enough to get the market moving again.

Source: Ackman-Ziff Real Estate

“There’s been market capitulation and there’s finally some breathing room for developers to focus on deals that make sense in the market,” Meister said.

“A 22 percent drop in price per square foot is just the right amount for a lot of developers to start to feel comfortable that they can build into an environment where rents have stabilized or are rising,” said Marion Jones, also a managing director at the firm.

Contributing to that optimism is the return of the 421a tax exemption that until this spring was unavailable to development hopefuls for more than a year. It may still be a while before the change in public policy sparks a clear shift in market reality, however.

“It’s going to take another quarter or so for that to really bake into how people are underwriting deals,” Jones added.

As with the investment sales market generally in New York, single blockbuster deals can swing total figures substantially, and so there’s still time for a game-changer in 2017. In March 2016, The Real Deal reported that only $90 million in development site sales had occurred through the first two months of that year, according to data from Real Capital Analytics. But just three sales would eventually make up more than $900 million in total volume for the year: 80 South Street and 550 West 37th Street in Manhattan and 85 Jay Street in Brooklyn.