Trending

US regulators want to stop Chinese companies from taking over American firms

HNA Group’s hedge fund acquisition is one of several deals for American companies being held up

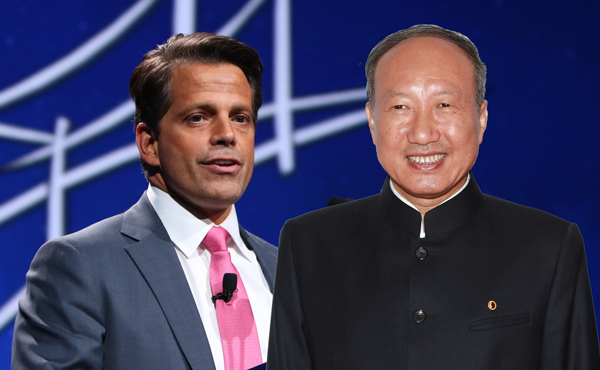

HNA Group’s proposed acquisition of the hedge-fund investing firm SkyBridge Capital is one of several Chinese deals that’s come under increased scrutiny from U.S. regulators.

The Committee on Foreign Investment in the U.S., also known as CFIUS, is growing increasingly wary of Chinese deals and has created a backlog of investigations, the Wall Street Journal reported.

HNA’s deal to purchase SkyBridge from financier Anthony Scaramucci, the new communications director for President Trump, is among several deals being held up. Another is China Oceanwide Holdings Group’s bid to buy Virginia-based insurer Genworth Financial.

The Chinese companies behind at least four deals have recently refiled or made plans to refile their applications after failing to get approval during the two-month review period.

Critics are wary of the security risks posed by Chinese companies, many backed by the country’s government, and lawmakers are proposing changes to the CFIUS review process that could tighten scrutiny on Chinese investment.

“A deal that might not otherwise raise much concern could raise serious concern if it’s being done by a Chinese company,” said Peter Alfano, a lawyer at the firm Squire Patton Boggs, who keeps a log of publicly disclosed CFIUS activity. [WSJ] – Rich Bockmann