Trending

StreetEasy competitor Zumper just launched a resi brokerage in New York

Citi Habitats' Gary Malin comes out against startup's new rental program

As many of the city’s rental agents were suffering anxiety attacks due to StreetEasy’s new daily fee on listings, rival search platform Zumper quietly started a rental brokerage business. And there are signs the strategy could make enemies of the established brokerages in the Big Apple.

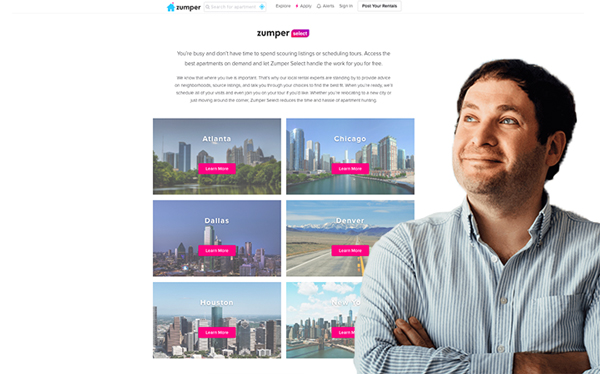

The San Francisco-based startup, which acquired New York City-based PadMapper last year, has rolled out “Zumper Select,” a feature that takes apartment hunters through the entire rental process from search to lease signing. Instead of involving agents from one of the traditional firms, Zumper is hiring its own agents who will facilitate deals and collect commissions.

“We have continually received renter feedback — and seen in user activity online — that renters are turned off by seeing the same apartment posted a dozen or more times, sometimes with differing information from different sources,” Zumper said in a statement, describing the feature as a way to verify listings are accurate and provide apartment seekers with “the best rental experience” possible. Renters will be able to search for apartments, chat in real-time with an agent/staffer or watch video tours of listings. Landlords will be able to use Zumper Select to market their listings directly to potential tenants.

“Zumper Select will provide a more seamless experience, keep renters engaged and ultimately [return] more leads on all listings for agents, property managers and landlords,” the statement said.

The startup — which has raised $39.2 million from investors — said it launched the Select service earlier this year in Chicago, Denver, Dallas and Houston. But New York City is its biggest market, with 500,000 visits to its site each month (out of 4 million nationwide). The 70-person startup has 14 staffers in New York, where six are licensed agents, including general manager Nathan Tondow.

The portal currently has about 65,000 rental listings throughout the five boroughs, and it gets feeds from major brokerages and directly from agents and landlords. It’s important to note that many of those listings are likely outdated or duplicates; competitor StreetEasy, the leader in the space, had about 30,000 rental listings on its portal before it began charging rental brokers $3 a day per listing and listing inventory fell by about half.

And Zumper Select is still just a drop in the bucket with some 800 listings. A spokesperson for the company said Zumper Select would not interfere with exclusive listings posted on its site, with around 98 percent of leads still going to brokers who pay to post listings.

But the city’s largest residential firms are already slamming the company and its new initiative.

Citi Habitats was first to lash out, and said in an email to agents that it would stop feeding open listings to Zumper immediately. “Zumper is trying to convert your business into their own business,” firm president Gary Malin wrote in the email, which was obtained by The Real Deal. “Given these facts, I don’t know why you would pay a competing brokerage firm to advertise your listings and take your clients.”

Malin, who declined to comment to TRD, discouraged agents from sending their listings to Zumper. “By posting to their site, you validate their service, which given their new direction, does not make business sense,” he said in the email. “They make money in multiple ways, do you make any money from them?”

Bold New York’s Jordan Sachs said Zumper should focus on what its good at — disseminating rental information. “Just because they have gathered a lot of rental data doesn’t mean they would be good brokers,” he said.

To some agents, Zumper Select also confirms a long-held fear that technology could replace make the broker obsolete. New York City firms have spent the last few months battling Zillow Group-owned StreetEasy, which has begun to monetize rental listings and has also taken heat for Premier Agent, an advertising program that generates buyer leads for paying agents. In response, a dozen major brokerages will syndicate their listings through the Real Estate Board of New York’s RLS system starting Aug. 1, though it isn’t consumer-facing.