Trending

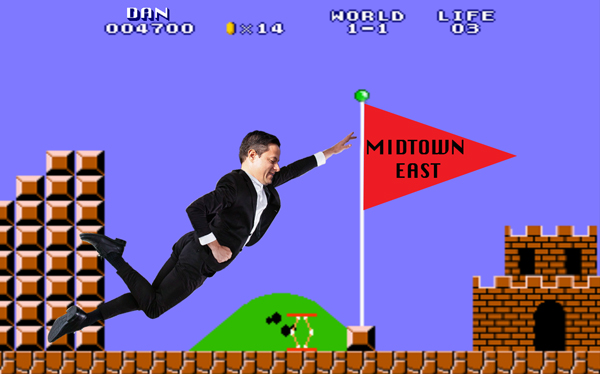

Get ready for a ton of new office space (maybe): City Council greenlights rezoning of Midtown East

Legislation could mean 6.5M sf of new office space

The City Council on Wednesday cleared the way for 6.5 million square feet of new office space to rise in Midtown East.

The council approved rezoning more than 70 blocks in the district, allowing developers to build to a higher floor area ratio (FAR) — the highest being an FAR of 27 in some areas.

“This is certainly the right place to put a lot of new density,” Council member Dan Garodnick said before the vote, noting that the district accounts for 10 percent of the city’s property tax revenue. “The goal is to improve [Midtown East] not to keep it the way it is.”

It’s been a long road to Wednesday’s decision. In November 2013, the Bloomberg administration rescinded an earlier rezoning proposal after it became clear that the administration didn’t have key support from the City Council. At the time, Garodnick opposed the rezoning, saying that it didn’t go far enough to ensure that crucial infrastructure updates accompanied new commercial development.

The latest proposal, which was championed by Garodnick, sought to mollify these concerns by identifying specific public improvements that developers will either need to undertake themselves or financially contribute to in exchange for density bonuses.

The latest proposal creates three ways for developers to build to higher FARs. If within a designated transit improvement district (near Grand Central Terminal), they need to complete certain below-grade infrastructure improvements. This follows a model similar to the deal SL Green Realty cut with the city to build its 1.7-million-square foot office tower, One Vanderbilt. The developer must complete $220 million worth of infrastructure improvements before tenants can occupy the building.

Building owners can also legally rebuild square footage that would now be considered overbuilt under the city’s 1961 zoning resolution — meaning they can knock down existing older structures and rebuild to the same square footage. In these cases, property owners would need to contribute to a public realm improvement fund.

Another option available is to buy from a pool of roughly 3.6 million square feet of landmarked air rights. A public realm improvement fund will receive either 20 percent of the value of these air rights sales or $61.49 per square foot — whichever is greater. This is a lower contribution rate than was initially proposed — $78.60 per square foot — but still drew criticism from the Real Estate Board of New York and owners of the landmarked properties. They argued that the rate effectively set the floor price at $307.45 per square foot, which they viewed as a potential deterrent for prospective buyers.

The city has identified 16 properties that are likely to take advantage of the rezoning in the next 20 years, though there’s some doubt that the neighborhood’s transformation will play out in a timely manner. Many of the buildings have multiple owners and are fully leased — potential obstacles for a landlord looking to knock down a pre-1961 building to make way for a glossy new office tower.

Officials have stressed that Midtown East needs to be rezoned to keep up with the likes of Hudson Yards, Lower Manhattan and other burgeoning commercial districts. Of the 475 buildings in the district, more than 300 of the structures are more than 50 years old, according to the City Planning Commission. The rezoning is expected to help gradually upgrade the district’s aging building stock. It remains to be seen which property owners will take advantage of the rezoning.