Trending

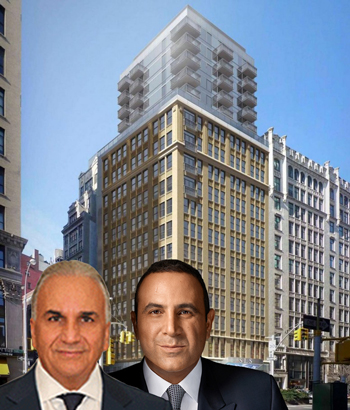

Sam Nazarian gets bought out of the Mondrian Park Avenue hotel

Moin Development, SBE-developed hotel at 444 PAS to open next month

Mere weeks before Mondrian Park Avenue opens, one of the developers of the ritzy Park Avenue South hotel has exited in a buyout deal, sources told The Real Deal.

David Moinian’s Moin Development bought out developer Sam Nazarian’s shares in the 189-key property at 444 Park Avenue South. The 20-story hotel, a conversion and expansion of a 15-story office building on the site, is expected to open next month.

Nazarian’s hospitality firm SBE Entertainment Group will be involved, but Nazarian, who has been an investor in the project for more than five years, has since been bought out of his roughly 10 percent interest on the eve of its opening.

The project was long touted as the first SLS hotel in New York City – Sls Park Avenue. Moin bought the property on the site for $45 million in 2011 and partnered with Nazarian’s SBE for a $150 million conversion designed by Philippe Starck. Fortress Investment Group provided the developers with a $109 million loan in 2015.

After SBE closed on its $805 million acquisition of Morgans Hotel Group in December 2016, the company moved to give Mondrian – one of that company’s brands – a location in New York. The other Mondrian hotels are in Los Angeles, South Beach and Qatar. In July, the developers opted to change the Sls Park Avenue’s name to Mondrian Park Avenue.

Prior to the buyout earlier this month, Nazarian said in a company release that the Mondrian brand’s “international allure is why we chose to give it priority in New York, and I’m excited that this property will be SBE’s first collaboration with New York’s real estate powerhouse family, David Moinian and Moin Development.” (Moinian’s brothers Joseph and Morris are also prominent real estate developers.)

Sources said Nazarian is on the hunt to find a better first location for the first SLS in New York City. There are six SLS hotels, and ones in Philadelphia and Washington, D.C., slated to open next year.

SBE’s Morgans Hotel Group acquisition also supersized its portfolio size to a total of 22 hotels with almost 7,000 rooms globally, meaning Nazarian may have wanted to place investment elsewhere.

Representatives for SBE and Moin declined to comment.

Journal Hotels will manage Mondrian Park Avenue, which will have a 5,000-square-foot restaurant from chef Danny Elmaleh called Cleo and 7,000 square feet of meeting and event space.

Sources close to Mondrian Park Avenue ownership said there are no plans to put the property up for sale. The NoMad property, at the northwest corner of West 30th Street, is located one block north of Gansevoort Park Avenue NYC, where the owners are exploring a sale.