Trending

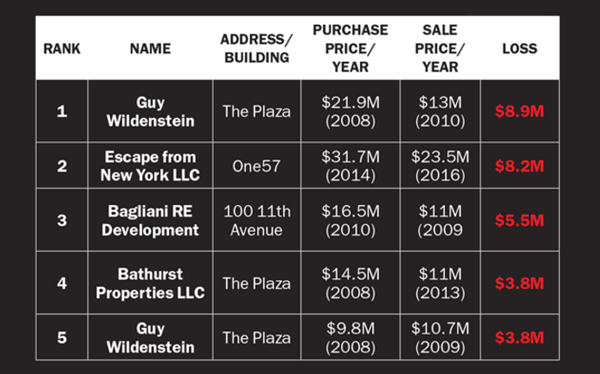

Here are the 5 biggest losers in the luxury resale market

TRD identifies the NYC sellers who lost the most on their condo bets

For some who’ve opted to sell, the results have been grim — particularly in buildings that debuted at the top of the cycle.

Most famously, the art dealer Guy Wildenstein — who was cleared of tax-fraud allegations this year by a French court — Sold His Plaza unit for $13 million in 2010. That was about 40 percent less than the $21.9 million he paid in 2008 and gave him the unlucky distinction of losing more money than any other investor in Manhattan in the last decade, according to The Real Deal’s analysis. Wildenstein also sold another condo at The Plaza for a $3.8 million loss in 2009. Attempts to track down Wildenstein were unsuccessful.

An investor under the name “Escape from New York LLC,” who ate more than $8 million after selling his 62nd-floor pad at One57 for $23.5 million, lost the second most in Manhattan during that stretch.

Next up was Bagliani RE Development LLC, which is based in Italy. It bought a penthouse at the Jean Nouvel-Designed 100 11th Avenue for $16.5 million in 2010 and sold it for $11 million in 2013 — taking a 33 percent haircut.

Financial losses have spanned the borough and have spared few. Leonardo DiCaprio, for example, paid $10 million in 2014 for a unit in Delos at 66 East 11th Street — a green condo with “wellness” amenities like purified air, posture-supportive flooring and Vitamin C-infused showers — only to resell it for $8 million late last year.

Mike Myers, of “Austin Powers” fame, meanwhile, sold at The Tribeca Condo Conversion 443 Greenwich Street for $14 million —$675,000 under what he paid less than a year earlier and a discount from his $15 million listing price. And at 150 Charles Street — the record-setting condo developed by the Witkoff Group in the West Village — the buyer of a maisonette swallowed a $400,000-plus loss on one of the first resales in January.

And the list goes on.

Two owners at One57  — Nigerian oil magnate Kola Aluko and business executive Sheri Izadpanah — are facing foreclosure.

— Nigerian oil magnate Kola Aluko and business executive Sheri Izadpanah — are facing foreclosure.

Even 15 Central Park West, the so-called Limestone Jesus, which has been largely immune from losses, hasn’t been unscathed. Late last year, an owner who bought a three-bedroom under the name Westside RE Properties LLC sold for $20.6 million, about $3 million less than the 2012 purchase price.

Compass’s Leonard Steinberg, Who Brokered The Charles Street deal, said while it may seem nonsensical for wealthy owners to sell for a loss, in some cases it makes more economic sense than holding on to a property.

“For every sale that happens where you can say, ‘Why did they sell?’ there’s a good reason for it,” he said. “It’s often not the property; it may be circumstance or timing.”

“When you pay an extreme price in an extreme market and you don’t hold on to that property for a long time, you can hit the market when it’s not extreme,” he said.

“You have to be patient. For some people, taking a loss is better than having to pay debt service.”