Trending

$3B in Manhattan condo projects approved for sale in Q3

Still, just one development received approval in September

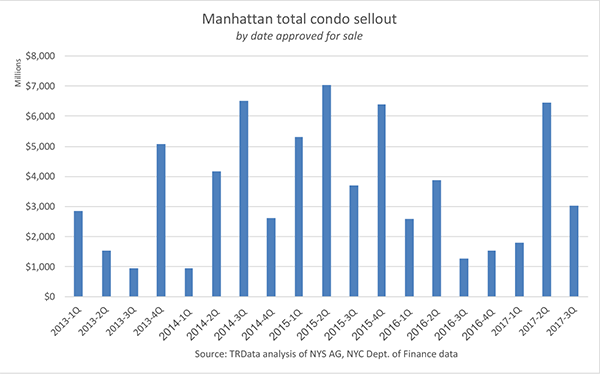

Manhattan condominium developers received the go-ahead to begin marketing 823 condominium units valued at $3 billion in the third quarter, a steep decline over the prior quarter, according to an analysis of new development condo filings by The Real Deal.

The three-month total had risen in each of the past three quarters, as the volume recovered from a steep decline in late 2016.

Yet, the market is in the middle of a slowing appetite for development, as Manhattan developers face high land costs and years of supply in the luxury sector. The New York Attorney General’s office, which regulates condominium filings, approved just one plan for sale in September, and that project’s target sellout is just $20 million. It was the lowest monthly total since April 2013, when there were no condos approved.

In addition, the past five quarters saw $14 billion in new condominium plans approved for sale, a 40 percent decline from the five quarters prior, which saw $25 billion in approved condo projects.

The dollar volume and number of condominium units approved represents the new supply added to the condo market, and, when compared with demand from buyers, can be used to project future pricing.

That volume of new supply is slightly higher than the total volume of condominium units that were closed and recorded in the third quarter. From July to September, buyers collectively paid $2.14 billion for 669 new development condo units, the data shows.

TRD compiled the totals using data from the state Attorney General’s office, the city’s Department of Finance and our own analysis.

The largest project given the greenlight to market during the third quarter was HFZ Capital Group’s Belnord condominium conversion, at 225 West 86th Street, which has a projected sellout price of $1.35 billion. The building has 215 residential units, but just 95 were reportedly vacant and ready for conversion as of April.

The next highest was the Victor Group and Lendlease Development’s 277 Fifth Avenue condominium in Nomad, which has a total sellout of $533 million for its 130 residential units.

Correction: Due to a data error, an earlier version of this story had an incorrect figure for the second and third quarter sellout figures. The number of units at 277 Fifth Avenue was corrected to 130.