Trending

Mo’ money mo’ problems: Macklowe’s accountant says developer’s companies “lose money every year”

Developer's profits at 150 East 72nd were $9M

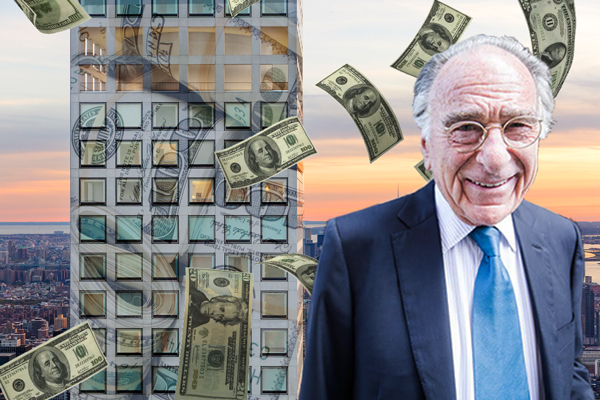

Poor Harry Macklowe.

The divorcing developer may have just sold a $91.1 million condominium at 432 Park Avenue, but he has virtually no income to speak of, according to an accountant hired by his lawyers amid his $2 billion divorce.

“His operating companies lose money every year,” John Gross, a partner at accounting firm BST, testified on Thursday. “So I couldn’t predict that there’s a steady stream of income in 2017 and going forward.”

Experts hired by Harry’s estranged wife, Linda, have argued that the developer is poised to pocket $55 million a year between 2017 and 2021 — a claim that Linda’s lawyers reiterated Thursday.

“[There are] tens of millions of dollars projected to come in,” Linda’s attorney John Teitler said in reference to Harry’s current projects, including 432 Park Avenue, 200 East 59th Street and 1 Wall Street. “Mr. Macklowe is in the game.”

Judge Laura Drager came up with a few other options for a cash-strapped developer. “There are yachts that can be sold! There are apartments that can be sold!” she exclaimed.

The couple’s divorce has laid bare Harry’s holdings, and shined a light on the rarely-disclosed terms of condo development. Gross testified that Harry’s income in recent years mostly stemmed from capital gains. In 2014, Harry pocketed $9 million in profits related to the sale of 128 condos at 150 East 72nd Street. Other years, he had no significant taxable income.

Both Linda and Harry have tried to minimize their assets in an effort to claim a larger piece of the marital pie. Harry has claimed his net worth is negative $400 million as a result of deferred capital gains taxes related to the sale of the GM Building.

The developer testified last month that his proceeds from condo sales at 432 Park dropped $350 million as a result of a 2012 capital infusion. Instead of pocketing $400 million in profits, his share was cut down to $48 million, he said.

In court on Thursday, a valuation expert hired by the developer’s lawyers reiterated that point and testified that Harry was only entitled to 39.41 percent of the promote.

Earlier in the day, lawyers for Linda cross-examined the appraiser hired by Harry to value the couple’s Plaza apartment. Steven Schleider, president of Metropolitan Valuation Services, said the 14,000-square-foot pad is worth $107 million, nearly double the $55 million value assigned by appraiser Jonathan Miller, who was hired by Linda’s team.

“When you came up with your valuation,” Teitler asked, “did you understand it was higher than any price for any apartment in New York City?”

Schleider had a one-word answer: “No.”