Trending

Where Brooklyn at? I-sales in the borough tumble for 2nd straight year

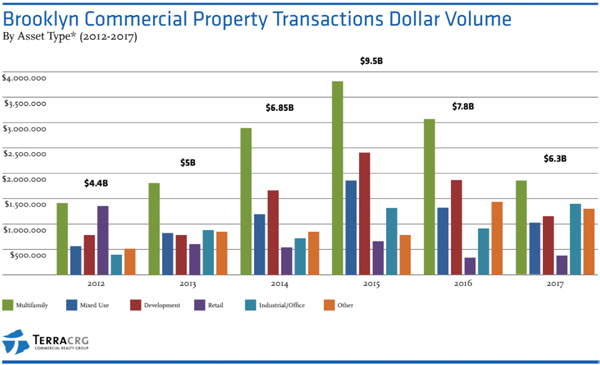

Commercial deals totaled $6.3B in 2017, down from $7.8B in 2016

Investment sales in Brooklyn have dropped for the second year in a row, according to a new report on the borough from TerraCRG.

Overall commercial transactions in Brooklyn were at about $6.3 billion for 2017, down from about $7.8 billion in 2016 and $9.5 billion in 2015, which TerraCRG CEO Ofer Cohen described as the peak of the Brooklyn market. He stressed that 2015 was a very unique year with several institutional transactions and that the investment numbers for 2017 were in line with what Brooklyn has typically seen recently, indicating a healthy and stable market.

“A year like 2015 doesn’t happen often,” he said, “but if you’re really looking at the last six years in Brooklyn or the last five years in Brooklyn, the volume was somewhere between $5 billion to $7 billion.”

The money for 2017 was spread across 1,359 transactions, down about 10 percent from 2016 and 33 percent from 2015. The highest number of these deals — 323 — took place in the Bedford-Stuyvesant, Bushwick and Crown Heights neighborhoods, followed by Central Brooklyn, where 263 deals took place.

TerraCRG divided the transactions into five major categories: industrial/office, retail, residential, mixed-use and multifamily. Dollar volume went up from 2016 in the industrial/office and retail categories by 52 and 23 percent, respectively, and dropped from 2016 in the residential, mixed-use and multifamily categories by 38, 21 and 39 percent, respectively.

Despite the overall drop in dollar volume, the average price per square foot still increased for multifamily, mixed-use and residential developments. TerraCRG partner Adam Hess said this indicated a “natural market correction” when discussing the multifamily category.

“Owners and buyers are in the process of trying to find an equilibrium, where transactions make sense with higher interest rates,” he said.

TerraCRG expects dollar volume to increase in 2018, based partly on signed contracts that they already have going into the year. Cohen said he predicts that a need for large distribution centers would play a role here as well, given how reliant consumers are becoming on deliveries.

“The idea that everything needs to be delivered within two hours to the 2.5 million people that live in Brooklyn or to the people that live in Manhattan means that you need a lot of distribution that’s very accessible,” he said.

However, he said the Watchtower sales from Jehovah’s Witnesses that have so consistently dominated the largest deals in Brooklyn over the past few years would finally start to dry up in 2018.

“Most of it is already sold,” he said, “so that segment of the market is probably not going to be as dominant in 2018, and definitely not in 2019.”