Trending

Paydirt: ‘Twas a massive week for the city’s I-sales market. Here’s what went down

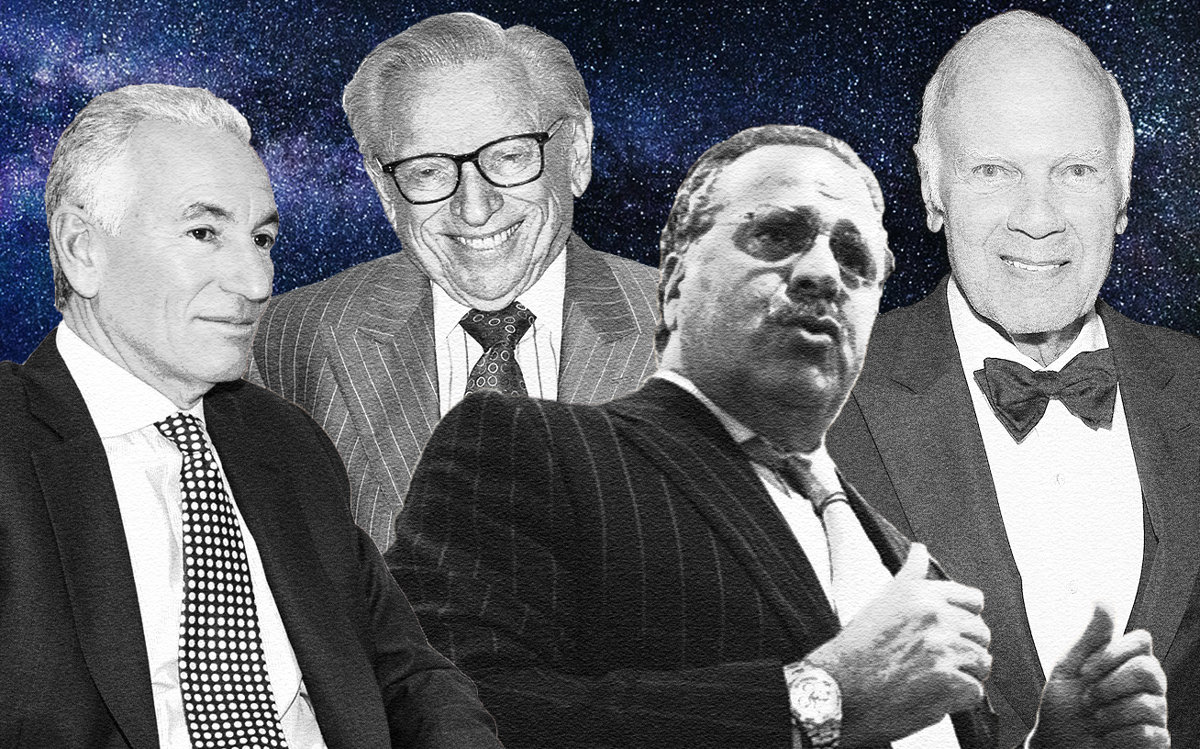

Silverstein, Kushner, Brookfield all make major plays

Passover is when New York real estate normally takes a breather. The elite book their trips to Sardinia and Cannes, the more earthbound set makes its way to Miami. Reporters on the beat can usually count on a slow news week. But not this year.

The past few days have seen a dizzying array of plays; an about-face at the Bronx’s biggest private development, a lucrative exit for a canny partner from Manhattan’s most-scrutinized tower, and a huge new deal that looks to be set off by a Hollywood megamerger. If you’re just flying back into town, here’s what you need to know.

No Mickey Mouse deal for Silverstein: Silverstein Properties is in contract to buy ABC’s Upper West Side headquarters for over $1 billion. This looks to be one of the developer’s biggest acquisitions since its deal for the World Trade Center complex (Larry Silverstein’s firm did put in a $3 billion-plus bid for the GM Building in 2008, but lost out to current owner Boston Properties.)

Disney owns more than 1 million square feet in the neighborhood. There had been speculation the entertainment giant would look to sell the ABC HQ and consolidate its space with that of 21st Century Fox, which it agreed to acquire in December. The Silverstein deal, as first reported by the Commercial Observer, includes 47 and 77 West 66th Street, and potentially some other buildings.

It’s interesting how Larry Silverstein’s fate in the office market seems karmically tied to Rupert Murdoch. In 2015, the developer secured a nonbinding letter of intent from the media mogul’s 21st Century Fox to build its new headquarters at 2 World Trade Center, a deal that would have finally allowed Silverstein to move ahead with the tower. But Murdoch backed out, and the tower is yet to get off the ground.

Exit through the lobby: After coming into 666 Fifth Avenue as a white knight in 2011, Steve Roth picked up the popcorn and waited. He waited as Kushner Companies went through what has got to be the most breathlessly chronicled global search for partners in the history of New York commercial real estate. From time to time, Roth weighed in on the state of play. Asked about the Kushners’ plans to redevelop the tower as a luxury condo and retail destination, he said: “it’s likely those are not feasible.” He projected nonchalance about the financial pressure on the property, making it clear that Vornado wouldn’t be the one feeling the heat (“We look upon it as if it’s a mezz loan warrant,” he said.)

On Friday, Roth said Vornado had a “handshake deal” to sell its stake in the tower back to Kushner Companies for a price that would recoup the real estate investment trust’s investment plus “a mezzanine type return.”

The transaction, assuming the handshake deal holds, would give the Kushners full control over their biggest Manhattan asset. It’ll allow them to move forward with a redevelopment project without any meddling from the powerful Roth. But I’m still curious about what numbers an investor or a lender comes in at – remember that just a year ago, the Kushners were valuing the redevelopment project at fanciful figures, ranging from $7.2 billion to $12 billion.

No go for Joe: Another year, another profitable exit from a major development for Joseph Chetrit. In 2013, the investor and his frequent partner David Bistricer bought the Sony Building for $1.1 billion, drew up plans for an opulent residential conversion of the tower, and then sold the tower as-is to the Olayan Group for about $1.4 billion in 2016.

Now it’s pulled off something similar in the Bronx. Chetrit and partner Keith Rubenstein, who had plans for a seven-building, 1,300-unit rental complex in Mott Haven, have instead sold the site to Brookfield Property Partners for $165 million. Chetrit and Rubenstein initially spent $58 million for the land and broke ground on the first phase last year. They were seeking a construction loan in the range of $500 million, which was set to be a record for a private development in the Bronx.

This site, by the way, is where that party was.

Chaser: If you’re looking for source material for a movie about New York real estate, you could do worse than starting with The Real Deal’s cover story this month. Blood diamonds, secret investors, empty monoliths on Wall Street, Angolan mines, and luxury condos – Konrad Putzier’s tale has it all.

(Paydirt is a weekly column that riffs on the biggest NYC real estate news of the moment, providing analysis and historical context on the deals and players that make this town tick. Read more from Paydirt here.)