Trending

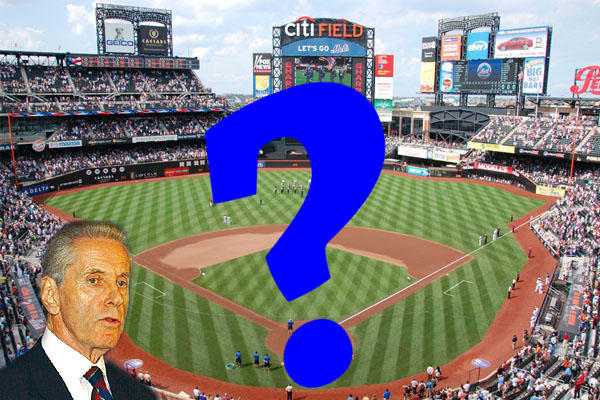

The Mets are selling shares again following grim report on Citi Field revenues

S&P Global predicts little revenue growth for the stadium

The stadium’s prospects are not looking good for this season and beyond, and, by extension, perhaps not for the New York Mets either.

S&P Global predicts the stadium will make very little revenue while operating costs rise, according to Forbes. The report also forecasts costs will increase by 2 percent annually until 2035.

Unaudited documents obtained by Forbes, however, show revenues have been rising since 2015 when The Mets made it to the World Series: Citi Field’s overall revenue in 2016 was more than $167 million, 10 percent more than the year before.

The stadium is operated by a company owned by Fred Wilpon and Saul Katz, who also own the team and founded Sterling Equities.

The S&P report comes as shares for the team are being sold for the first time since 2012, when Wilpon and Katz were in the midst of a lawsuit issued by the representative of Bernie Madoff’s victims. Cash from the 2012 sale was used to pay operating expenses, loans and lower debt, according to Bloomberg. [Forbes] — Erin Hudson