Trending

Disney picks up massive Hudson Square site for $650M

Disney subsidiary would build new campus to replace UWS complex it's selling for $1B

At the same time that it’s selling its longtime Upper West Side headquarters, the Walt Disney Company picked up a massive development site at 4 Hudson Square for $650 million.

Disney acquired the rights to develop the Trinity Church Real Estate-owned site, which offers 1.2 million buildable square feet, for 99 years, the corporation announced Monday. The sale of the Disney subsidiary American Broadcasting Company’s Upper West Side campus for north of $1 billion to Silverstein Properties is expected to close sometime this month, sources told The Real Deal.

In the spring, ABC was considering acquiring 4 Hudson Square among other sites in that neighborhood. The site — which currently consists of five parcels and a large building at 304 Hudson Street — allows ABC to construct one large building. There is 1.2 million square feet of rentable space, but it’s zoned for only 800,000 square feet. On a zoned basis, the price would come out to north of $800 per square foot.

According to Disney, the property will house the corporation’s New York operations, with offices and production spaces for WABC-TV, ABC News, “Live with Kelly and Ryan,” “The View,” and Disney Streaming Services. “Good Morning America” would continue to be broadcast from ABC’s Times Square studio.

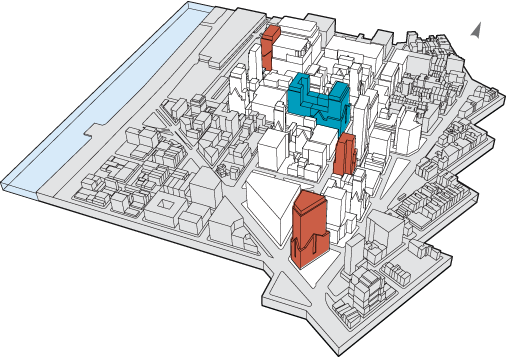

An illustration of 4 Hudson Square (Credit: Trinity NYC)

Sources said the 4 Hudson Square acquisition is structured as an “estate for years,” which refers to a leasehold for any period time that is not automatically renewed. Norges Bank’s stake purchase in Trinity’s $3.6 billion, 11-building portfolio in 2015 was also structured as an “estate for years,” sources said.

Silverstein recently lined up a $900 million loan to acquire the campus, which runs along West 66th Street. Demolition would not occur for as long as five years, as the broadcaster is expected to lease the space back until a new headquarters is ready.

Disney meanwhile is in the middle of the monster acquisition of 20th Century Fox.

Eastdil Secured is representing ABC in the Upper West Side sale and the 4 Hudson Square acquisition. CBRE is advising Trinity in the latter deal. Eastdil declined to comment, and CBRE and Trinity could not be immediately reached.