Trending

The 10 biggest Queens deals in Q2 2018

The Factory Building topped the list at a $400M price tag

A massive office sale in Long Island City took the top spot in Queens during the second quarter of the year.

Square Mile Capital sold off its stake in the neighborhood’s Factory Building at 47-07 30th Place to Atlas Capital Group and Partners Group for $400 million, the largest deal of the quarter by a margin of almost $140 million, according to data from Real Capital Analytics. Other notable deals included Treetop Development’s sale of a multifamily portfolio in Queens to A&E Real Estate and American Realty Advisors’ $262.5 million purchase of a FedEx warehouse site in Maspeth.

Four of the top 10 largest deals were residential sales, while the remaining six were split between two development sites, two general sites, one office site and one industrial site.

The deals were worth about $1 billion overall, much higher than the first quarter’s total of about $358.4 million and the fourth quarter of 2017’s total of about $540.4 million.

The full list of Queens’ top 10 deals for the first quarter is below:

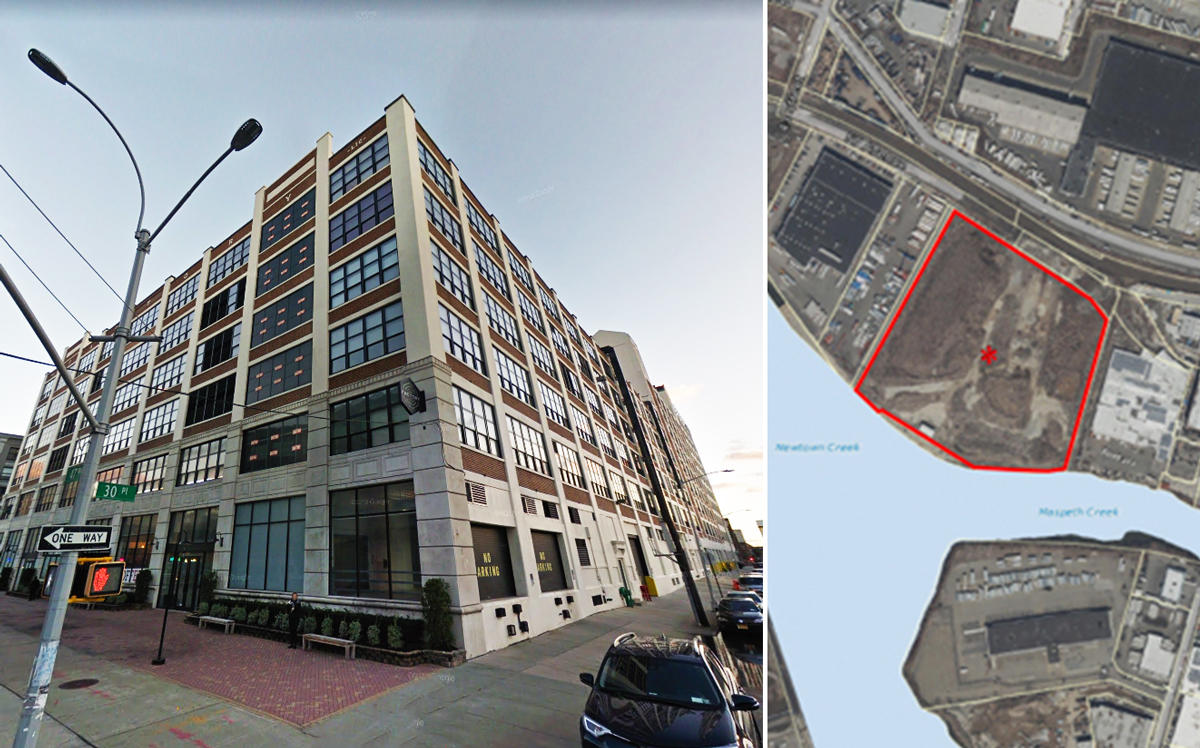

1. 47-07 30th Place, $400 million

Buyer: Partners Group, Atlas Capital Group

Seller: Square Mile Capital

The largest deal in Queens last quarter was Square Mile Capital selling its stake in Long Island City’s Factory Building for $400 million. Square Mile and Atlas used to own a combined 51 percent stake in the building, which spans about 1 million square feet. Atlas kept its interest and bought out Square Mile by partnering with Partners Group, an asset manager. Inveso Real Estate owns the remaining 49 percent of the office and retail building. Tenants include Polo Ralph Lauren and Macy’s.

2. 46-06 57th Avenue, $262.5 million

Buyer: American Realty Advisors

Seller: SunCap, Zirinsky Family

American Realty Advisors closed on this roughly 350,000-square-foot site FedEx warehouse site in May. The industrial real estate owner Prologis was initially planning to buy the site for $265 million, but its bid fell through due to a decline in the company’s share price, after which American Realty Advisors stepped in.

3. 11-12 30th Drive, $83.3 million

Buyer: Cape Advisors, Wainbridge

Seller: Criterion Group LLC

Shibber Khan’s Criterion Group sold its development site in Astoria to Cape Advisors and Wainbridge in April. Criterion had purchased the waterfront site in 2014 for $57 million and was looking for financing to build a project on the site with 711 units. The company is now facing a lawsuit from Greystone EB-5 and the Bassuk Organization, who claim Criterion backed out on almost $230 million of construction financing for the project.

4. 94-26 56th Avenue, approximately $56.5 million

Buyer: Zara Realty

Seller: Treetop Development

Treetop Development sold this apartment complex in Elmhurst to Zara Realty in April. The property contains 164 rental units and three commercial units, and Treetop had bought it in 2016 for $40.7 million. Zara plans to make several renovations to the property, including new facades, doors and a new roof.

5. 132-25 Maple Avenue, approximately $51.1 million

Buyer: A&E Real Estate

Seller: Treetop Development

Treetop Development sold a six-building multifamily portfolio of Queens buildings to A&E Real Estate. The portfolio totals 428 apartments and about 375,000 square feet overall, and the priciest part of the deal was for 132-25 Maple Avenue in Flushing, which stands six stories tall with 180 units across two buildings. A&E plans to hold onto the properties for 20 or 30 years.

6. 132-57 and 132-61 Sanford Avenue, approximately $40.4 million

Buyer: A&E Real Estate

Seller: Treetop Development

This Flushing property, also part of the Treetop portfolio, stands six stories tall with 126 units. It is known as Sanford Terrace.

7. 41-40 Denman Street, approximately $36 million

Buyer: A&E Real Estate

Seller: Treetop Development

The final building in the Treetop portfolio to crack the top 10 was at 41-40 Denman Street in Elmhurst, known as Denman Gardens. The building stands six stories tall with 122 units.

8. 37-11 30th Street, approximately $33.3 million

Buyer: Slate Property Group, Avenue Realty Capital

Seller: The Estate of Robert W See, See Factor Industry Inc

Slate closed on this development site in Long Island City in April. The company is planning a seven-story rental project with about 200 units at the site and purchased it as part of an estate sale for Bob See, who died in 2015. The site spans 30,000 square feet but has 200,000 buildable square feet.

9. 144-27 Sanford Avenue, $27 million

Buyer: Xin Xiang Lin

Seller: Property Reserve

Flushing investor Xin Xiang Lin bought this two-story Flushing building in May. The building was owned by the Mormon church and has about 84,000 buildable square feet.

10. 82-14 161st Street, $21 million

Buyer: Barone Management

Seller: Sisters of the Order of St. Dominic

The $21 million sale of this Jamaica site in June rounded out the second quarter’s top 10 list. The property spans about 59,000 square feet, and Barone Management is planning to build a charter elementary school and two new residential buildings on the site, which has more than 295,000 buildable square feet.