Trending

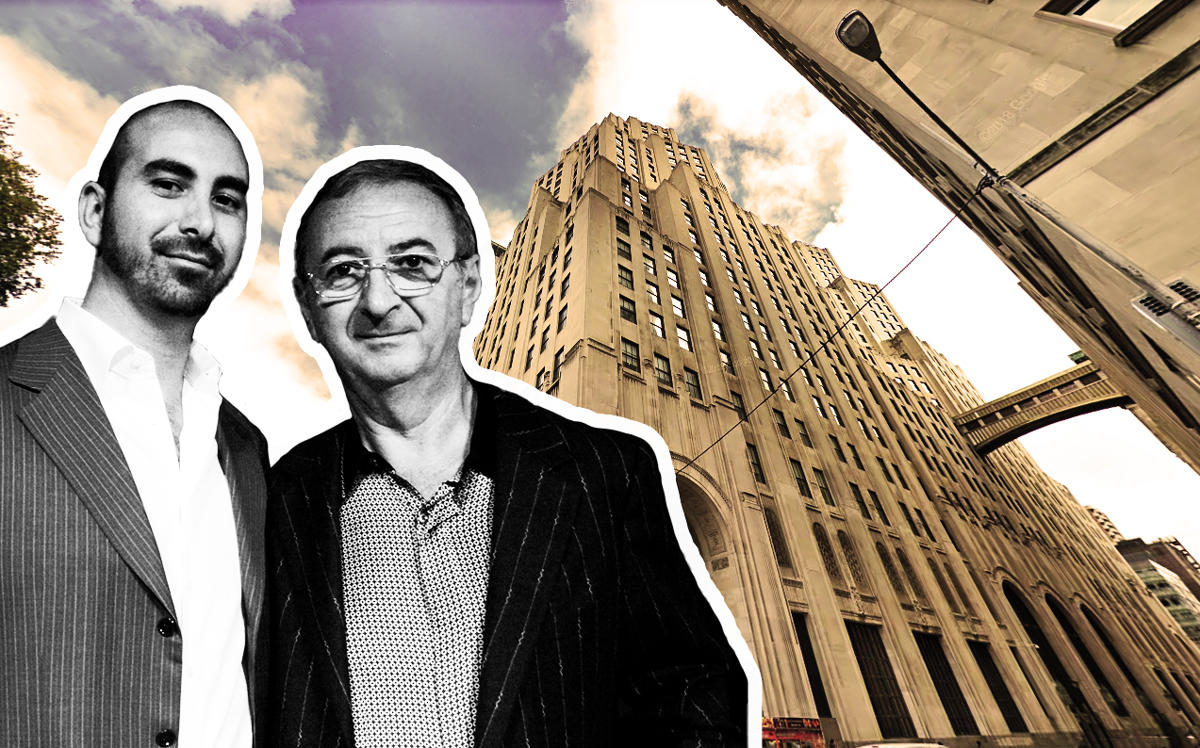

Tamir Sapir failed to report $194M from partial sale of 11 Madison: IRS

Son Alex is appealing appeals on fines, additional payments

UPDATED: Thursday, Sep. 13, 12:30 p.m.: If you could make $194 million disappear from your taxes, that’d be pretty cool right?

That’s what the Internal Revenue Service alleges now deceased Trump Soho co-developer Tamir Sapir (or his accountant) thought he could do, tax appeal proceedings filed in United States Tax Court in Washington, D.C. shows.

In 2017, the IRS fined Sapir’s estate, now controlled by his son Alex, more than $600,000 for filing a false return for tax year 2010 and ordered Sapir to pay his fair share—which apparently only amounts to an alternative minimum tax of $1.4 million, a flat rate the IRS imposes on tax filers that report a loss.

Alex Sapir has appealed the IRS decision. Sapir did not respond to a request for comment and his tax attorneys at Nixon Peabody declined to comment. Tamir Sapir died in 2014 after a lengthy illness.

The tax dispute regards capital gains from the Sapir Organization’s 2010 sale of a 49 percent stake in 11 Madison to CIM Group. On his initial return, Tamir Sapir deducted a claimed $450 million in personal liability for a loan on the property, which combined with the rest of his tax return, left him a reported total loss for that year of more than $253 million. The IRS, however, ruled that Tamir Sapir improperly claimed liability for a non-recourse real estate mortgage, a type of loan in which the bank — not the borrower — assumes the economic risk. As such, the IRS decided Sapir failed to report $194.2 million in income from the $469 million sale to CIM.

“Did Mr. Sapir’s accountants or attorneys not remember their basic tax course?” asked Bridget Crawford, a tax law professor at Pace University, who reviewed the documents at the request of The Real Deal. “The IRS took them to school when it included on Form 886-A, the Explanation of Adjustment, that neither certain contractual provisions nor the business partnership agreement itself ‘can convert a debt what is ultimately nonrecourse debt into a recourse debt.’”

Sapir was also fined $325,243 for filing late and $278,062 for submitting what the IRS deemed inaccurate documents. His individual tax return was due on October 2011, but was filed in April 2014. Alex Sapir, the executor of his father’s estate, disputed the late fees under the grounds that it was not due to “willful neglect.” He claimed he was merely following the instruction of his accountant.

Sapir’s attorneys argued that the company’s partnership agreement had been modified such that Sapir himself would be personally liable for the majority of the building’s $806 million in outstanding debt, but the IRS maintained that such paper-pushing does not actually affect the nature of the non-recourse loan, as Crawford noted. It’s possible that the loan terms were also renegotiated with the lender Column Financial, but Sapir’s attorneys do not make such a claim.

The Sapir family was known to be dealing with significant debts around the time of the 11 Madison sale. In 2009, Alex Sapir claimed in a Las Vegas lawsuit that his family real estate business was more than $250 million in the red with only $4,000 in cash, according to a 2010 Forbes report.

The Sapir Organization and CIM cashed out of the property in 2015, selling to SL Green Realty in a $2.3 billion deal. The purchase price stands as the third-highest for a New York City commercial building, just behind the $2.8 billion for the GM Building and Google’s recent $2.4 billion purchase of the Chelsea Market building. Both the 2010 stake sale to CIM and the 2015 sale provided Sapir with a hefty return on his $675 million initial investment on the property.

Sapir has since set out on his own, founding ASRR Capital – now known as Sapir Corp. – a publicly-traded Israeli investment firm that is very active in South Florida.

Clarification: This story was updated to clarify that Sapir has taken this matter to United States Tax Court where a final decision is pending .