Trending

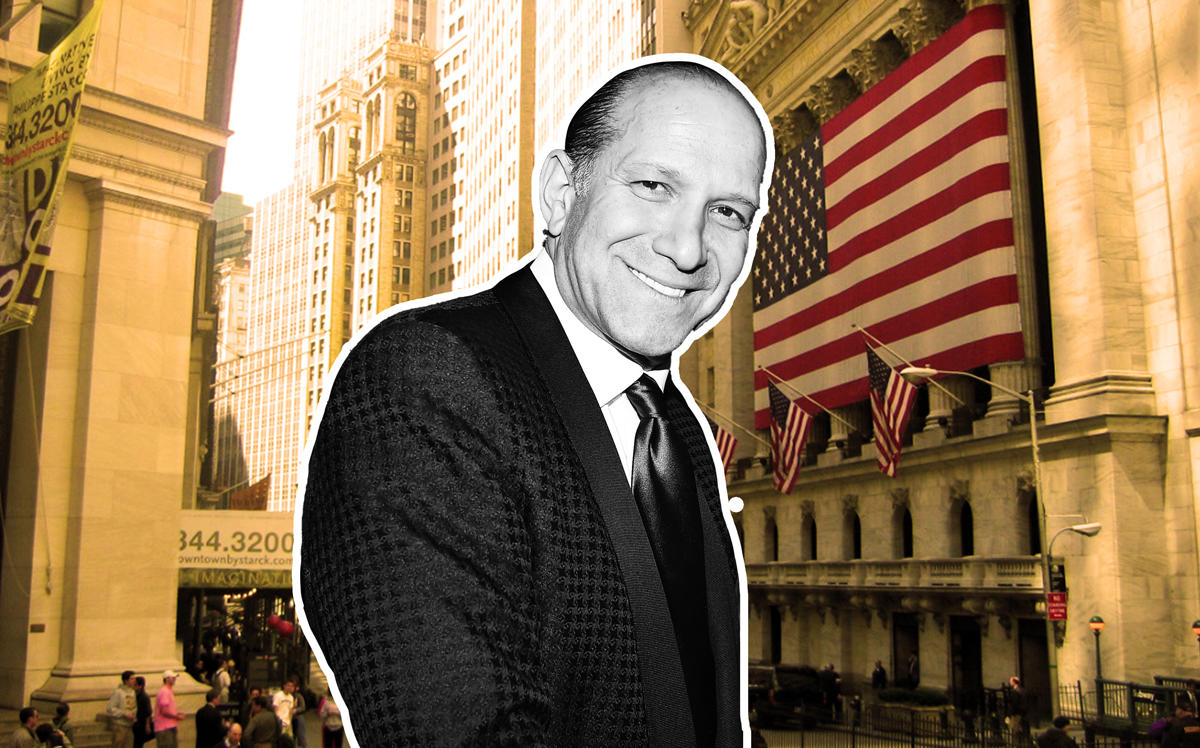

Here’s how Howard Lutnick is growing Cantor’s real estate biz

The Cantor Fitzgerald head is teaming up with a former Deutsche Bank exec

Howard Lutnick isn’t done yet.

The head of Cantor Fitzgerald LP has managed to stage an improbable comeback on Wall Street, according to Bloomberg News. Lutnick lost two of every three people who worked for him on 9/11, including his brother (though he was later criticized for cutting checks off of deceased employees). But since then, he has become a billionaire and is now spending hundreds of millions of dollars to move into new businesses.

Lutnick has partnered with Anshu Jain, the former co-CEO of Deutsche Bank, to court sovereign wealth funds to back Cantor’s move into investment banking and prime brokerage. He is now the sole stockholder of Cantor Fitzgerald Group Management and has a roughly 60 percent economic stake in the company, giving him a net worth of at least $1.5 billion.

He hopes to expand more into real estate by competing with Wells Fargo to finance multifamily homes, and he and Jain are trying to get talent from rivals with pay packages of more than $10 million.

It’s not his first try at expanding his empire’s real estate presence. In 2012, Lutnick’s BGC Partners announced it would be rolling out a real estate derivative platform.

Lutnick has been at Cantor for his entire adult life, joining after graduating from Haverford College in 1983 and becoming president and CEO in 1991. He said his rise started in 1986, when he convinced Bernie Cantor to invest in Burlington Resources before it spun off from Burlington Northern Railroad. Bernie Cantor and the company earned $150 million from the decision.

“That’s how you become president when you’re 29,” he told Bloomberg. “You make the boss so much money that he decides he really likes you.” [Bloomberg] – Eddie Small