Trending

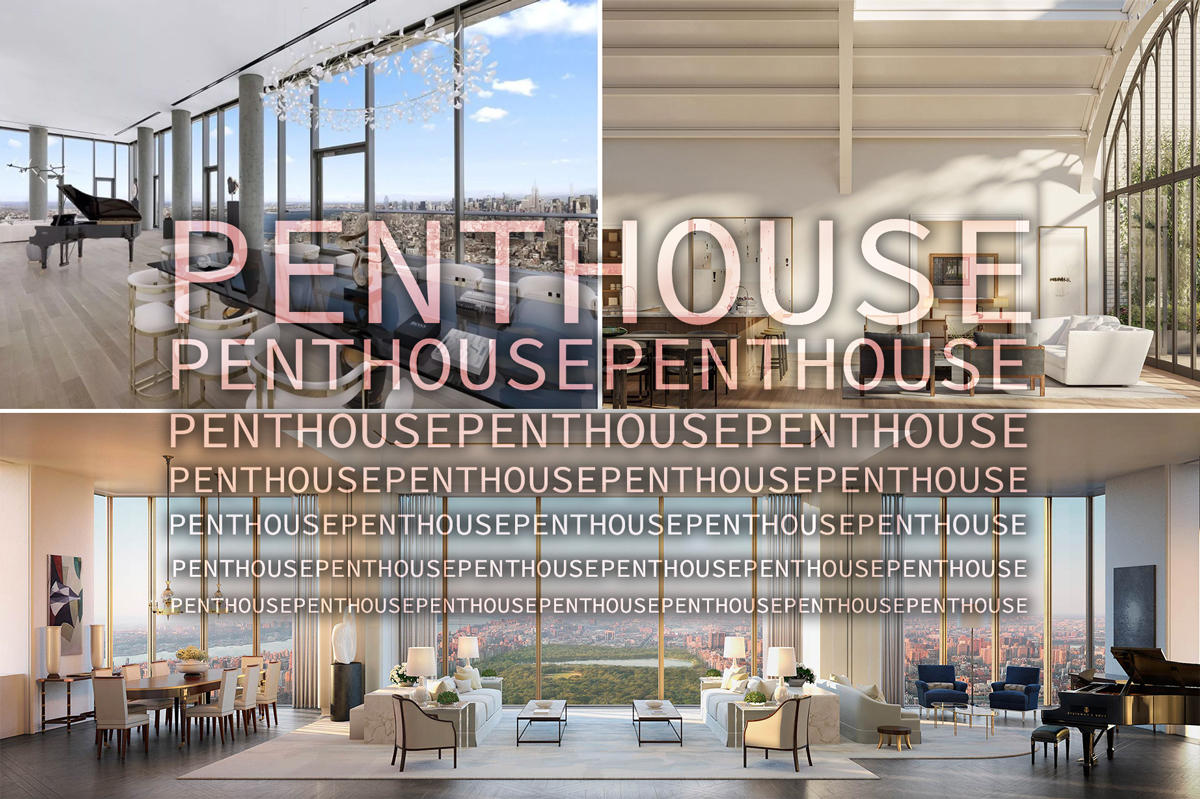

The penthouse pileup: Inventory swells thanks to the new dev glut

The number of PH units are up 16 percent year over year

Penthouse listings — despite their catchet — aren’t immune to the new development glut.

A flurry of post-Labor Day listings has brought the total number of penthouses on the market to 443. That’s a 19 percent uptick in the number of listings between September and March and a 16 percent year-over-year increase, according to data compiled by StreetEasy. Luxury inventory generally increases in the fall, as many units are taken off the market during the summer lull. Still, it’s a significant jump from last year, when the number of listings between March and September grew by 6 percent.

The lethargy is in part a symptom of the broader slowdown on the high end — 81 of the 443 penthouse units currently on the market are asking more than $15 million. But it’s also a result of changing definitions of luxury and the simple fact that buyers have more to choose from, brokers told The Real Deal.

“Historically, penthouses have been the trophy property,” said Reba Miller, a broker at Berkshire Hathaway HomeServices. “Today, the trophy is many things. Not everyone needs a penthouse to feel like they got the trophy.”

Some properties are newly on the market. When 111 West 57th Street finally launched sales in September, listings included a duplex penthouse asking $56 million. At 555 West End Avenue, the Solarium Penthouse is asking $18 million.

The new batch is adding to those that have been lingering — and are now asking lower prices. At 56 Leonard Street, for example, one property is listed for $49.5 million, down from $61 million at the end of last year and $53.3 million in March. Another started at $35 million last year and is now asking $26 million.

In September, 15 percent of all penthouses listed in Manhattan saw price cuts — up from about 11 percent in March. At the $15 million and higher price point, however, only about 5 percent of listings in September saw a decrease, according to data compiled by StreetEasy.

In some ways, the trajectory of the penthouse market has been an amplified version of of the broader luxury sector. In the third quarter, the number of closed luxury sales — the top 10 percent of the market — dipped 11 percent from a year earlier, according to Douglas Elliman. At the same time, active listing inventory rose 27 percent.

“We’ve seen a surge in new inventory on the market at all price points, but on the ultra-luxury end, this latest wave of homes is compounding a surplus that’s been growing since 2015,” said Nancy Wu, an economic data analyst at StreetEasy.

Jason Haber, a broker at Warburg Realty, said that, with one of his buyers, “every apartment we go see seems to be a penthouse” — because there are so many currently available. And even with properties listed near $20 million, he said, listing agents are aggressively soliciting offers, willing to hear out buyers who come in below the asking price.

“Any offer will be responded to,” he said. “You didn’t get that a year and a half ago.”

Some notable deals, however, have bucked the trend. The five-story penthouse atop the Crown Building went into contract for a massive $180 million this year. Plus, over the summer, another sold for $30 million at 152 Elizabeth Street, which is the first New York City project for Pritzker-prize winning architect Tadao Ando.

Not everyone needs a penthouse to feel like they got the trophy.

Another more granular aspect of the swell in inventory is the increasingly varying definitions of what a penthouse unit actually is, said Compass’ Leonard Steinberg. Some buildings have one top-floor unit classified that way while others have several.

“What is a penthouse these days?” he said. “There’s a lot of muddiness in the market as to how things are classified.”

But overall, the price cuts, re-listings and stale listings are shaping a new marketplace for luxury properties. In the shifting landscape, with new and abundant choices, buyers don’t have the same expectations.

Penthouse listings are competing with other comparable penthouses — but now also with other high-end properties, Miller said. A penthouse in a building built several years ago may not appeal in the same way as a new development project with a different design or updated set of amenities. In an older building, prospective buyers may immediately object to the lobby.

“You can go to many buildings, buy on a lower floor, and feel like you bought the penthouse,” she said.

Not to mention, Steinberg said, penthouse buyers move more slowly in any market — much less one that’s in the midst of a slowdown.

“When you have more opportunity, there’s less urgency,” he said. “A penthouse buyer is usually not a desperate buyer for a home.”