Trending

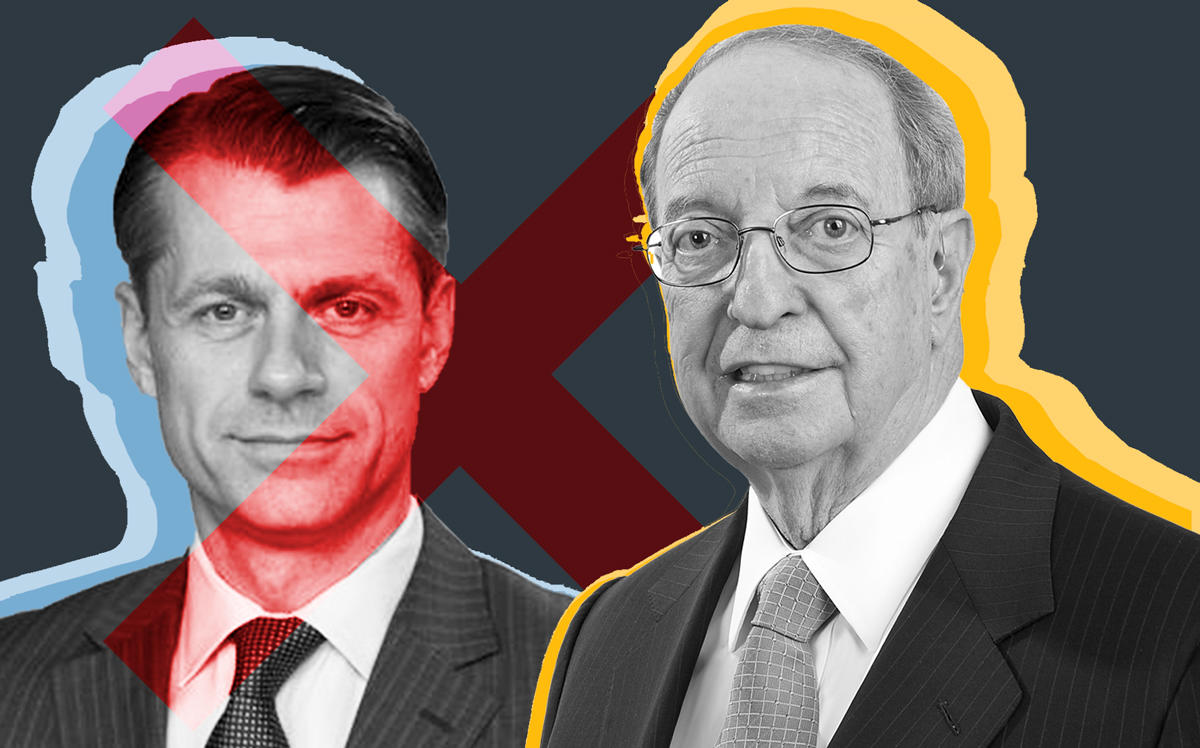

Forest City’s former CEO Albert Ratner opposes the Brookfield deal

It’s the wrong price and wrong timing, he said

Forest City Realty Trust’s former CEO plans to vote against the Brookfield Asset Management acquisition, claiming the stock was undervalued and the acquisition process shoddy.

In an open letter, Albert Ratner, who controls nearly 1 percent of Forest City’s stock, argued the $6.8 billion deal has the wrong price and wrong timing, the Wall Street Journal reported. Ratner argued it “resulted from a flawed process” and Forest City could have a higher value by waiting 26 months to sell.

The opposition comes ahead of the Nov. 15 vote. The board has narrowly endorsed it in a 7-to-5 vote.

Brookfield agreed in July to buy Forest City for $25.35 a share, or $11.4 billion including Forest City’s debt. That was a 26.6 percent premium to Forest City’s stock price, the report said.

The deal was part of a series of changes for Forest City this year. In January, MaryAnne Gilmartin stepped down as CEO of Forest City New York to form her own development company, L&L MAG. Around the same time, Forest City announced that it was selling nearly all of its remaining stake in Pacific Park, bringing Greenland USA’s interest in the megadevelopment up to 95 percent.

Forest City’s portfolio includes properties like the New York Times headquarters. The company is concentrated in urban markets including Boston, San Francisco and Dallas. Brookfield has expertise in repositioning office buildings, as it did in Manhattan West as well as its plan at 666 Fifth Avenue. [WSJ] — Meenal Vamburkar