Trending

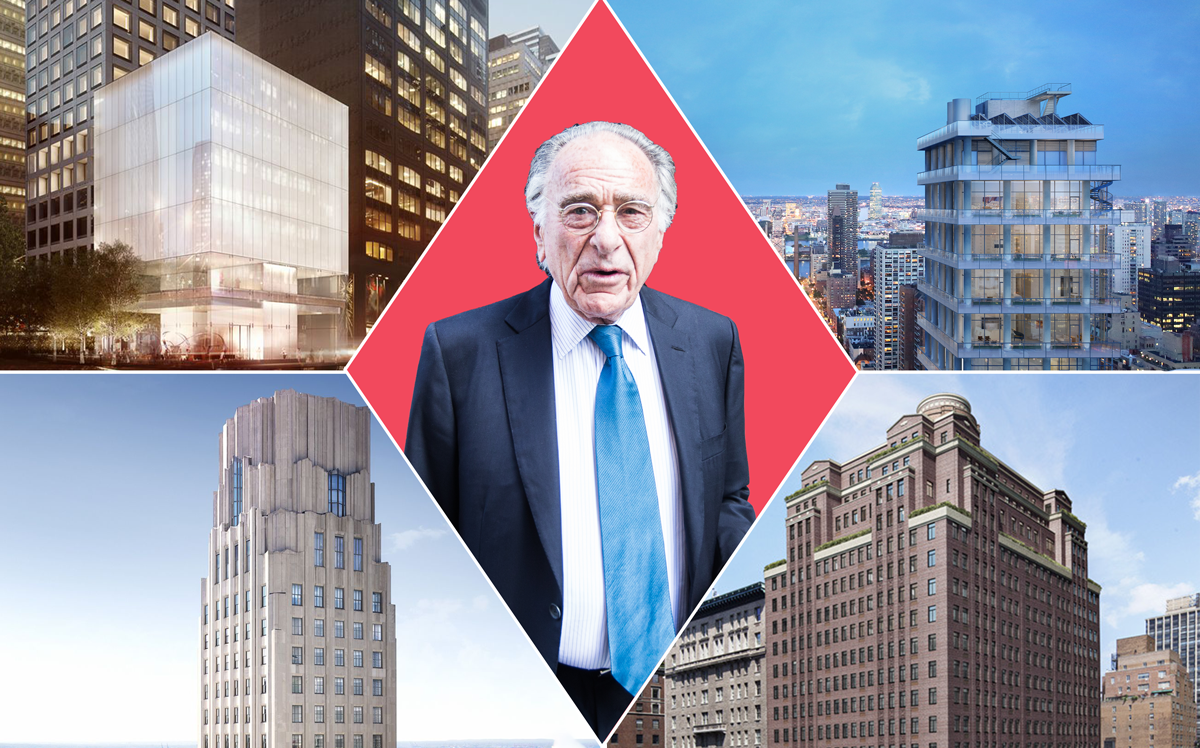

Divorce, Macklowe style: How an $82M stake in NYC properties will be halved

For all his work at 432 Park, Harry will only keep $1.25M on the promote -- not enough to afford a single apartment at the tower

Harry and Linda Macklowe’s 57-year marriage — and their bitter 14-week divorce trial — can be boiled down to this: one of New York’s most storied developers may keep a property empire in which his stake has been valued at $82 million, but he must pay his ex-wife $41 million for the privilege.

In a 64-page decision on Thursday, Judge Laura Drager closed the book on one of real estate’s ugliest divorces, which shone a light on little-known aspects of real estate development. And in seeking to split their marital assets, the judge displayed how much Harry’s stake is worth in exacting detail.

Of 10 properties listed, his most valuable position was an $18.9 million stake in 210 East 53rd Street, according to the decision, followed by his $15.7 million equity stake in the retail and commercial portion of 432 Park Avenue. The developer also has a $12.9 million equity stake in 1 Wall Street, his office-to-residential conversion (a project that’s backed by former prime minister of Qatar Sheikh Hamad Bin Jassim Bin Jaber al-Thani), and a $6.9 million equity stake in 200 East 59th Street, a forthcoming condo project.

But to retain those properties, Harry must pay Linda for her share of Macklowe Properties’ investment in the projects: $9.45 million for her portion of the 53rd Street development; $7.85 million for her position in 432 Park’s retail and commercial component, and $6.45 million for her stake in 1 Wall Street.

The decision calculated the Macklowes’ debt at $66.9 million, mostly tied to the developer’s business. But because they used debt to support their lavish lifestyle, Drager ordered Linda to contribute 30 percent — or $20 million — to shoulder that burden. Harry’s share is $46.8 million.

From a dollar perspective, the couple’s contemporary art collection — valued around $700 million — is their biggest asset, and one that Linda cultivated for years as Harry toiled in real estate. Judge Drager ordered the couple to sell the art and split the proceeds.

“It must kill her,” one source said. Neither party’s attorneys responded to a request for comment by press time.

Dilution of Macklowe’s promote

Just as the trial pulled back the curtain on Macklowe’s holdings, the 64-page decision reveals the inner-workings of how developers are paid.

At 1 Wall Street, which has a projected sellout of $1.6 billion, Harry’s promote — or share of the profits — was determined to be $7.4 million, according to court documents. (Of that, he’ll owe Linda $1.5 million.) At 200 East 59th Street, which has a projected sellout of $332.7 million, Harry stands to collect $4.8 million, of which Linda gets $1.7 million.

But Harry’s share of the profits at 432 Park Avenue — which he once called the pinnacle of his career — reflect the harsh reality of what happens when developers’ stakes are diluted.

Although the supertall condo has a projected sellout of $3.1 billion — a penthouse there sold for north of $90 million in 2017— Harry’s share of the profits is just $2.5 million, according to the judge’s decision. Of that, he’ll owe Linda $1.25 million, the court said.

The promote would have been higher but for a series of events in 2011, a year after Harry sold his interest in the project to CIM Group. CIM, in turn, hired Citibank to bring in additional investors in order to complete the condo tower, and Harry’s interest shrank as CIM’s own stake dropped to 39.4 percent. “The court recognizes that risks are inherent in the promotes,” the judge wrote. “The value of [Harry’s] interest in the 432 Park Residential Promote was diluted because of the need for additional investors.”

The GM sale

In divvying up the Macklowes’ holdings, the court also weighed in the developer’s sale of the GM Building for $2.9 billion in 2008. Two years prior, Macklowe put the building up as collateral in his obsessive quest to buy a seven-building portfolio from Equity Office Properties by way of the Blackstone Group. Macklowe would rush through the deal without finishing due diligence, borrowing $5.8 billion from Deutsche Bank over a one-year term before landing a $1.2 billion hard-money loan from Fortress Investment Group.

In court, Linda argued that Harry should assume more of their marital debt since he personally guaranteed the deal, even after promising he would not.

But Drager wrote in her decision that the acquisition of the so-called EOP portfolio was a “reasonable business decision” that would have “greatly enhanced” the Macklowes’ assets if it weren’t for the recession. “The nature of the Husband’s business necessarily entailed risks,” she wrote. “The court will not second guess a party’s reasonable business decisions made during the marriage.”

Throughout the trial, the judge did little to conceal her disdain for the lifestyle enjoyed by the sparring millionaires sitting in her courtroom.

In her final decision, she fired off a parting shot, noting that Linda chose to stay married to Harry for nine years after the so-called “EOP Debacle” notwithstanding her anger over the botched investment.

Even after losing the crown jewel of Macklowe Properties’ portfolio, she wrote, “The parties’ lifestyle was unaffected, even though the country fell into a recession. They purchased at least 25 pieces of art from 2008 until this action began. They built a yacht valued at $32.5 million.”

| Property | Value | Linda's share | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 150 East 72nd Street | $140,000 | $70,000 | |||||||||||||||||||||

| 1143 First Avenue | $3,920,000 | $1,960,000 | |||||||||||||||||||||

| 737 Park Avenue | $12,750,000 | $6,375,000 | |||||||||||||||||||||

| Roofcom Associates | $4,000,000 | $2,000,000 | |||||||||||||||||||||

| Shark | $4,600,000 | $2,300,000 | |||||||||||||||||||||

| 432 Park Avenue Retail Commercial and Garage - Equity | $15,700,000 | $7,850,000 | |||||||||||||||||||||

| 210 East 53rd Street Retail and Garage | $18,900,000 | $9,450,000 | |||||||||||||||||||||

| 200 East 59th Street - Equity | $6,900,000 | $3,450,000 | |||||||||||||||||||||

| 1 Wall Street - Equity | $12,900,000 | $6,450,000 | |||||||||||||||||||||

| Macklowe Operating Companies | $2,750,000 | $1,375,000 | |||||||||||||||||||||

| Total | $82,560,000 | $41,280,000 |