Trending

Concessions may finally be peaking in Brooklyn rental market: Elliman

Queens' rental market, meanwhile, is still dominated by incentives

Renters in Brooklyn should grab concessions while they’re still available.

The market share of rental incentives being given by landlords in Brooklyn declined this month for the first time in almost three years, according to a new report from Douglas Elliman.

The share of new Brooklyn rental transactions with incentives fell to 47 percent from 47.5 percent at the same time last year. The change is largely due to the fact that landlords are seeing an increasing demand for rentals, since there is a slowdown in the sales market, according to Jonathan Miller, author of the report and CEO of appraisal firm Miller Samuel.

Miller predicted that “concessions may continue to drift lower” if the for-sale market keeps cooling.

“A growing number of would-be buyers are camping out in the rental market,” Miller said, “It’s almost entirely because of the slowdown in the purchase market.”

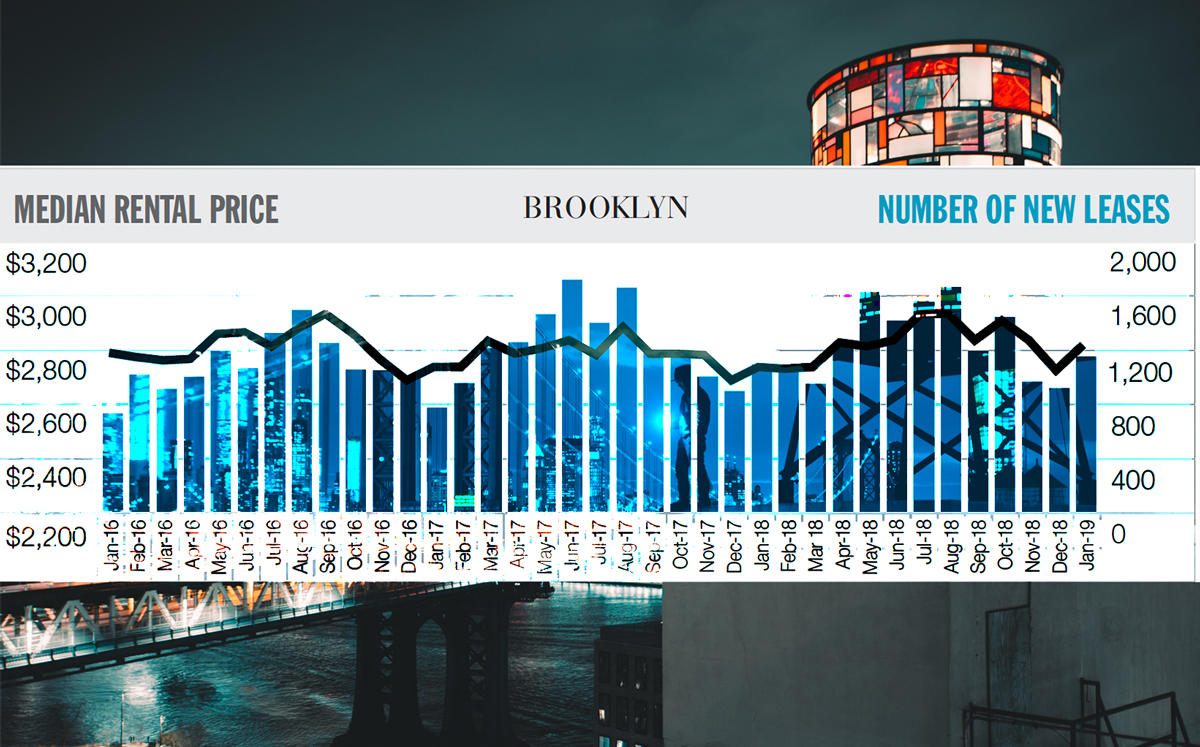

While the market share of concessions in Brooklyn slipped, the average price of net effective rent increased 2.7 percent to $2,832, up from $2,628 at the same time last year.

In the luxury segment, median rental price reached $5,459, a 0.5 percent increase from $5,434. New development rose at a higher rate, with a 5 percent year-over-year increase in average median rental price to $3,260 from $3,103.

The number of new leases being signed overall increased 25.7 percent, with 1,150 signed in the last year.

(Credit: Miller Samuel)

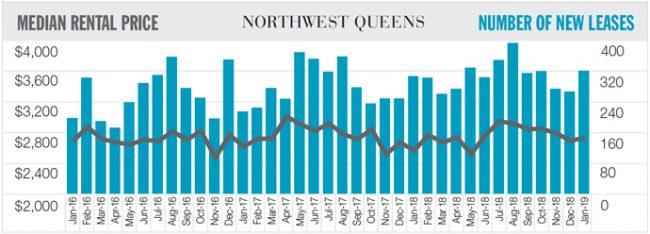

In Northwest Queens, a steady influx of new development — which represents a third of the market — skewed prices high, according to Miller.

Net effective median rent price is $2,694, up 7.5 percent from last year’s $2,507.

Concessions remain the name of the game in Queens, where the rate of incentives stayed flat. Of all new rental leases signed in northwest Queens, 58 percent saw concessions, the same as last year. But the trend was stronger in new development, with concessions in 74.5 percent of new rental leases.

“It’s still unusually high given the high share of new development,” Miller said.

More leases were signed last month in northwest Queens, up 4.6 percent to 319 from 305 at the same time last year.