Trending

National Cheat Sheet: Michael Cohen testifies about Trump’s real estate, Toll Brothers sees Great Recession-era numbers… & more

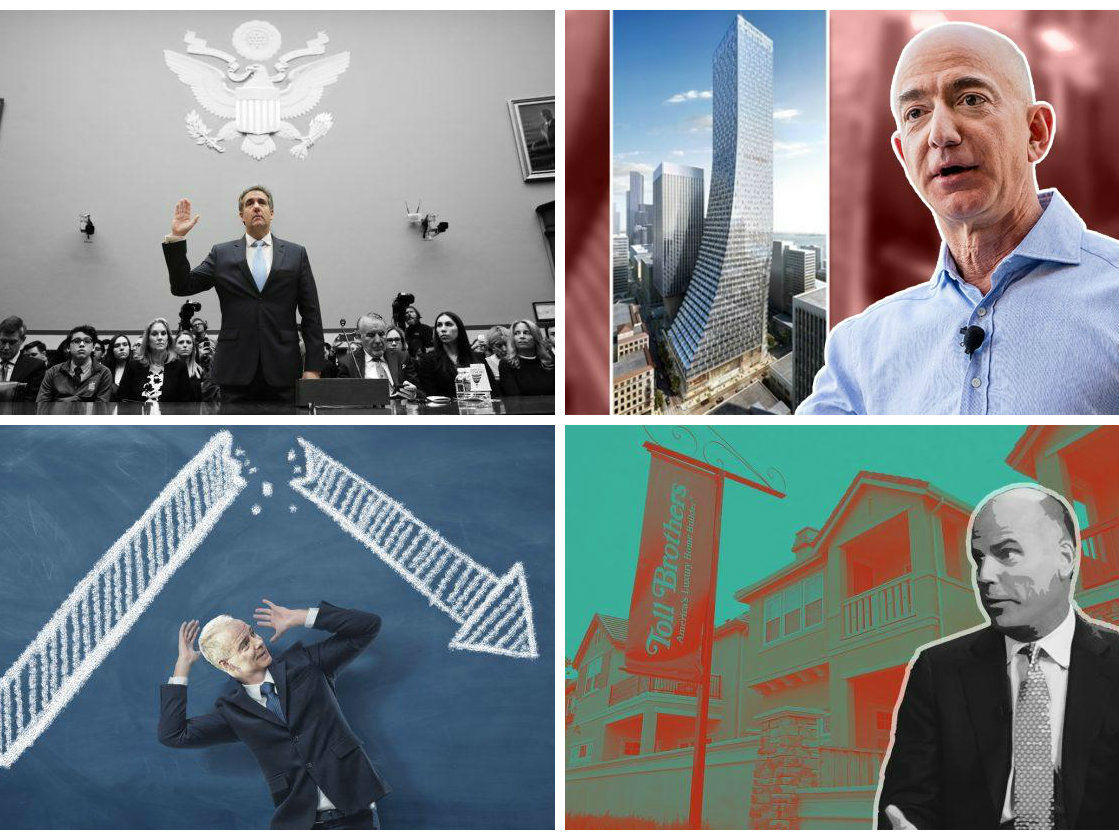

Cohen testimony touches on Trump buildings, ‘Executive-2’

President Donald Trump inflated the values of his real estate holdings in New York so he could get a loan from Deutsche Bank, his former personal lawyer Michael Cohen testified on Feb. 27 in a congressional hearing, using the Trump Organization’s 40 Wall Street in downtown Manhattan as an example. “Find an asset that is comparable, find the highest price per square foot that’s achieved in the area and apply it to that building,” Cohen explained. Cohen, who was sentenced to three years in prison in December after pleading guilty to multiple charges, also spoke about other real estate projects — including a planned Trump Tower Moscow project that is part of special counsel Robert Mueller III’s investigation — and named Donald Trump Jr. as “Executive-2,” an unidentified individual who appears in documents filed by federal prosecutors. [TRD]

Toll Brothers has its worst quarter for contracts in nearly a decade

One of the nation’s largest luxury homebuilders saw new home orders fall 24 percent in its first fiscal quarter of the year. Toll Brothers cited the disappearance of buyers in California and a tepid market in New York as contributing to its worst quarter for contracts since 2010. Net signed contract value, meanwhile, fell by 31 percent, to $1.16 billion. Toll Brothers CEO Douglas Yearley Jr. blamed the “lack of current inventory in certain locations and the industry-wide slowdown that began in the second half of 2018” for the less-than-stellar numbers. The company, whose co-founder Robert Toll stepped down as executive chairman late last year, did get some good news. “Although we experienced a year-over year decline in contracts each month of this first quarter, the decline decreased as the quarter progressed,” Yearley noted. [TRD]

Realogy has worst-ever stock closing price after dismal earnings report

Real estate conglomerate Realogy Holdings released a grim earnings report on Feb. 26 — and the company’s stock plunged as a result. Profits in 2018 dropped by 68 percent, to $137 million, and Realogy lost $22 million in the fourth quarter of 2o18. The company, whose NRT unit controls prominent residential brokerage brands like Citi Habitats, Coldwell Banker, the Corcoran Group and Sotheby’s International Realty, also had $35 million less in revenue last year than it did in 2017. “Most of the challenge in the 2018 market showed up in the last half of the year,” explained CEO Ryan Schneider, citing a soft housing market. Realogy’s stock stood at $14.14 per share as of closing time on Feb. 26 — a 42 percent decline from the same time a year ago. [TRD]

Elliman’s profits plunge amid residential market slowdown

Douglas Elliman pocketed just $5.2 million in 2018 profits — a quarter of its net income — parent company Vector Group said in an earnings report on Feb. 28. The New York-based brokerage, led by chairman Howard Lorber, noted that total revenue was up 4.4 percent year-over-year, to $754.1 million. But Elliman also lost $2.6 million in the final quarter of last year, compared to a net income gain of $900,000 in 2017’s fourth quarter, and Lorber said the firm would review its expenses. The Real Deal recently named Elliman the top residential brokerage in Manhattan, where it has nearly 2,000 agents, some of whom have handled big-money closings at properties like 432 Park Avenue and One57. Due to competition from rivals, Lorber said Elliman won’t consider cutting agent commissions. [TRD]

Compass’ latest tech acquisition is CRM firm Contactually

While Compass has hit pause on expanding into new markets, the SoftBank Group-backed brokerage isn’t done pursuing acquisitions. The firm snapped up cloud-based customer relationship management system Contactually this week as part of a push to ramp up its technology. Contactually, which launched in 2011, reported $7.3 million in revenue in 2017, according to Inc. magazine. Compass already launched its own CRM powered by Contactually last year, so the purchase will “supercharge the Compass offering and bring us closer to our vision of the industry’s first end-to-end platform,” said a statement from Compass founder Ori Allon. The price that Compass paid to buy Washington, D.C.-based Contactually, whose clients have been unnerved by the deal, was not disclosed. [TRD]

MAJOR MARKET HIGHLIGHTS

Amazon drops plans for 722K sf lease at Seattle’s Rainier Square tower

Perhaps not content snubbing New York City, e-commerce behemoth Amazon has now also cancelled its plans to lease the Wright Runstad & Company’s still-under-construction Rainier Square office tower in downtown Seattle, according to the Seattle Times. The technology giant, which cited a tough political climate for its surprise decision to ditch a planned second corporate campus in Long Island City, inked a 722,000-square-foot lease for the 58-story tower back in 2017. “We are always evaluating our space requirements and intend to sublease Rainier Square based on current plans,” the company said in a statement provided to the outlet. The lease “was one of the biggest in Seattle history,” the outlet reported. [TRD]

Manhattan hotel sees revenue spike after dropping Trump name

The Dominick Hotel, once known as the Trump Soho, has had a 20 percent increase in revenue per available room since it rebranded itself in December 2017, Bloomberg reported. The Dominick also rented out 7,000 more room nights this past year than it did in 2017, according to the outlet. “No matter what your stance, one thing almost everyone certainly wants to take a vacation from is politics,” Gesina Gudehus-Wittern, the director of marketing firm IpsosStrategy3, told Bloomberg. CIM Group, a Los Angeles-based private equity firm that owns the hotel, reportedly plans to sell it despite the fact that business is booming. [TRD]

Kushner Cos. buys $1.1B multifamily portfolio in Maryland and Virginia

In its largest deal in more than a decade, the Kushner Companies has shelled out $1.1 billion for 6,000 rental apartments in Maryland and Virginia — its largest buy since it bought 666 Fifth Avenue for $1.8 billion in 2007, according to the Wall Street Journal. Private equity firm Lone Star Funds sold the portfolio to Kushner Cos., which is aiming to bolster its suburban multifamily portfolio. “Multifamily is the DNA of our company,” company president Laurent Morali told the outlet. This most recent deal means that the Kushner Cos. now owns roughly 22,000 multifamily units. Morali, who The Real Deal had a candid conversation with last summer, told Bloomberg that the company has another 6,000 units in the pipeline. [TRD]

Chicago mansion seeking $45M is again city’s most expensive listing

A mansion that sat unsold on the market at $50 million for two years has returned again in Chicago — with a $45 million price tag, the Chicago Tribune reported. The price makes the six-bedroom Lincoln Park home located at 1932 North Burling Street the most expensive listing on the market, followed by a Gold Coast mansion that’s seeking $22 million. United Automobile Insurance Company CEO Richard Parillo and his wife Michaela spent $65 million building the mansion after buying the land it currently sits on for $12.5 million in 2005. Tim Salm of Jameson Sotheby’s International Realty is the listing agent for the property. [TRD]

Elliman’s Florida expansion continues with Palm Beach brokerage buy

Scott Gordon Realty, a boutique brokerage based in Manalapan, Florida, just south of Palm Beach, has agreed to be acquired by Douglas Elliman. The former, which is led by the husband-and-wife team Scott and Mindy Gordon, has 12 agents and two office employees. Elliman currently has 22 offices in Florida with around 1,100 agents. The New York-based firm has made several Sunshine State acquisitions over the past few years, having snapped up Pink Palm Properties in Boca Raton last summer and the St. Petersburg-based Strickland Property Group in early February. [TRD]

‘Burning Man’ meets ‘Coachella’ at spec developer’s lavish open house

A spec home developer went to great lengths to market his West Hollywood home last month, throwing a Hieronymus Bosch-inspired open house complete with fire dancers, an edibles bar, a techno dance floor and nude performers, according to the Hollywood Reporter. Nile Niami is hoping to sell the six-bedroom, 10-bathroom home at 10701 Bellagio Road for $55 million, and felt the spectacle would help. “The idea was to create something that was a combination of Burning Man, [Mexico’s] Ondalinda music festival and Coachella,” Niami told the outlet. Hilton & Hyland’s Branden and Rayni Williams are the listing agents. [TRD]