Trending

New York still global elite’s favorite place to buy real estate: report

But London beat NYC for overall number of high-wealth individuals, a new Knight Frank-Douglas Elliman report shows

The New York market may have cooled in 2018, but the city is still appears to be the most popular place in the world for prime property investment.

New York is the world’s leading city for both residential and commercial investment, cementing its position as a global wealth hub, according to Knight Frank and Douglas Elliman’s 2019 wealth report. The study, which surveys global trends among the highest-wealth individuals, looked at property investments of $10 million or more.

It wasn’t all good news for New York, however. The city fell to second place on the overall wealth ranking, beaten by London because of two metrics: the number of high net-worth individuals and lifestyle, which refers a city’s security and affordability.

New York’s relegation to second place may have been due to “stock market volatility and a strong U.S. dollar, which led some foreign buyers to sit on their hands during 2018,” the report said, and could have been compounded by “the underlying structural issue of oversupply.”

While London beat New York for most resident high net-worth individuals, defined as those with over $30 million, New York still has the most billionaires, with 94 resident in the city. New York also saw the highest rate of new high-net worth individuals, adding 55,434 in 2018 alone.

At a launch for the new report held at JDS Development Group and Property Markets Group’s new luxury condo tower 111 57th Street, Howard Lorber, chairman of Douglas Elliman, acknowledged that 2018 had been a tough year for the firm in New York City.

“Our business was probably down about 15 percent,” Lorber said. “About half of that was velocity, meaning sales. And about half of that was pricing.”

But he said he didn’t the market bottomed out yet, at least not “until the prices come down, and the inventory is bought up.”

Prices will stay static in New York over the next year, the report predicted.

But Susan De Franca, president and CEO of Douglas Elliman Development Marketing, said that the wealthy demographic surveyed in the report were less affected by market fluctuations than other buyers. She pointed to high-profile sales like Ken Griffin’s $238 million penthouse at 220 Central Park South, and big deals at 432 Park Avenue.

“The real high-profile properties that have very limited inventory — those super ultra high wealth individuals are still looking at them at a very significant asset class,” De Franca said.

While New York’s results were mixed, there was good news for Los Angeles and Miami, where the report predicted investment by high net-worth individuals would grow by 2 percent and 5 percent respectively in the coming year.

“Florida’s low tax status may spur some U.S. residents to move to the sunshine state in the wake of the new State and Local tax (SALT) deductions,” the report said.

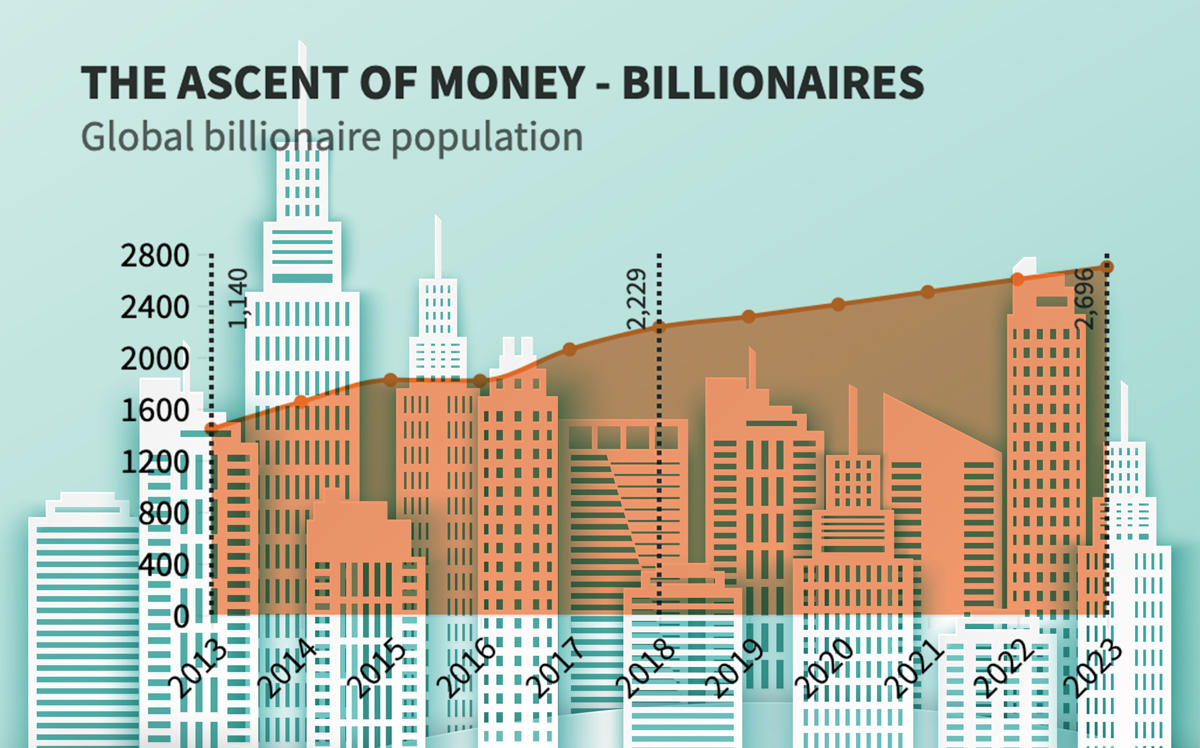

Globally, however, wealth growth is slowing, especially in the U.S. where it is now at 3 percent, down from 10 percent in 2017. Despite an overall cooling, Asia is leading wealth growth, with the report predicting India will see 39 percent growth in the next five years, followed by the Philippines with 38 percent and China with 35 percent.