Trending

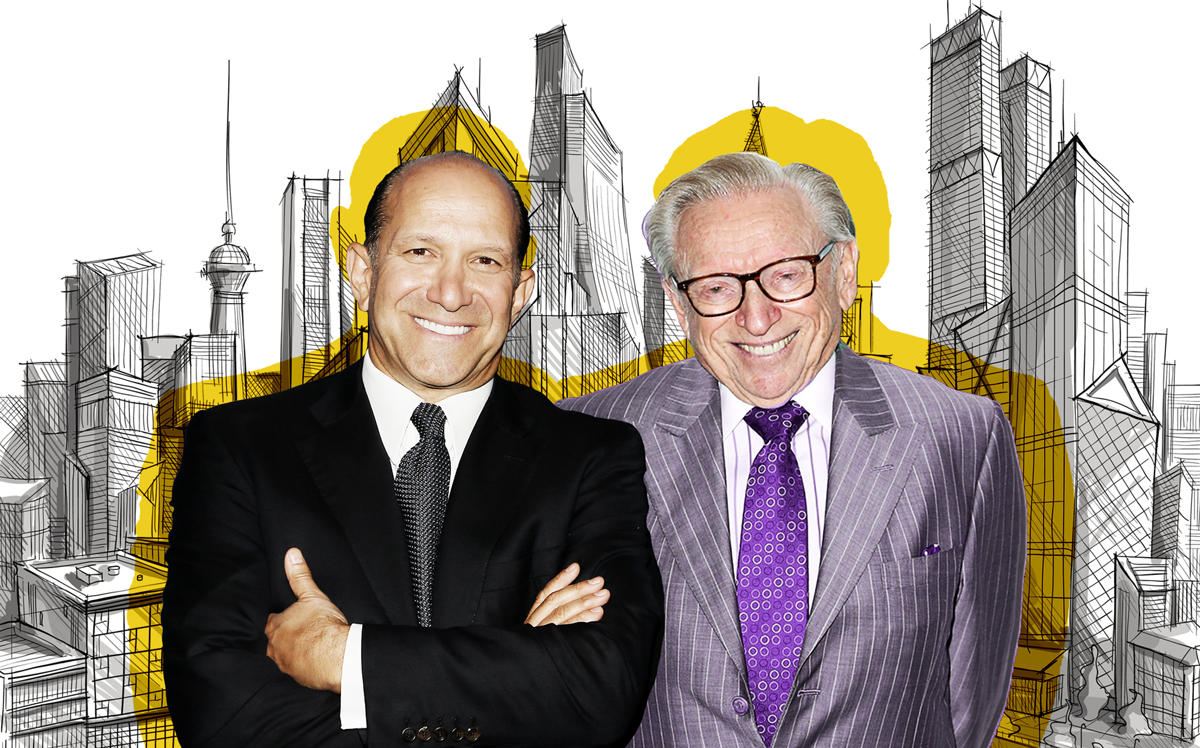

Silverstein, Cantor Fitzgerald to raise nearly $2B Opportunity Zone fund

It is among the largest targeted funds to be directed at Opportunity Zones

Silverstein Properties and Cantor Fitzgerald are looking to raise almost $2 billion for an Opportunity Zone fund.

The joint venture will target primary metropolitan markets for mostly ground-up developments, including retail, office, industrial and hospitality buildings, the firms announced. It is not clear which markets the firms plan to target.

“The joint venture targets investments in Opportunity Zones with third-party developers, as well as large-scale projects where Silverstein Properties is the developer,” the firms said in a statement.

A source with knowledge of the companies plans said the initial goal is to raise about $1.8 billion for the fund — one of the most ambitious funds launched to date.

CIM Group has a planned $5 billion fund, and Anthony Scaramucci‘s hedge fund, SkyBridge Capital, and its development partner Westport Capital are looking to raise $3 billion.

Opportunity Zones, a hallmark clause of the 2017 tax overhaul, incentivizes development in low-income areas by offering tax deferments and relief. An impending deadline at the end of the year to gain the largest benefit, 15 percent, has prompted a rush of firms to set up funds in recent months.

However, the real estate and finance industries are still holding their breath for more regulatory language to iron-out uncertainties in the program, a process that was delayed significantly by the government shutdown over the winter.

The pairing of developers and financial firms to raise is a common thread among Opportunity Zone funds, whereby financial firms can locate and fundraise capital, and developers hold the expertise to deploy it. For example, developer Youngwoo & Associates has partnered with crowdfunding startup EquityMultiple to raise a $500 million Opportunity Zone fund.