Trending

Brooklyn concessions continue to fall but market won’t “change overnight”: Elliman

Share of deals with concessions fell from 47.5% to 44.7%

For almost three years, the rental market in Brooklyn was defined by a constantly increasing amount of concessions. But that may be starting to change.

After two years and 11 months of increases, concessions in the borough saw a year-over-year drop for the second month in a row in February, according to the latest report from Douglas Elliman. The share of new deals with concessions was at 44.7 percent, down from 47.5 percent last February and from 47 percent in January. The size of the concession remained unchanged year over year at 1.4 months of free rent.

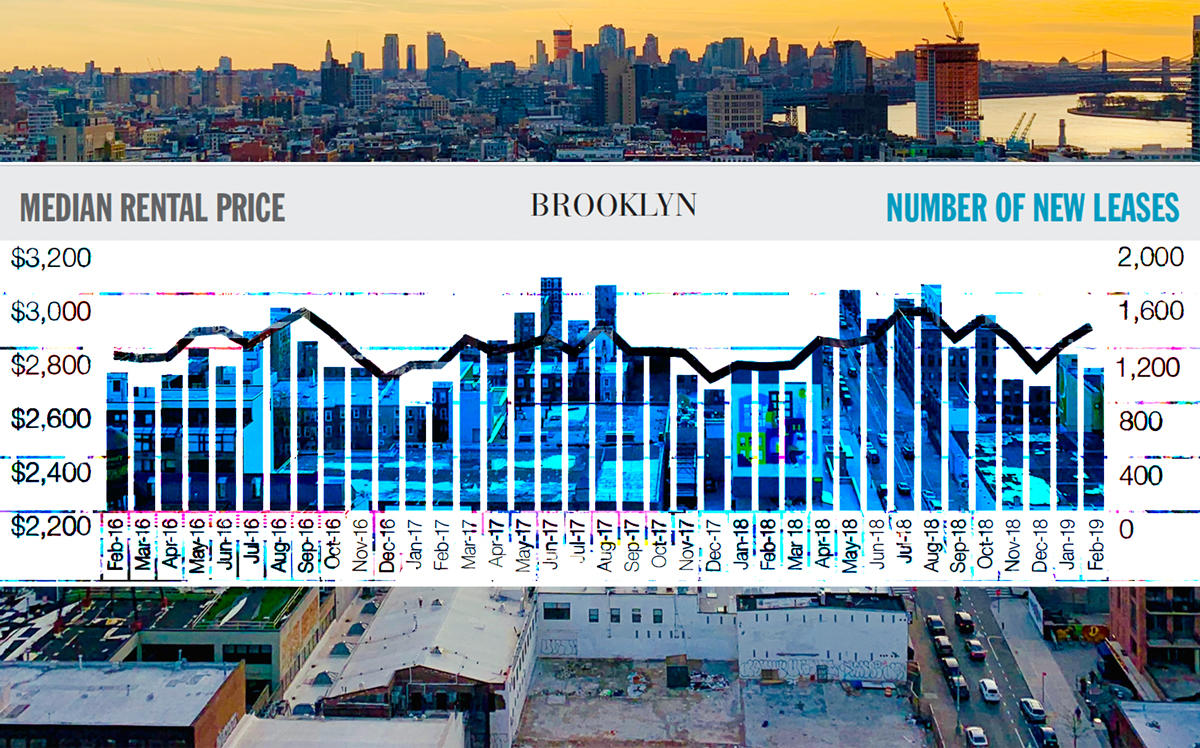

Meanwhile, net effective median rent in the borough rose year over year for the third straight month, increasing by 5.8 percent to $2,784, according to the report.

The number of new leases in the borough dropped 3.8 percent year over year to 1,050, while the listing inventory dropped 3.5 percent to 1,787. Units spent 28 days on the market, down from 31 last February, and the listing discount fell from 1.7 percent to 1 percent.

Jonathan Miller, CEO of the appraisal firm Miller Samuel and author of the report, said the drop in Brooklyn concessions could be attributed to buyers staying in the rental market for longer, which helps keeps vacancies lower and rents higher.

However, he said that tenants had gotten so used to getting concessions on new deals that they would not be disappearing from the market immediately.

“It’s not going to change overnight,” he said, “because there have been so many concessions for so long that it’s really expected by tenants.”

“It was a slow grind on the way up with concessions,” he continued, “and at least at this point, it looks to be the same on the way down.”

(Credit: Miller Samuel)

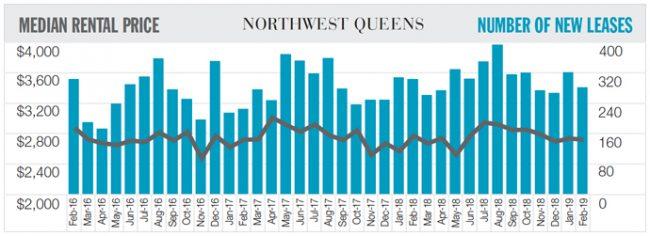

The market for concessions appears to be more resilient in northwest Queens, as they ticked up year over year from 48.8 percent to 49.3 percent. However, this was a significant drop compared to January, when 58 percent of deals included concessions, and the size of concessions dropped slightly compared to last year, falling from 1.6 months to 1.4 months.

The net effective median rent in the borough dropped year over year for the first time in four months, falling 1.1 percent to $2,685.

The number of new leases dropped year over year for the first time in seven months, declining from 301 to 280, marking a 7 percent decrease. Listing inventory dropped as well by 21.4 percent to 442.

Units in the borough spent 28 days on the market, down from 29 last February, and the listing discount increased from 0.6 percent to 0.8 percent.