Trending

Brodsky Org picks up a second Pacific Park development site

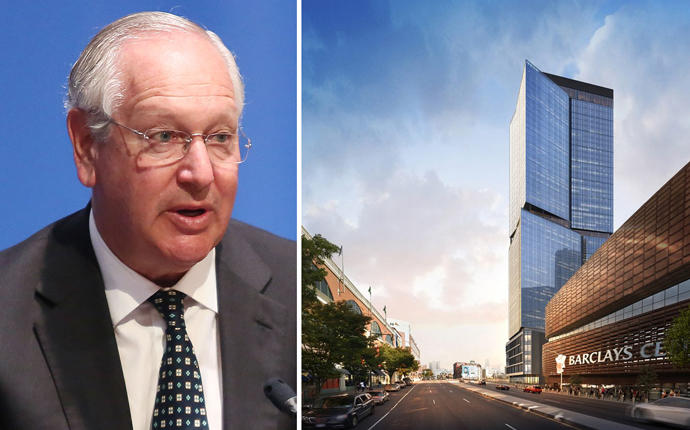

Manhattan-based real estate firm will manage development in JV with Greenland

After picking up a 300-unit apartment development site at Pacific Park last year, the Brodsky Organization is expanding its footprint at the long-delayed mega-complex with another 859-unit site next to Barclays Center.

The developer has entered into a joint venture with the project’s master developer Greenland Forest City Partners to develop 18 Sixth Avenue, the New York Post reported. The project is set to break ground within the next two weeks.

Brodsky “bought a significant piece and will manage development,” Greenland Forest City executive vice-president Scott Solish told the Post. Greenland remains the majority shareholder of the joint-venture.

The Brodsky Organization bought the development lease at 664 Pacific Street from Greenland last September, with plans to build a 300-unit rental building. TF Cornerstone picked up two sites at the complex as well, renewing some of the momentum at the 13-year-old project where just 5 of a planned 15 buildings have been completed so far.

18 Sixth Avenue, at a cost of $640 million, is expected to be finished in 2022, while the remainder of the project may take until 2035 to complete.

Forest City began development at Pacific Park, formerly Atlantic Yards, in 2005, but faced delays due to construction difficulties and the financial crisis. Greenland USA, a subsidiary of China’s Greenland Group, picked up a 70 percent stake in the project in 2013, and upped its stake to 95 percent last January. The remaining 5 percent was picked up by Brookfield Asset Management when it bought up Forest City in December.

As The Real Deal previously reported, the Brodsky Organization chose not to assume the EB-5 debt on 664 Pacific Street when it picked up that property, meaning that a $249 million mezzanine loan would have to be redeployed elsewhere. The TSX Broadway hotel project has emerged as the top choice for redeployment of those funds. [NYP] — Kevin Sun