Trending

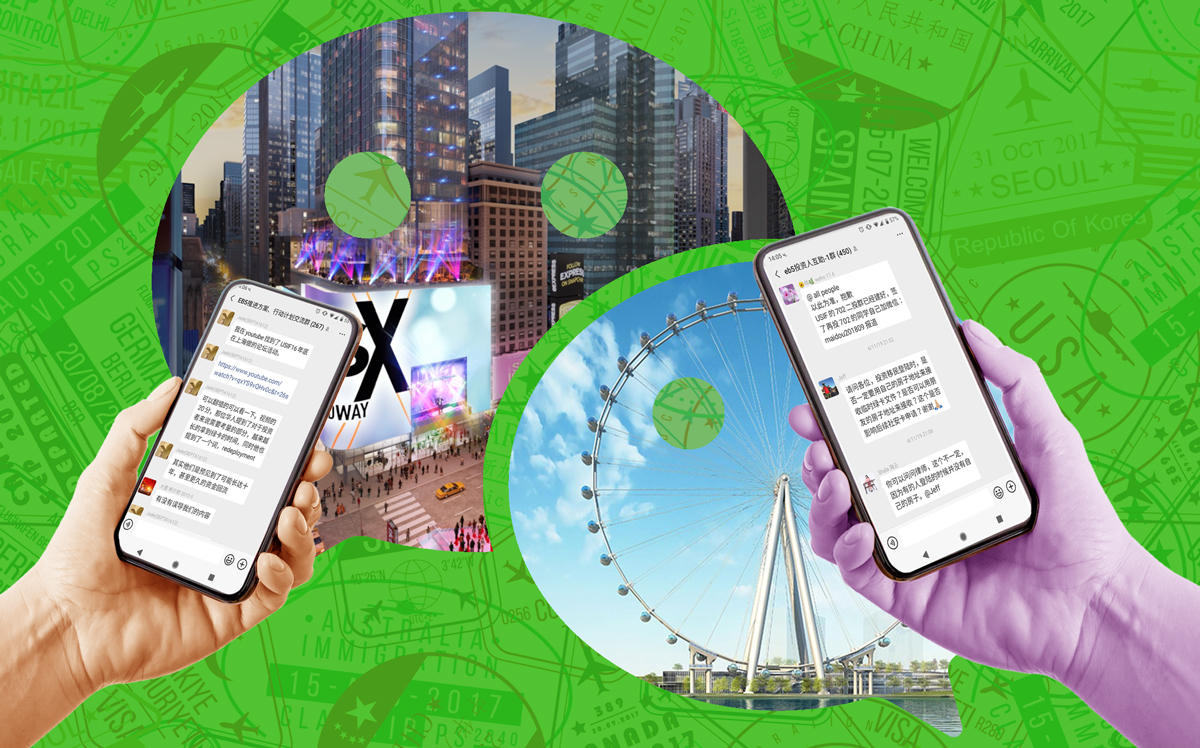

EB-5’s WeChat wars

Chinese investors are taking to the messaging app to organize. But misinformation runs rampant

Not long after developers pulled the plug on the $900 million New York Wheel – the biggest EB5-backed project ever to go belly-up – a group on the popular Chinese messaging app WeChat lit up over the possible ramifications for investors.

When the planned 630-foot-tall Ferris wheel project went bankrupt in October, a $206 million loan, made through the regional center CanAm Enterprises, appeared to have been wiped out. But the question of whether the Wheel had created enough jobs to secure visas for the EB-5 investors remained.

“The money is doubtful, but there’s still hope for green cards via litigation,” wrote chat member Yujin CMB 54 2016.9.29, who does not appear to be one of the NY Wheel EB5 investors. (In order to establish trust, many investor chatrooms request that users create an alias containing their project name and application date.)

Another chat member, Jenny 555TEN 2015.11, put it more bluntly.

“It’s time to sue.”

The Wheel’s EB-5 investors — who it appears have not filed a lawsuit — are in a now-familiar predicament. A visa backlog at the United States Citizenship and Immigration Services and some high-profile instances of alleged fraud have led to a spike in litigation surrounding the controversial “cash-for-visa” program, which for years has supplied major U.S. developers with billions of dollars in cheap debt. Frustrated investors in China, sitting thousands of miles away from the projects and facing a gulf of information just as wide, are taking to WeChat to discuss the myriad twists and turns of the program, air grievances, and, in some cases, band together to discuss their legal options.

Though the closed nature of WeChat groups makes it difficult to get a full picture of EB-5-related activity, WeChat group administrators contacted by The Real Deal estimate that there are hundreds of such groups in total. Many are dedicated to specific projects and agencies, while others host general discussions on EB-5 topics such as the visa backlog, redeployment of funds, and lobbying.

“Since investors can’t find a legal way to ask regional centers or agents for a list of other investors to contact, they have to use WeChat to get connected,” said Connor Chen, founder of popular EB-5 blog EB5Sir, noting that these intermediaries have little incentive to help investors organize.

Find your tribe

For investors trying to make sense of troubled projects, WeChat is a means of tracking down co-investors, with an eye to taking a stronger and more well-funded case to court.

“The WeChat thing is the investors now organizing to sue the regional centers,” said Michael Gibson of USAdvisors, which works with EB-5 applicants to determine where to invest.

“The investors typically don’t know who else is involved in the investment, so they put together these investment groups on WeChat where they complain about these projects.”

On EB5Sir, for example, the comment sections abound with long lists of WeChat user IDs to help investors band together in project-specific groups, as well as more general “mutual assistance” chat rooms. Investors have managed in some cases to cajole former or current agency employees to give them lists of contacts.

Though many EB-5-focused WeChat groups take pains to vet group members and verify that they really are investors on a particular project, this can be difficult because most regional centers and agencies don’t provide that information to their investors.

“They can ask for photos or screenshots of documents as proof, but it’s not always easy to verify who someone is,” EB5Sir’s Chen says. “Some members of these groups might be shills for various agencies or other third parties, but it’s hard to say.”

But even while serving as a tool for disgruntled investors, WeChat may also allow unscrupulous lawyers looking to score a payday to take advantage of them, given the abundance of misinformation on the platform.

“We have many [developer] clients in the EB-5 industry,” said Steven Goldberg of the law firm Rosenberg & Estis, “and we are seeing our clients being attacked by these types of lawyers and harassing their investors.”

In one contentious EB-5 project last year, Nick Mastroianni III’s U.S. Immigration Fund — the most prolific regional center in the EB-5 program — took issue with a private investigator badmouthing one of his projects on WeChat.

Zoe Ma wrote that 702 Seventh Avenue — known as TSX Broadway — is “an abyss,” “very horrible” and “a shitty project.”

USIF sued Ma and the attorney she was working with in Manhattan state Supreme Court, accusing them of having “improperly approached these Chinese investors at a time when they were most vulnerable.” The lawsuit was dismissed in late March, and USIF has appealed the decision.

Ma, who has filed a federal racketeering case against USIF, countered that USIF was the one spreading misinformation online, and accused the company and one of its attorneys of “dividing the investors on WeChat.”

Know thy projects

One of the big problems is that few of these EB-5 investors thought they would be at this point.

“Right now, what I’m seeing is that EB-5s are the fraud of the day,” said Jeffrey Schneider, a trial attorney with a background in fraud and receivership work who is working with the court-appointed receiver in the case of the Jay Peak ski resort in Vermont. The developers on that project allegedly stole $50 million in EB-5 funds — the largest fraud case in the history of the program.

Barring any scandals, EB-5 projects are also facing an issue the visa backlog has created known as retrogression. Because EB-5 has proven so popular with investors, the Chinese quota for the visa is currently oversubscribed and has a substantial backlog.

From 2011 through 2017, at least 70 percent of all EB-5 visas issued each year went to investors from China, as Chinese nationals were able to take advantage of other countries’ unused quotas. In 2018, that percentage fell to less than 50, as quotas for other countries have also begun to fill up.

In November, Charles Oppenheim, who oversees visas at the Department of State, estimated the backlog for EB-5 visas for Chinese nationals to be 14 years. But on WeChat, some are floating estimates as high as 45 years.

In one group created in January which soon attracted over 200 members, a document was shared containing the calculation “50,000 pending applications * 2.7 people per application on average / 3000 visas per year = 45 years.”

“I feel like I’m standing in line on my grandchildren’s behalf,” responded one user.

“Looks like I’ll be 65 years old by then,” said one 45-year old investor. “Just in time for a pleasant retirement in the U.S.”

In any case, the extended backlog means there’s nearly $17 billion worth of EB-5 money that needs to be reinvested so that it remains “at risk” and Chinese investors can still keep their place in line for a green card, according to a 2017 estimate from NES Financial, a San-Jose based firm specializing in EB-5 fund administration.

Schneider said he’s seeing more litigation as projects get to the point where investors are supposed to be paid back.

“This was money that was raised years ago,” he said. “It’s that they’ve been on the shelf for a couple of years long enough for the developers to get the projects up and running, so now is the time that they’re supposed to be repaying them, and they’re not.”

But investors are often not organized enough to make a strong case in court, said Robert Lu, an attorney in Reid Wise’s Los Angeles office who’s representing nine Chinese investors suing a regional center in California.

“Unlike with, say, a class action,” Lu said, “there’s no appointed spokesperson or designated individual to sort of transact with the developer or some of the EB-5 individuals that are handling their cases.”

Investors are also beginning to wake up to this lack of transparency.

“They’re just making money off of an information imbalance,” said a user named Saite 12.20.2015. “It’s our own fault for being lazy and stupid.”

“True,” responded another user — an investor on the Washington D.C. Highline project. “I’m too lazy.”

Get in touch with the Indians

There may be some relief on the horizon for EB-5 investors.

In October, a federal judge in Washington, D.C. allowed a class of Chinese investors to move forward with a lawsuit against the Department of State challenging the way it counts family members toward the visa-preference quotas.

Currently, the State department counts investors and their family members against the cap. The lawsuit argues that only investors should be counted against each country’s cap, which could help clear the backlog.

Another potential source of hope: In February, both houses of Congress introduced bills dubbed the “Fairness for High-Skilled Immigrants Act of 2019” that would ease the EB-5 backlog (as well as a backlog in EB-2 visas for high-skilled immigrants) by removing country quotas for “employment-based” visas. The senate bill, introduced by senators Kamala Harris (D-CA) and Mike Lee (R-UT), currently has 27 co-sponsors.

Many investors have come to see lobbying as the most promising way of breaking the deadlock, which has led them to show an interest in non-Chinese social media as well. One user – “High-speed Rail 1508” – claims to access Twitter via VPN every day just to tweet memes at members of Congress.

“Anyway, if they don’t reform the system, and don’t help resolve this backlog for us, I’ll flip over the wall every day to curse at them,” he said, referring to China’s Great Firewall. “I’ve @-ed all the relevant representatives.”

Help #EB5 pic.twitter.com/3qEfoVwDXG

— JW (@Junwang45213476) January 14, 2019

Equality it is! So, please support #Equality-for-high-skilled-immigrants (#HR1044), no legal immigrants should be discriminated by their birth places! Grant an HR6 alike amnesty to #EB5 investors, who deserve it the most! pic.twitter.com/YPQiW86ZzG

— EB5 Fairness (@bella_usc2010) March 13, 2019

Some investors see the recent diversification of the EB-5 investor pool as an opportunity for international collaboration.

“We should get in touch with the Indians, and team up to revoke country quotas. Prioritization by date is the most reasonable approach,” an investor in Greenland Group’s Metropolis project in Los Angeles wrote, in a WeChat group named “EB5 advancement proposals and action plan discussion group.”

“And the Vietnamese,” chimed in an investor on the Silvery Towers in San Jose. “I hear that the backlog is getting serious for Vietnam as well.”

— Sea (@SeaHihi815) January 7, 2019