Trending

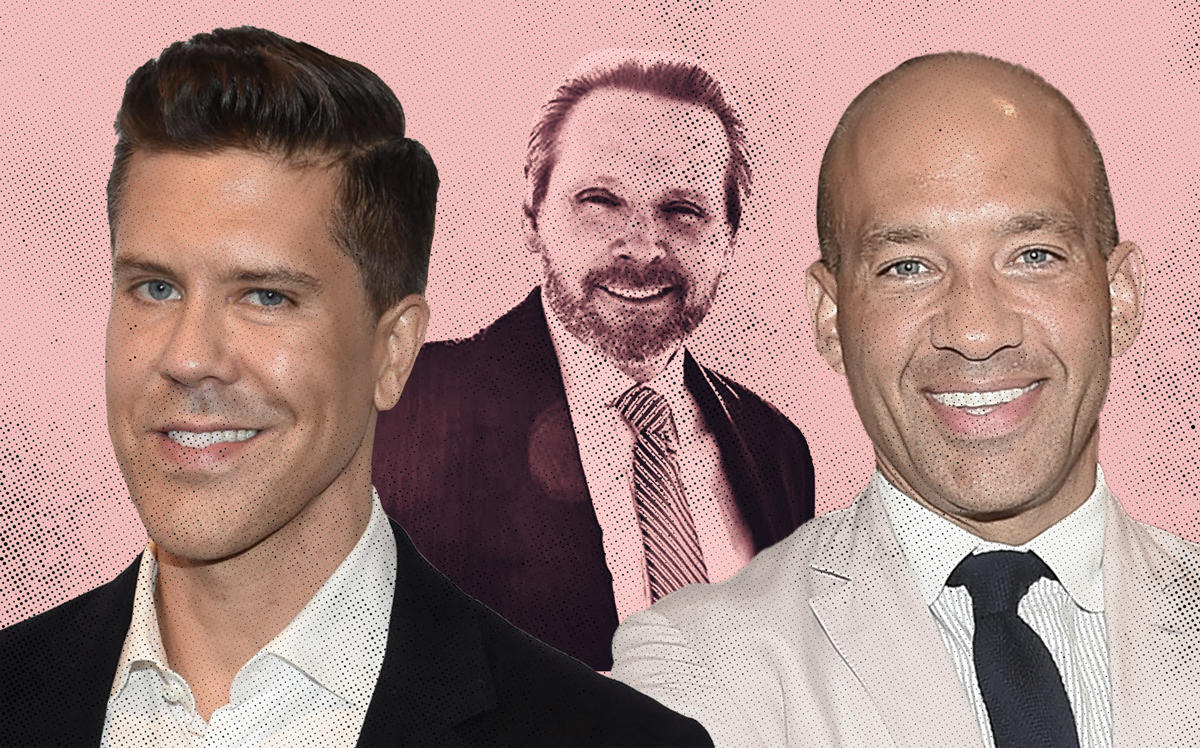

New details emerge as Fredrik Eklund’s beef with Bob Knakal continues

JLL broker said he was stiffed on referral fee for 1 Prospect Park West condo, which resurfaced during separate dispute between Elliman agents and a Warburg broker

The latest chapter in the legal feud between top brokers Fredrik Eklund, partner John Gomes and Bob Knakal provides a window into how referral business gets done — and how quickly things can fall apart — at the highest echelons of residential and commercial new development.

The years-long spat between the trio of star brokers recently spilled out into public view because of a 2017 sales commission at 25 Mercer Street that Warburg Realty’s Ana Centola claimed Douglas Elliman’s Eklund and Gomes cut her out of. The matter went into the Real Estate Board of New York’s arbitration process and Knakal, JLL’s chairman of New York investment sales, was one of three arbitrators who ultimately awarded $244,380 to Warburg. Eklund and Gomes called foul, accusing Knakal of being biased against them due to an earlier incident where, according to new court records, they’d refused to pay him a 20 percent referral fee after Knakal had recommended them to Sugar Hill Capital Partners‘ Alex Friedman, who was looking for a marketing team to handle a $200 million condominium project in Park Slope.

Elliman demanded a new arbitration process and refused to pay Warburg the commission (though it is Eklund and Gomes who would actually foot the bill), but REBNY refused a do-over. The matter then moved to New York County Supreme Court, and copies of emails filed last week reveal juicy details about the earlier incident between Knakal and the high-kicking Elliman team. All brokers and their firms declined to comment. Sugar Hill did not respond.

On March 15, at REBNY’s procedural review of the contested arbitration, a report filed with the court described Knakal defending his impartiality by saying he would never do anything to harm his relationship with Elliman’s chairman Howard Lorber, “nor do something out of spite.”

The incident at the core of Knakal’s alleged bias started with a three-sentence email he sent to Friedman, Eklund and Gomes in September 2016 — “Alex, Fredrik and John did a fantastic job for me on the sale of my personal residence at 45 Park Avenue. They are GREAT at what they do. I give them my highest recommendation and know they would do a great job for you on your project.”

The next month, Knakal claimed to have learned they’d won the exclusive on the project at 1 Prospect Park West, according to the new court records, and his starting offer for the referral fee was 20 percent of what the brokers would earn in commissions, after paying off third parties. (The condo is currently targeting a nearly $200 million sellout with sales expected to launch in fall 2019.) A 20 percent referral fee was standard at Knakal’s former firm, Massey Knakal, though 25 percent is common practice in commercial real estate, sources told The Real Deal later.

Eklund responded saying that Elliman had won an exclusive on the project years earlier: “We always appreciate you referring us new business and are open to discuss rates in advance meeting the sellers or buyers, but not after we won it. Thanks Bob and once again congrats on the sale of your apartment!”

Eklund later explained that Elliman handles referrals internally for agents and that his four-agent team on the project was “sharing this project with the new development division so we cannot take it on if there was a referral to begin with in the first place.”

“Just too many chefs in the kitchen,” he wrote.

Sprinkled throughout the email thread were a few nuggets that seem to suggest Knakal’s business philosophy. In one email, Knakal revealed he has “done the overwhelming majority of my referral deals, both in and out, on a handshake and there have been millions of dollars transacted this way.”

Knakal, in his response after Eklund said 20 percent was too high, sought to elicit a lower offer from the Elliman brokers: “We are not looking to get rich here… We are just looking for some small recognition for putting you guys in a position to get this deal,” he wrote in an email. “We could not have teed you guys up more.”

He signed off another message with “I leave it to you to decide what the right thing is…”