Trending

Clipper Equity plans $204M conversion of UWS rental

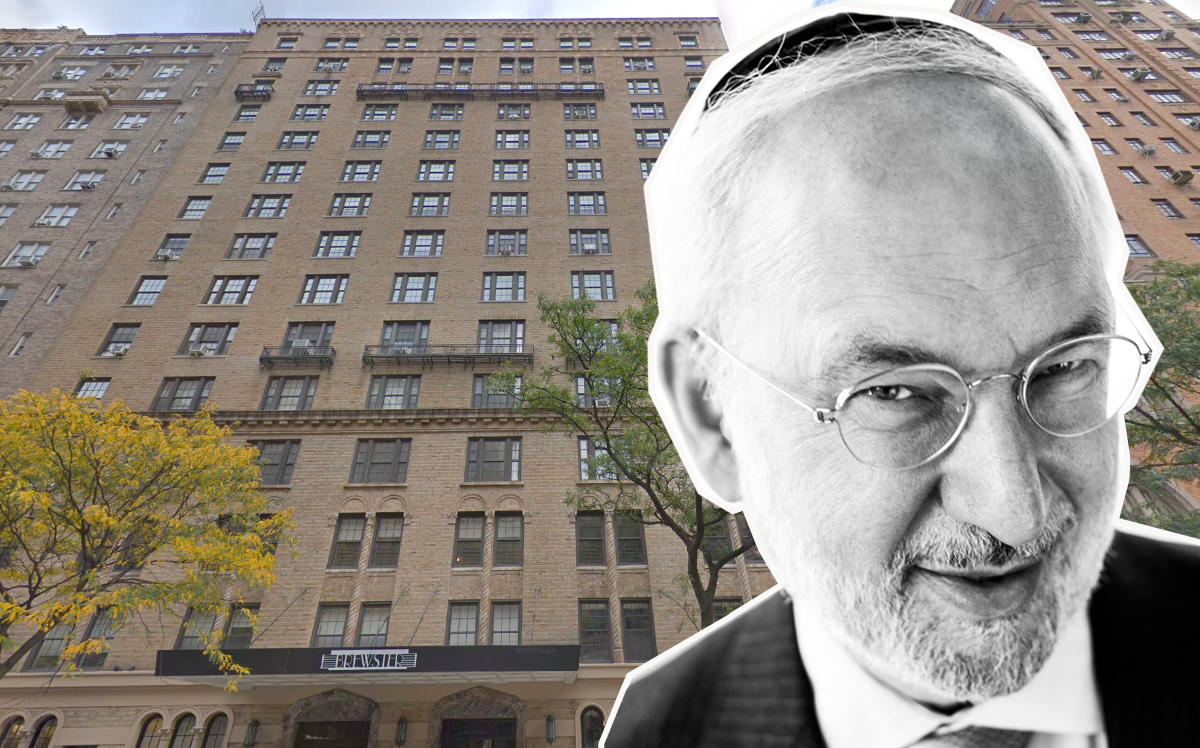

David Bistricer's firm bought 21 West 86th in 2016 for $173M

David Bistricer’s Clipper Equity wants to convert a large portion of an Upper West Side rental building into condominiums — with a projected sellout of nearly $204 million.

The Brooklyn-based real estate firm filed plans last month with the New York State Attorney General’s office to convert the majority of units in the Brewster, a 153-unit building at 21 West 86th Street, into 108 condos. The projected sellout works out to around $1.9 million per condo unit.

Bistricer’s company bought the 15-story property from Barings Real Estate Advisors for $172.5 million in 2016. Records show Clipper secured a $104 million loan from New York Community Bank for the acquisition.

After a major renovation, the Brewster’s current rental listings range from a 708-square-foot one-bedroom asking $5,625 a month to a penthouse spanning 2,166 square feet that is asking $17,500 a month. Bistricer was not immediately available for comment.

Department of Finance records show there were rent stabilized units at the property as of July 2018, though the current count could not immediately be ascertained. Nineteen rent-regulated tenants took the prior owner Barings to court over renovations to the building that excluded their units, but ultimately lost the case on appeal.

Clipper also owns 10 West 65th Street, and last month the developer bought out the Chetrit Group at its massive project at 77 Commercial Street in Greenpoint. The project is slated to have 720 units across three buildings, including 200 affordable units.

According to CityRealty, the Upper West Side’s Broadway corridor has logged 144 sales over the last 12 months, with a median price of $1.38 million. That’s down from 250 sales and a median price of $1.57 million during the same 12-month period a year prior.

In November, The Real Deal reported on Clipper’s deregulation strategy for its New York portfolio, citing investor documents. The documents make no mention of 21 West 86th Street.