Trending

Gary Barnett and Steve Witkoff are looking for deals out of NYC; trade war catches up to retail: Daily digest

A daily round up of New York real estate news, deals and more for August 20, 2019

Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page at 9 a.m., 12:30 p.m., and 4 p.m. ET. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:00 p.m.

Kohl’s reported declining sales for the third straight quarter. The department store chain posted strong growth for most of 2018, but the recent slide has caused concern among investors. The company’s shares are down about 43 percent over the past year. [WSJ]

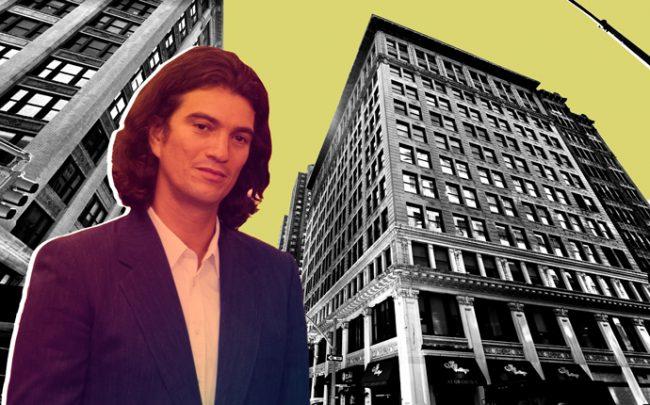

WeWork CEO Adam Neumann and 21-33 Irving Place (Credit: Getty Images and Google Maps)

A landlord is trying to get out of a lease with WeWork after seeing its IPO filing. Belvedere Management Co., which owns 21-33 Irving Place, is suing the co-working company after becoming concerned about its ability to fulfill the lease. [TRD]

Rabsky refinanced the Rheingold. The Brooklyn developer received a refinancing package worth more than $200 million from Berkadia Commercial Mortgage for its 500-unit residential building in Bushwick. [TRD]

A Manhattan landlord was caught splitting up a condo into *nine* illegal micro-units. Landlord Xue Ping Ni is facing up to $144,750 in fines for renting out the hazardous living spaces in a Lower East Side apartment. The horizontal divisions reportedly reminded investigators of a scene from “Being John Malkovich.” [Insider]

The Fed has been chipping away crisis-era regulations, concerning some observers. In a process known as “tailoring,” the Fed has been incrementally tweaking regulations to improve the efficiency of regulations written during the crisis. “No individual thing jumps out, but if you look at the sum total, the direction of travel is not entirely encouraging,” a former Fed governor said. [NYT]

The We Company’s Adam Neumann (Credit: Getty Images)

The We Company is somehow worth 10 times as much as this public competitor. Office operator IWG, best known for its Regus brand, filed for bankruptcy after the dot-com crash. The firm’s experience has often been used as a point of reference for WeWork’s business model, as it nears its IPO. [WSJ]

Douglas Elliman is now bigger. And in Texas. The brokerage has announced a joint venture with Sudhoff Companies, a real estate marketing and sales company based in Houston that specializes in new development. “Houston is a lot like Palm Beach, a lot like Beverly Hills, Los Angeles and parts of Long Island,” president Scott Durkin said. [TRD]

Jeffrey Epstein signed a will two days before his suicide. The disgraced financier established a $500 million private trust for his fortune, according to documents filed in the Virgin Islands. New York real estate player Mark Epstein was the only remaining heir listed. [NYT]

A Brazilian hotel company is looking at the Four Seasons restaurant space. The home of the short-lived Four Seasons revival experiment, which ended after just ten months, was designed by Brazilian architect Isay Weinfeld. The high-end Fasano Hotel company reportedly wants “to rescue Weinfeld’s work and take the onus off him for the Four Seasons’ failure.” [NYP]

Major real estate players are looking to get out of New York. Gary Barnett, Michael Stern and Steve Witkoff are among developers who have been looking beyond the city in the wake of new rent laws, transfer taxes, and an overall political shift. “At some point, you prefer to go where you’re wanted, where you don’t get bad surprises and where politicians aren’t eager to gang up on you,” one developer said. [Crain’s]

We made a map of 311 complaints across the city. Manhattanites hate noise, Brooklyners keep having heating and water problems, and “bulky item collection” is all the rage in Queens. [TRD]

The yield-curve inversion is hitting mortgage REITs where it hurts. It turns out a strategy of borrowing short-term to buy long-term doesn’t work so well when the short-term debt is costlier. Three of the largest mortgage REITs have cut their dividends so far this year. [TRD]

New tariffs against Chinese imports could impact apparel retailers. One analyst estimated that 25 percent tariffs on apparel could cause as many as 12,000 stores to shut down. About 40 percent of all clothing and 70 percent of shoes sold in the U.S. are made in China, and a 10 percent tariff against these products kicks in on September 1. [WSJ]

Jimmy Van Bramer

A Queens Council member has returned thousands in real estate donations, months behind schedule. Council member Jimmy Van Bramer made a pledge to do so by January, but his campaign only cut the checks on Monday, after a Daily News story found that he hadn’t returned any real estate donations [TRD]

This morning my campaign returned all real estate contributions mentioned in the @emma_a_whitford story. And we caught a few not mentioned that we returned as well. Inexcusable that it wasn’t done sooner but I’ve honored my pledge and we will continue to return any others found. pic.twitter.com/1pNxBoAMHa

— Jimmy Van Bramer (@JimmyVanBramer) August 19, 2019

Savanna closed on its $180 million deal for 360 Lexington Avenue. AEW Capital Management was the seller, and the acquisition was financed with a $126 million loan from Barclays. The new owners are planning a $20 million capital improvement program at the property, which is about 82 percent leased. [NYP]

The city is going after three more buildings in its Airbnb crackdown. The city hit the buildings and landlord Slavik Gofman with a new lawsuit on Monday, saying the company made more than 2,800 illegal short-term rental reservations to almost 9,400 guests at at least 21 illegal listings between 2016 and 2019. [TRD]

A Billionaires’ Row penthouse is back on the market, at barely half the prior price. The two-level penthouse on top of the Ritz-Carlton New York, Central Park hotel at 50 Central Park South is now asking $49 million. The asking price in 2012 was $95 million. [TRD]

One of the city’s largest unions is pushing for better maternity care for members. Local 32BJ of the Service Employees International Union, which is self-insured through its own health fund, is using its size to push for change at hospital systems in the region. The fund pays for about 1,300 births a year, at a cost of nearly $23 million. [WSJ]

A 60,000-square-foot Whole Foods is coming to Madison Avenue. The gourmet retailer and Amazon subsidiary signed a new lease on parts of the bottom two floors of 63 Madison Avenue at 28th Street, where the owners of the 870,000-square-foot office tower are planning a “retail glass box” as part of a major renovation. [NYP]

Compiled by Kevin Sun

FROM THE CITY’S RECORDS:

Residential sales:

An anonymous buyer acquired a unit at 220 Central Park South in Midtown for $24 million. [ACRIS]

Commercial sales:

A commercial building at 218 Clarkson Avenue in Flatbush, Brooklyn, sold for $20.5 million. [ACRIS]

Compiled by Mary Diduch