Trending

How a small stretch of land on the Far West Side became an Opportunity Zone

Manhattan landlord Stellar Management requested that the state include “census tract 135” in the federal tax program, emails show

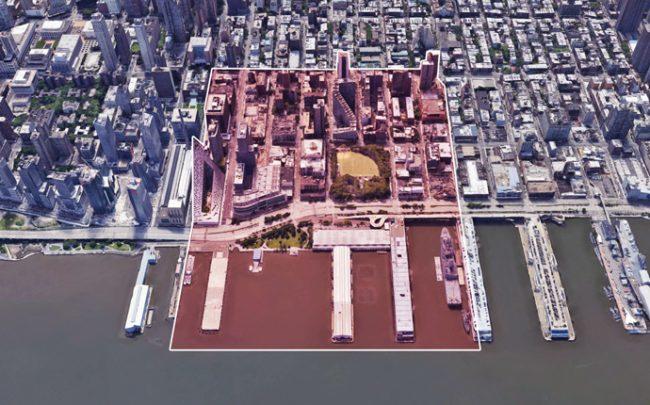

It’s hard for “census tract 135” not to stand out on a map of Opportunity Zones in the five boroughs.

While most of the New York City areas tapped for the federal tax program are clustered together in working-class neighborhoods, like the South Bronx, Jamaica and Brownsville, the roughly 16-block tract stands completely on its own on Manhattan’s Far West Side.

Sources previously told The Real Deal that the U.S. Treasury Department had identified the area as low-income, and the New York City Regional Economic Development Council recommended it for the OZ program based on investments in the city during the program’s selection process.

But documents obtained through a Freedom of Information Law request show that Manhattan-based landlord Stellar Management, which is facing multiple accusations of illegally deregulating New York apartments, also lobbied for the area to be designated.

That effort, many observers say, marks an unusual amount of involvement from a private real estate company in the selection process.

An aerial view of Census tract 135 (Credit: Google Maps)

The Hell’s Kitchen census tract — which is miles away from the city’s other Opportunity Zones — runs from West 50th Street to West 58th Street and from 10th Avenue to the Hudson River, and it had a mean household income of almost $112,000 as of 2017, according to Census Bureau data. The area is home to luxury new developments like the Max, TF Cornerstone’s 44-story mixed-use apartment tower where rents can run as high as $8,000 a month, and businesses including the hedge fund Pershing Square Capital Management and a Jaguar dealership.

The Urban Institute, a Washington, D.C.-based economic and social policy think tank, has flagged that the area is seeing rapid changes, based on factors such as median income and the number of residents with bachelor’s degrees.

Brett Theodos, a research associate at the Urban Institute’s Metropolitan Housing and Communities Policy Center, said he was confused about why a census tract on Manhattan’s Far West Side would be included in a program designed to help low-income communities.

“The fact that it had already gentrified by 2016 makes me skeptical that it was truly in need of the help,” he said, “and the fact that it’s in Manhattan close to Central Park, close to Midtown — it’s just hard to imagine that this is a truly capital starved community.”

Representatives from Stellar declined to comment, and the firm’s interest in the Far West Side tract remains unclear.

The company does not appear to own any land in the area, though it sold a property right on the border at 454 West 58th Street to an LLC for more than $11 million in 2017, according to property records.

Stellar’s correspondence

Stellar’s chief investment officer, Matthew Lembo, had reached out to the state with his firm’s input soon after the process of picking New York neighborhoods for the OZ program began in February 2018.

“It was a pleasure meeting you in March at your offices, where we appreciated the opportunity to explain to you our vision for the investments that we believe the Opportunity Zone Program can bring to New York City,” Lembo wrote in an email to members of Empire State Development, the state’s economic development organization, that April.

In addition to the tract on the Far West Side, his email also recommended that the state include tracts in Bedford-Stuyvesant, Bushwick, Washington Heights, the Lower East Side and the area surrounding Penn Station.

“Should the census tracts from our concentrated list be nominated as Opportunity Zones, Stellar Management stands ready and willing to swiftly deploy at least $100 million of equity capital into those underserved communities,” Lembo wrote.

The state ended up designating two other census tracts in the East Village that Lembo had recommended.

New York State officials maintained that they did not consider Stellar’s interests when deciding which census tracts to include in the federal program and that the firm was just one of many groups that reached out with suggestions.

The Far West Side tract had been part of the city’s and state’s economic development plans for years and has previously received grant money from the state, they said.

“New York State worked within federal guidelines and submitted Opportunity Zone recommendations based on guidance from the State’s Regional Economic Development Councils, local and public input, prior public investment, and the ability to attract future private investment,” ESD spokeswoman Kristin Devoe said in a statement to TRD.

“This was a data rich, regionally focused process, and all nominated tracts were subject to federal approval,” Devoe added.

Seeking opportunities

Since developers Larry Gluck and Steve Witkoff co-founded Stellar in 1985 with a focus on buying and building low-income rental properties in Washington Heights, the company has branched out into larger and more upscale projects.

Stellar has also become a frequent target over New York’s rent stabilization laws and is currently facing at least two lawsuits from tenants in more than a dozen of its buildings.

Unlike many of its peers, though, the company has yet to launch its own OZ fund, which means the $100 million investment it promised remains theoretical for now.

Lembo told Forbes last fall that Stellar plans to use its balance sheet to fund investments in Opportunity Zones but was noncommittal about whether the company would launch a widespread fundraising effort.

At the same time, several developers who have since launched their own funds targeting designated tracts, who spoke on background, said they did not make any recommendations to state governments about which areas should be included in the program.

One executive said his firm was not even aware that the federal program existed until the tax bill had already passed.

“I think most people not only didn’t reach out but didn’t even know there was something to reach out about,” the executive said. “Clearly, some people were paying attention, and if they were, this could obviously be a big benefit to them.”