Trending

SoftBank’s woes go far beyond WeWork, council bill targets commercial tenant harassment: Daily digest

A daily round up of New York real estate news, deals and more for September 24, 2019

Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 3:25 p.m.

Scammers sent out numerous phishing emails using Howard Lorber’s address. A Douglas Elliman source confirmed to Inman that multiple recipients had received scam emails that appeared to be from the brokerage’s chairman. It is unclear if Lorber’s account was compromised, or if a scammer simply “spoofed” his email address. [Inman]

IKEA is opening its first Queens location next summer. The 115,000-square-foot store, the Swedish furniture giant’s third in New York, will be located at the Rego Center shopping mall in Rego Park. [Patch]

Compass CEO Robert Reffkin and Maëlle Gavet

Compass’ COO is out. Maëlle Gavet is leaving,the latest in a string of recent exits at the SoftBank-backed residential brokerage. In an email to agents Tuesday, CEO Robert Reffkin described the departure as a “mutual decision.” [TRD]

WeWork’s Adam Neumann (Credit: Getty Images, iStock)

And Adam Neumann is stepping down as WeWork’s CEO. The startup’s founder is moving into a non-executive chairman position, after facing pressure from investors to resign. Artie Minson, the company’s CFO, and Sebastian Gunningham, its vice chairman, will replace Neumann as co-CEOs; the company said it will not search for an external CEO. [TRD]

Despite low mortgage rates, home-price gains are still slowing down. The deceleration continued for a 16th straight month in July, with home prices in 20 cities tracked by the S&P CoreLogic Case-Shiller index rising just 2 percent, the least since August 2012. Nationwide home prices rose somewhat faster, growing 3.2 percent. [Bloomberg]

Co-working rivals are cashing in on WeWork’s struggles. Flex-space company Knotel, co-working startup Industrious and meeting-space company Convene have all raised funds over the past month amid WeWork’s IPO woes, in part by highlighting the differences between themselves and the SoftBank-backed giant. In particular, firms often point out that their partnerships with landlords will better protect them in a downturn. [WSJ]

WeWork CEO Adam Neumann and Softbank CEO Masayoshi Son (Credit: Getty Images)

The WeWork IPO is just the latest in SoftBank’s long list of problems. SoftBank-backed companies including Uber, its Chinese rival Didi Chuxing, Slack and cancer-test company Guardant Health are all likely to be marked down in the firm’s third-quarter reporting. The odd structure of Softbank’s Vision Fund — in which 40 percent of the capital comes in the form of debt-like preferred stock — poses greater risks in a downturn, and Masayoshi Son’s firm recently took out an unusual three-year loan to pay back its investors, using its stakes in Uber and Guardant as collateral. [WSJ]

A City Council bill seeks to stop harassment of commercial tenants. The bill, which has been approved for a general vote on Wednesday, would require landlords in recently-rezoned neighborhoods to certify that they had not harassed tenants for at least 60 months in order to get construction permits. Penalties may include a $1,000 fine and two-year construction ban. The Real Estate Board of New York supports the bill, which exempts certain types of critical construction work. [WSJ]

De Blasio returns with a long list of unfinished city business. With his long-shot presidential bid over, the mayor’s priorities for New York City include: overhauling NYCHA, including tackling lead paint and mold and generating new revenue; reforming the city’s convoluted property tax system; fulfilling a commitment to stop using hotels as homeless shelters; rescuing the Brooklyn-Queens Connector project; fixing a decayed segment of the Brooklyn-Queens Expressway; and building new jails to replace Rikers Island. [The City]

Some developers embrace short-term rentals. From a condo project in Nashville marketed for short-term rental use, to hotel-licensed, Airbnb-branded developments in Miami and Austin, developers are taking a new approach to increasing profits and driving sales. They are also taking steps to address safety and regulatory issues which have historically led landlords to shy away from transient uses. [WSJ]

A Queens landlord faces a $17,000 fine for threatening a tenant with ICE. Landlord Diana Lysius, facing foreclosure on her rental property after falling behind on mortgage payments, began threatening Guyanese-immigrant Holly Ondaan after the tenant stopped paying rent. “Have my money or I’m calling ICES [sic] that day period,” one message read. Lysius was found to have violated the city’s human rights law. [NYT]

The Manhattan district attorney responds to Trump’s federal lawsuit. President Trump sued in federal court last week to block a subpoena for his tax returns, but District Attorney Cyrus R. Vance Jr.’s office says Trump and his lawyers have invented a “new presidential ‘tax return’ privilege,” belied by the fact that “every president since Jimmy Carter has voluntarily released his tax returns before or upon taking office.” [NYT]

New NAR data shows more brokers abandoning the franchise model. The latest numbers from the National Association of Realtors show that the percentage of brokerages affiliated with a franchise company has fallen to 11 percent from 13 percent two years ago. Keller Williams is the nation’s largest franchise with 153,904 agents, while Berkshire Hathaway saw the most gains over the past two years. [Inman]

Airbnb investor General Atlantic is expanding at Park Avenue Plaza. The private equity firm inked a lease to expand by roughly 30,000 square feet at Fisher Brothers’ 55 East 52nd Street, bringing its total space in the 45-story tower to more than 93,500 square feet through 2039. Asking rent for the space was in the low $100s per square foot. [TRD]

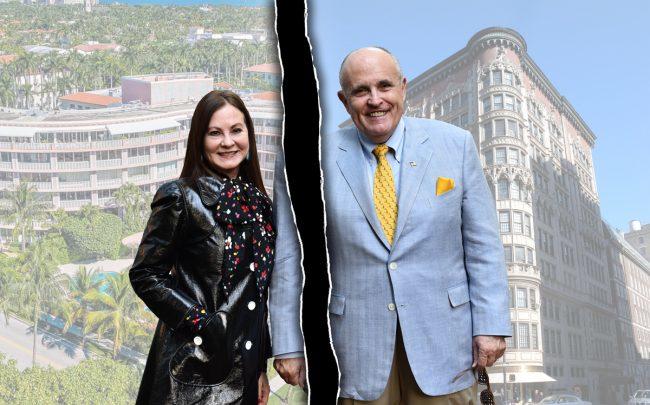

Judith and Rudy Giuliani with 315 South Lake Dr in Palm Beach, Florida and 45 East 66th Street in New York (Credit: Getty Images, Trulia, Highrises)

These are the luxury properties at stake in Rudy Giuliani’s messy third divorce. From an Upper East Side co-op and two Palm Beach condos to a home in the Hamptons, the former New York mayor and current Trump lawyer’s divorce from Judith Giuliani is a complicated process — partially because he apparently ignored friends’ advice to get a prenup. [TRD]

Twelve New Jersey-based firms got subsidies by threatening to move to the same New York complex. The firms, including Jaguar Land Rover and travel company FC USA, used the threats to secure New Jersey tax credits totaling more than $100 million. But it seems that none of the companies seriously considered moving. [NYT]

Office leasing in New York fell dramatically in August. With just 1.56 million square feet in deals inked, August’s transaction volume was down 68.2 percent from July and down 30.8 percent year-over-year. [NYP]

U.S. mortgage holders’ home equity has hit an all-time high. With a collective gain of nearly $428 billion in the second quarter, the average mortgage holder saw a $4,900 home-equity gain in just one year. Despite all-time low mortgage rates, few homeowners are tapping into that equity than in the past — perhaps a holdover from the previous housing crash. [CNBC]