Trending

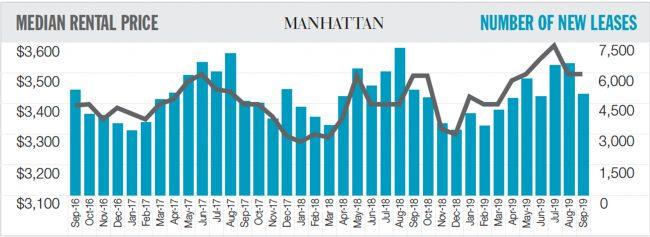

Rents tick up and concessions fall amid broader economic uncertainty

But Manhattan’s rising vacancy rate may signal tenants are walking in the face of rents that are too damn high

New York’s strong rental market is winning off the back of sluggish sales.

Rents increased year over year this September in Manhattan and Brooklyn to $4,336 and $3,366, respectively, while concessions fell, according to Douglas Elliman’s September report, authored by appraisal firm Miller Samuel.

In Manhattan, the share of new leases signed with an owner paying broker fees and concessions was 34.3 percent, down from 37.4 percent in the same period last year. In Brooklyn, 34.6 percent of new leases came with concessions — a large drop from 43.1 percent.

“As long as the sales market in the region remains soft, demand in the rental market should remain strong,” said Hal Gavzie, Elliman’s head of rentals, in a statement.

Queens, however, was a different story. New leases fell by almost 10 percent while rents declined by 1.7 percent to $2,875, compared to last September.

Jonathan Miller of Samuel Miller explained the difference in the borough by pointing to Queens’ decline in new development leases. These leases accounted for close to 40 percent of the rental market in September 2018; now, it’s closer to 32 percent.

“In addition to the lower new development rental activity in Queens, the sales market is also much stronger there than in the other boroughs which may also be contributing to this standalone effect,” he said in a statement.

For Gary Malin, president of brokerage Citi Habitats, the tide may be about to turn in renters’ favor.

He pointed to Manhattan’s vacancy rate increasing year over year for the past three months as a sign that renters are choosing to get out of the market rather than sign a pricey lease.

“It indicates that owners hit the [rent] threshold from a tenant’s perspective,” he said. “Tenants are really pushed to their limits.”

Malin said that, based on traffic reports on projects Citi Habitats handles, he knows clients are looking at multiple properties, and they’re not confined by location.

“People are really shopping for value,” he said. He added that as the threat of a recession looms large among broader uncertainty associated with purchasing property, “renting is always a safe bet.”

Write to Erin Hudson at ekh@therealdeal.com