Trending

SoftBank looks to take over WeWork, NYC investigates WeLive: Daily digest

A daily roundup of New York real estate news for October 14, 2019

Every day The Real Deal rounds up New York’s biggest real estate happenings, from breaking news and scoops to announcements and deals. We update this page throughout the day, starting at 9 a.m. Please send any tips or deals to tips@therealdeal.com.

This page was last updated at 6:25 p.m.

Adobe is expanding to 109,000 square feet at 1540 Broadway. The software company renewed its 27,323-square-foot lease on the 17th floor of the building and added 81,972 square feet on the 18th, 19th and 20th floors, according to Real Estate Weekly. Colliers represented Adobe in the deal, and CBRE represented the owner EDGE Fund Advisors on the new 10-year lease. [REW]

An effort to turn a former women’s prison into a community hub is dead. The NoVo Foundation, co-founded by Warren Buffett’s son, abruptly announced on Friday that it would no longer work to develop the project, known as the Women’s Building, at 550 West 20th Street. The organization said it made the decision after deciding that it would be better to spend the hundreds of millions of dollars it would take to repurpose the building on supporting groups that could help marginalized communities faster and more directly. The building is under state control, and its future is now unclear. [The City]

Saks has teamed up with Authentic Brands to bid roughly $270 million for Barneys. Saks, which Hudson’s Bay Company owns, would launch Barneys departments in 41 of its stores, take over the website of the bankrupt retailer and possibly take over some Barneys locations. Barneys had filed for bankruptcy over the summer, and at a court hearing on Friday, a lawyer for the high-end fashion retailer said the company needed more time to solidify a possible deal that would keep it alive. [WSJ]

An early Facebook employee and venture capitalist wants to sell his Manhattan penthouse for $29.5 million. Matt Cohler has listed his Nolita penthouse, as he wants to move to the Upper East Side to be closer to his family. His firm Benchmark has made lucrative investments in companies including Instagram and Dropbox, but he doesn’t expect to make a big profit on his penthouse, which he bought about a year ago for $29.95 million. [WSJ]

Masayoshi Son (Credit: Getty Images)

SoftBank might take full control of WeWork. The co-working giant is trying to figure out how to improve its finances after pulling its plans for an initial public offering, and the deal from SoftBank represents one possible solution. SoftBank — which already owns a third of WeWork — would invest several billion dollars worth of equity and debt into the company and assume Neumann’s voting power, giving it a bigger role in turning around the company. [WSJ]

The city is investigating WeLive’s Financial District location. Officials are looking into whether units that were supposed to be long-term apartments are instead being advertised as hotel rooms. It’s the latest piece of bad news for WeWork’s co-living division, which hasn’t expanded beyond its initial two locations and failed to grow into India and Israel. [NYT]

Ken Griffin bought two more units in 220 Central Park South. The billionaire set a record with his $238 million condo purchase in the building and has now purchased a pair of adjacent apartments on the 20th floor for $1.89 million and $2.06 million as well. The units seem to be either for guests or staff and bring the total value of Griffin’s purchases in the building to about $244 million. [NYP]

There were 11 luxury contracts signed for about $77.5 million in Manhattan last week. This was a decrease in sales and dollar volume from the week before, when 14 contracts were signed for about $118 million. The properties spent an average of 411 days on the market and had an average discount of 6 percent from the original asking price. The deals included six co-ops and five condos, marking the first week since June 17 to 23, 2013 when co-ops outsold condos. [Olshan]

Brooklyn’s luxury market saw 19 contracts signed last week for a total of roughly $55.3 million. Both figures were up from the previous week’s 16 contracts signed for about $44.7 million. The average contract went for about $2.9 million, and the properties spent an average of 169 days on the market. [Compass]

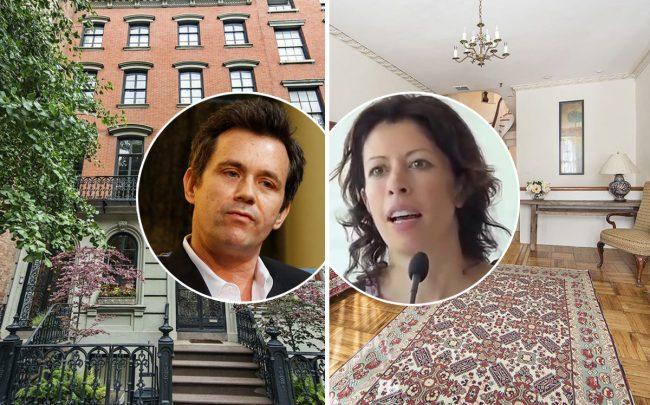

Joel Schreiber (Credit: Shir Stein and Wikipedia)

WeWork’s first investor is getting sued by his lenders. A pair of lawsuits allege that Joel Schreiber has defaulted on almost $3.3 million, according to The Real Deal. A lawsuit from plaintiffs Vikram Kuriyan accuses Schreiber of using his stake in WeWork to back loans that he later defaulted on. The suit comes at a time when the value of Schreiber’s stock in WeWork has plummeted. [TRD]

Another 100 Sears stores are going to close soon. The closures amount to roughly a quarter of the 425 stores that financier Edward Lampert bought out of bankruptcy. The company filed for bankruptcy a year ago, but it has continued to struggle since then with declining sales and losses as online shopping became more and more popular. [WSJ]

A Bronx property is seeing a boost in interest thanks to the Opportunity Zone program. The Benedetto family, which owns the building at 40 Bruckner Boulevard in the South Bronx, is taking bids on a 99-year lease for the property and will announce the winner at the end of the month. [The City]

Nicolai Ouroussoff and Cecily Brown with 125 East 10th Street (Credit: Columbia GSAPP via Flickr, Wikipedia, and StreetEasy)

Architecture critic Nicolai Ouroussoff bought an East Village townhouse for $7.75 million. Ouroussoff bought the house with his wife Cecily Brown, and it is located near the intersection of Stuyvesant and East 10th Streets. It was designed in the 1850s by James Renwick and hit the market in February with an $8.3 million asking price. [TRD]