Trending

Legislation introduced to protect tenants in ‘keyless’ buildings, Compass pushes back against WeWork comparison: Daily digest

A daily round up of New York real estate news, deals and more for October 17, 2019

Every day, The Real Deal rounds up New York’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page at throughout the day, starting at 9 a.m. ET. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 4:40 p.m.

Legislation aims to protect tenants’ privacy in keyless buildings. The bill, introduced by Manhattan Councilman Mark Levine, would prevent landlords from using data acquired through keyless or “smart-lock” technology to harass or evict tenants. [Crain’s]

Compass refutes WeWork comparison. Both companies are backed by SoftBank, were boosted by impressive valuations despite questions about profitability, and have seen a slew of executive departures. However, in hours of interviews with The Real Deal, six of Compass’s C-suite executives sought to distance the brokerage from the narrative of the troubled coworking giant. [TRD]

Union that represents office cleaners expecting contract fight. 32BJ is gearing up for a fight with the real estate industry over its soon-to-expire contract. [TRD]

Gary Barnett is assembling a Columbus Circle development site. As part of that effort, Barnett’s firm, Extell Development, is in contract to buy the New York Institute of Technology’s property at the corner of Broadway and West 61st Street in a deal valued at about $90 million. [TRD]

South Florida developers riff on shift from condos to rentals at TRD Miami showcase. New York developer Michael Shvo, who is making a push in Miami beach, said he would not follow the trend, arguing that with the right site and project, the general market’s performance is irrelevant. [TRD]

The City Council has its sights set on a raft of new housing bills. Council members, which last year passed a slew of tenant protections, plan to move forward with the legislation before the end of the year. The package includes the largest set of lead laws since 2004, an ambitious mandate for homeless housing and a cap on rental fees. [City Limits]

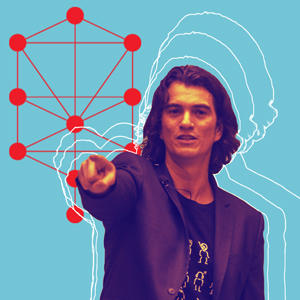

Adam Neumann

How a spiritual group helped WeWork’s rise. New details have emerged about former WeWork CEO Adam Neumann’s connection to the Kabbalah Centre, a group that promotes Jewish mysticism and helped build WeWork in its early days through a network of wealthy members. [WSJ]

Brokerage firms are strategizing ways to make up losses after the cost of application fees was capped at $20. (Credit: iStock)

Brokerages are looking to make up losses on application fee cap. “Every rental company out there is going into cardiac arrest,” said Eddie Shapiro, president of New York-based brokerage Nest Seekers International, of the $20 limit imposed by the state on brokerages and listing agents. While some firms are strategizing ways around it, others say it’s a wait-and-see game. [TRD]

VTS CEO Nick Romito

VTS grows retail footprint with $20 million acquisition. The unicorn tech firm purchased PropertyCapsule, which currently manages about 2 billion square feet of retail properties, according to VTS CEO Nick Romito. [Bloomberg]

The office market in Brooklyn is starting to cool. Despite a strong start to the year, with more than 500,000 square feet in signings in both the first and second quarters, deals fell to 195,000 square feet in the third quarter. [WSJ]

Home foreclosures are down almost 20 percent. That’s the finding of a new Q3 report from Attom Data Solutions, which showed a drop in foreclosures in New York City, Los Angeles and South Florida — while Chicago saw an uptick. [TRD]

Report calls into question WeWork’s “membership” tally. On its S-1 filing, the co-working giant said it had 527,000 memberships, however sources told Business Insider that many apparent members represented unused workstatations. [BI]

Normandy Founder Finn Wentworth, Columbia CEO E. Nelson Mills, 799 Broadway and 250 Church Street (Credit: Google Maps)

Columbia Property Trust is buying Normandy Real Estate Management. The merger, announced yesterday and worth $100 million, is expected to close by the end of the year. [TRD]