Trending

Broker confidence declines for another quarter: REBNY

Confidence index is still 23 percent up year-over-year

An unfriendly regulatory environment has pushed brokers’ confidence down for the second straight quarter. But things are still better than they were a year ago.

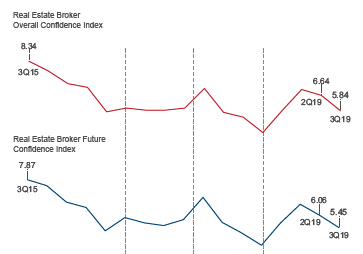

Brokers reported an average confidence score of 5.84 out of 10 points during the third quarter of 2019, according to the Real Estate Board of New York’s Broker Confidence Index. That was down 12 percent from the quarter prior, but still up 23 percent from the same quarter a year before, when the confidence index hit an all-time low of 4.75.

An index value above five indicates that broker sentiment remains more positive than negative.

The confidence index for residential brokers alone came out to 5.72, while their commercial peers remained slightly more optimistic with an index of 5.84. The confidence gap between commercial and residential brokers has tightened, however, as commercial confidence fell by 15 percent quarter-over-quarter, while residential fell by just 8 percent.

“New tax laws, changes in deductions, increased mansion tax, stressful political climate, upcoming election year and negative press coverage of the NYC real estate market,” are weighing on dealmakers’ minds, one residential broker commented on the survey.

Commercial brokers agreed, with one noting that “a rising regulatory environment that is unfriendly to business will negatively impact future market performance.”

(Source: REBNY)

The Real Estate Broker Future Confidence Index, which tracks brokers’ expectations for the market six months down the line, declined in step in the overall index. It fell 10 percent quarter-over-quarter to 5.45.

As a whole, brokers have consistently shown more confidence in the current market than in the future, though there have been a number of inversions on the residential side in recent years. For example, at the end of 2018, “present situation confidence” among residential brokers was at 4.89 while future confidence was 5.22, according to REBNY numbers.

Looking at broker responses to individual survey questions, the residential market in particular has been notably schizophrenic of late, with very low confidence in the real estate market itself (below 3.0 for the past two quarters) coupled with high confidence in the financing market (more than 9.0 for the past three quarters).

Residential brokers now expect the market itself to improve in the future while financing may deteriorate somewhat, according to their responses.

Beyond local regulatory and market concerns, brokers are also keeping an eye on the health of the broader economy. “Overall economic malaise will slow down velocity of leasing, but I do not foresee that within six months,” one commercial broker said.

“Real estate cycles are what they are and it’s evident we were due for a correction,” said one residential broker. “If the economy can stay strong eventually buyer confidence will swing around but inventory is very high which will take time to absorb.”