CW Realty to bring mixed-use project to troubled Williamsburg site

CW Realty to bring mixed-use project to troubled Williamsburg site

Trending

Jeff Sutton pays record price in Williamsburg: brokers

Property provides up to 16,740 buildable square feet

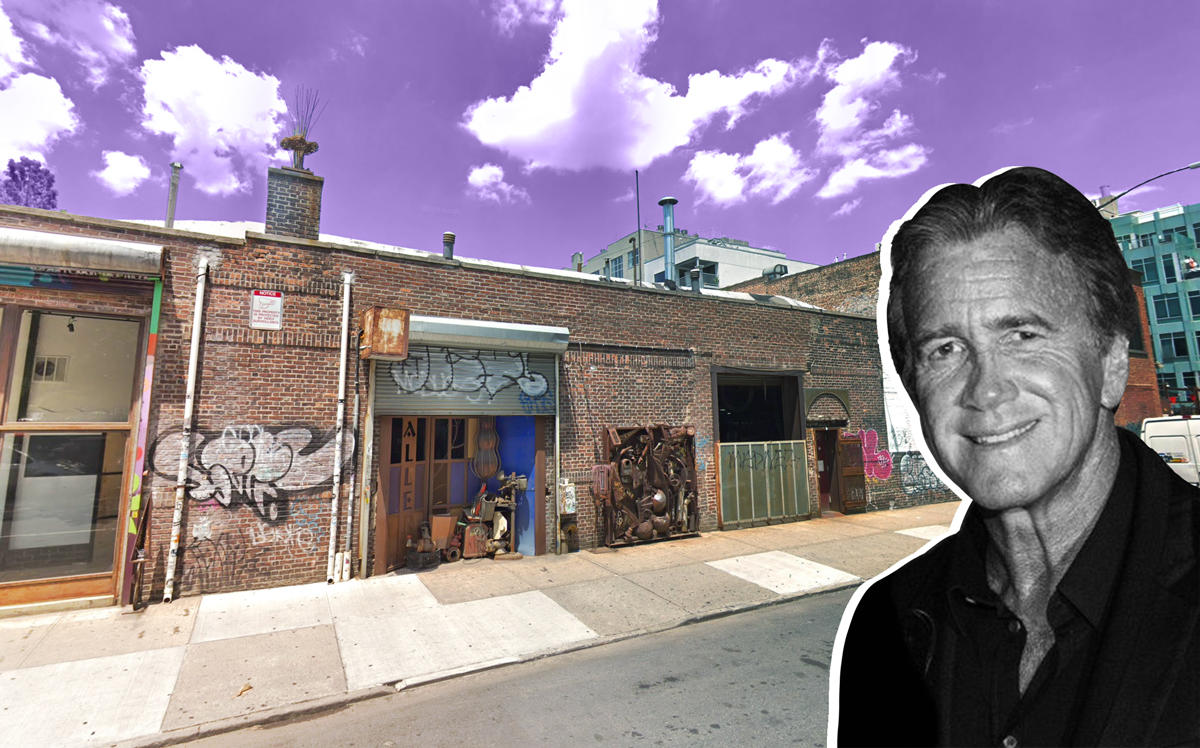

A Williamsburg commercial building that housed a metal fabrication company has sold for what appears to be a record-high price per square foot in the neighborhood.

Avi Kendi sold a one-story building at 166 Berry Street for $20 million to Jeff Sutton’s Wharton Properties, according to property records filed with the city last week.

Read more

CW Realty to bring mixed-use project to troubled Williamsburg site

CW Realty to bring mixed-use project to troubled Williamsburg site

On to the next one: Rabsky planning yet another Brooklyn project

On to the next one: Rabsky planning yet another Brooklyn project

With the property spanning 6,200 square feet, the deal translates to $3,226 per square foot — a record for the neighborhood, according to the seller’s brokers, B6 Real Estate Advisors. (The team included Thomas Donovan, Tommy Lin, Eugene Kim, Robert Rappa, DJ Johnston, William Cheng, Bryan Kirk and Michael Murphy.)

According to B6 data that dates to 2013, the previous top development sale in Williamsburg was in 2016, when 176 Bedford Avenue netted $2,069 per square foot. The top retail deal for the neighborhood came in 2013, with the sale of the North 6 Holdings portfolio with a price per square foot of $1,621.

The building sits a couple of blocks from the Brooklyn waterfront, at the corner of North Fourth Street.

“This was one of the best-located corners in all of Williamsburg that hasn’t been redeveloped yet,” Donovan said. He added that the property was on the market for 90 days, with an asking price of $20 million, before the deal went into negotiations.

It was not immediately clear what Wharton plans to do with the building, which offers up to 16,740 buildable square feet, according to B6. No applications have been filed with the Department of Buildings.

Kendi had owned the property since 2000, acquiring it from Golden Flow Dairy Farms, according to property records, which did not list the price of the sale. Kendi founded Metal Dimensions Gallery, housed at the Berry Street building, in 1997. Its metal work ranges from custom storefronts to staircases.

Kendi declined to comment and Wharton did not immediately return a request for comment.

Elsewhere in the city, Wharton, known for its retail real estate investments, recently refinanced the retail portion of 747 Madison Avenue with a $90 million loan from JP Morgan Chase.